FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

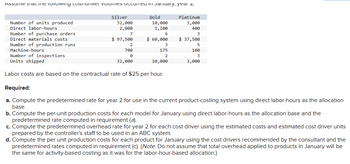

Transcribed Image Text:Assume that the following cost-univer volumes occurred in January, yeai z.

Silver

32,000

2,000

7

$ 97,500

2

700

0

Number of inspections

Units shipped

32,000

Labor costs are based on the contractual rate of $25 per hour.

Required:

a. Compute the predetermined rate for year 2 for use in the current product-costing system using direct labor-hours as the allocation

base.

b. Compute the per-unit production costs for each model for January using direct labor-hours as the allocation base and the

predetermined rate computed in requirement (a).

Number of units produced

Direct labor-hours

Number of purchase orders

Direct materials costs

Number of production runs

Machine-hours

Gold

10,000

1,200

6

$ 60,000

3

175

2

10,000

Platinum

3,000

400

3

$ 37,500

5

100

3

3,000

c. Compute the predetermined overhead rate for year 2 for each cost driver using the estimated costs and estimated cost driver units

prepared by the controller's staff to be used in an ABC system.

d. Compute the per unit production costs for each product for January using the cost drivers recommended by the consultant and the

predetermined rates computed in requirement (c). (Note: Do not assume that total overhead applied to products in January will be

the same for activity-based costing as it was for the labor-hour-based allocation.)

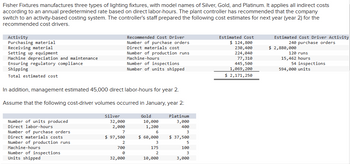

Transcribed Image Text:Fisher Fixtures manufactures three types of lighting fixtures, with model names of Silver, Gold, and Platinum. It applies all indirect costs

according to an annual predetermined rate based on direct labor-hours. The plant controller has recommended that the company

switch to an activity-based costing system. The controller's staff prepared the following cost estimates for next year (year 2) for the

recommended cost drivers.

Activity

Purchasing material

Receiving material

Setting up equipment

Machine depreciation and maintenance

Ensuring regulatory compliance

Shipping

Total estimated cost

Number of units produced

Direct labor-hours

In addition, management estimated 45,000 direct labor-hours for year 2.

Assume that the following cost-driver volumes occurred in January, year 2:

Number of purchase orders

Direct materials costs

Number of production runs

Machine-hours

Number of inspections

Units shipped

Recommended Cost Driver

Number of purchase orders

Direct materials cost

Number of production runs

Machine-hours

Silver

32,000

2,000

7

$ 97,500

2

700

0

32,000

Number of inspections

Number of units shipped

Gold

10,000

1,200

6

$ 60,000

3

175

2

10,000

Platinum

3,000

400

3

$ 37,500

5

100

3

3,000

Estimated Cost

$ 124,800

230,400

224,040

77,310

445,500

1,069, 200

$ 2,171,250

Estimated Cost Driver Activity

240 purchase orders

$ 2,880,000

120 runs

15,462 hours

54 inspections

594,000 units

Expert Solution

arrow_forward

Step 1

Hi student

Since there are multiple subparts, we will answer only first three subparts.

