Principles of Accounting

12th Edition

ISBN: 9781133626985

Author: Belverd E. Needles, Marian Powers, Susan V. Crosson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 6P

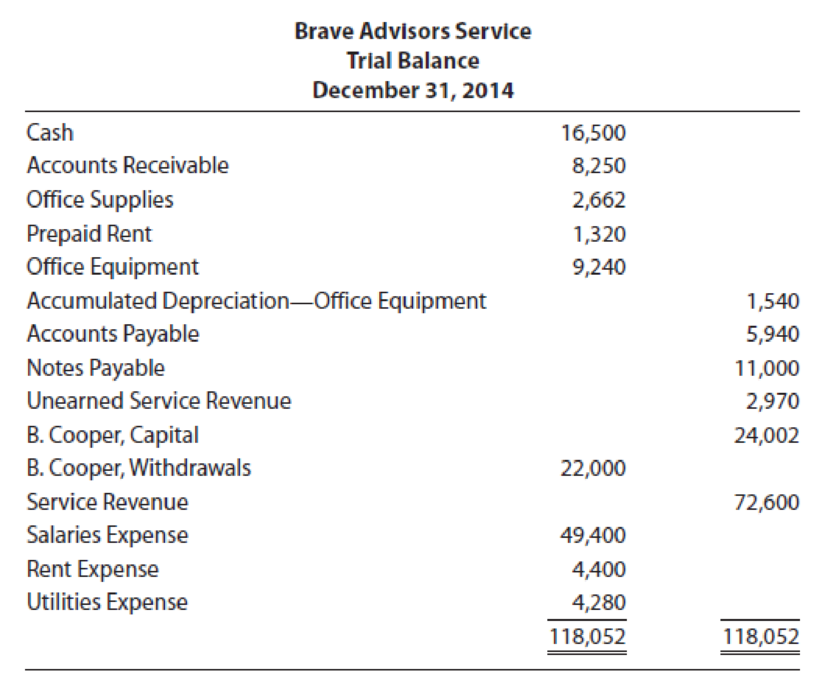

Brave Advisors Service’s

The following information is also available:

- a. Ending inventory of office supplies, $264

- b. Prepaid rent expired, $440

- c. Depreciation of office equipment for the period, $660

- d. Accrued interest expense at the end of the period, $550

- e. Accrued salaries at the end of the period, $330

- f. Service revenue still unearned at the end of the period, $1,166

- g. Service revenue earned but unrecorded, $2,200

REQUIRED

- 1. Open T accounts for the accounts in the trial balance plus the following: Interest Payable; Salaries Payable; Office Supplies Expense; Depreciation Expense—Office Equipment; and Interest Expense. Enter the balances shown on the trial balance.

- 2. Determine the

adjusting entries and post them directly to the T accounts. - 3. Prepare an adjusted trial balance.

- 4. ACCOUNTING CONNECTION ▶ Which financial statements do each of the above adjustments affect? Which financial statement is not affected by the adjustments?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

R&B Electrical began operations on 1/1/2017. Their annual reporting period ends 12/31. The trial balance on 1/1/2019 follows:

Account title

Debit

Credit

Cash

6,000

Accounts receivable

6,000

Allowance for uncollectable accounts

1,000

Supplies

13,000

Materials

7,000

Equipment

78,000

Accumulated Depreciation

8,000

Land

Accounts payable

Wages payable

Interest payable

Income taxes payable

Long-term notes payable

Common stock (8,000 shares, $0.50 par value

4,000

Additional paid-in capital

80,000

Retained earnings

17,000

Service revenue

Wages expense

Supplies expense

Bad debt expense

Interest expense

Depreciation expense

Income tax expense

Misc. expenses

Totals

110,000

110,000

Transactions during 2019:…

On November 30, 2019, Davis Company and the following account balances:

1. Prepare general journal entries to record preceding transactions. 2. Post to general ledger T-accou11ts. 3. Prepare a year-end trial balance on a worksheet and complete the worksheet using the following information: (a) accrued salaries at year-end total $1,200; (b ) for simplicity, the building and equipment are being depreciated using the stright-line method over an estimated life of 20 years with no residual all c) supplies on hand at the end of the year total $630; (d ) bad debts expense for the year totals $830; and (e ) the income tax rate is 30%; income taxes are payable in the first quarter of 2020. 4. Prepare company's financial statements for 2019 . 5. Prepare 2019 (a) adjusting and (b) closing entries in the general journal.

Unadjusted account balances at December 31, 2019, for Rapisarda Company are as follows: The following data are not yet recorded:a. Depreciation on the equipment is $18,350.b. Unrecorded wages owed at December 31, 2019: $4,680.c. Prepaid rent at December 31, 2019: $9,240.d. Income taxes expense: $5,463.Required:Prepare a completed worksheet for Rapisarda Company.

Chapter 3 Solutions

Principles of Accounting

Ch. 3 - Prob. 1DQCh. 3 - Will the carrying value of a long-term asset...Ch. 3 - If, at the end of the accounting period, you were...Ch. 3 - Prob. 4DQCh. 3 - Prob. 5DQCh. 3 - Prob. 6DQCh. 3 - Match the concepts of accrual accounting that...Ch. 3 - The Prepaid Insurance account