Overhead costs means all type of indirect costs being incurred in business. These costs can not be allocated directly to products and services. Some cost driver needs to be used for overhead costs allocation.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Production and sales (units) Materials cost ($) Labour cost per unit ($) at $12 per hour Machine hours (per unit) Total no. of production runs Total no. of purchase orders Total no. of deliveries to retail division Market/Retail prices Overhead costs: Machine set-up costs ($) Machine maintenance costs ($) Ordering costs ($) Delivery costs ($) Total ($) Product S Product R 3,200 5,450 117 95 9 1 12 64 80 260 total: 6 2 30 82 64 320 306,435 415,105 11,680 144,400 877,620 Rinse @ $241.69 = full cost +10% oll Retail price Rinse: $260 The company's policy is to transfer the washing machines from the assembly division to the retail division at full cost plus 10% resulting in internal transfer prices, of $220.17 and $241.69 for S and R when transferred to the retail division. The retail division sells S for $320 per machine and R for $260 per machine to the market. (a) Use activity based costing to allocate the overheads and recalculate the transfer prices for S and R. (b) Calculate the…arrow_forwardCompute conversion costs given the following data: direct materials, $356,600; direct labor, $196,300; factory overhead, $194,500 and selling expenses, $40,900. a.$390,800 b.$153,600 c.$551,100 d.$747,400arrow_forwardCompute conversion costs given the following data: direct materials, $351,300; direct labor, $207,800; factory overhead, $189,700 and selling expenses, $46,300. a. $748,800 b. $143,400 c. $541,000 d. $397,500arrow_forward

- A local picnic table manufacturer has budgeted these overhead costs - ERROR: "Handling materials" is $33,350 - (note their order as you will use the same order down below): Purchasing Handling materials Machine setups $70,000 33,333 70,500 25,500 45,000 Inspections Utilities They are considering adapting ABC costing and have estimated the cost drivers for each pool as shown (again, note their order): Cost Driver Activity Orders 700 Material moves Machine setups Number of inspections Square feet 1,334 15,000 5,000 180,000 Recent success has yielded an order for 1,000 tables. Assume direct labor costs per hour of $20. Determine how much the job would cost given the following activities (once more, note their order for the last worksheet): Activity Order (units) Direct materials 1,000 112,700 15,200 5,300 60 Machine hours Direct labor hours Number of purchase orders Number of material moves Number of machine setups Number of inspections Number of square feet occupied 800 100 450 8,000…arrow_forwardAssume the following information appears in the standard cost card for a company that makes only one product: Standard Quantity or Hours Standard Price or Rate Standard Cost Direct materials 5 pounds $ 11.00 per pound $ 55.00 Direct labor 2 hours $ 17.00 per hour $ 34.00 Variable manufacturing overhead 2 hours $ 3.80 per hour $ 7.60 During the most recent period, the following additional information was available: 20,000 pounds of material was purchased at a cost of $10.50 per pound. All of the material that was purchased was used to produce 3,900 units. 8,000 direct labor-hours were recorded at a total cost of $132,000. The actual variable overhead cost incurred during the period was $25,000. Assuming the company uses direct labor-hours to compute its predetermined overhead rate, what is the variable overhead efficiency variance?arrow_forwardActivity Cost Pool Supporting direct labor Machine processing Machine setups Production orders Shipments Product sustaining Activity data have been supplied for the following two products: Number of units produced per year Direct labor-hours Machine-hours Machine setups Production orders Shipments Product sustaining Activity Cost Pool Supporting direct labor Machine processing Machine setups Production orders Shipments Product sustaining Total overhead cost Activity Rates $9 per direct labor-hour $3 per machine-hour $45 per setup $150 per order $ 130 per shipment $ 875 per product K425 0 $ Total Expected Activity K425 M67 2,000 M67 200 1,000 2,800 Required: How much total overhead cost would be assigned to K425 and M67 using the activity-based costing system? 0 7 7 14 2 50 40 2 NNNN 2arrow_forward

- Paparo Corporation has provided the following data from its activity-based costing system: Activity Cost Pool Total Cost $ 888,300 Assembly Processing orders $ 60,560 Inspection $ 101,572 Data concerning the company's product Q79Y appear below: Annual unit production and sales Annual machine-hours Annual number of orders Annual inspection hours Direct materials cost Direct labor cost Multiple Choice Total Activity 54,000 machine-hours 1,600 orders: 1,340 inspection-hours O $144.43 per unit 600 1,040 70 45 According to the activity-based costing system, the average cost of product Q79Y is closest to: (Round your intermediate calculations to 2 decimal places.) $49.00 per unit $ 41.13 per unitarrow_forwardAssume that Swifty has identified three activity cost pools.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education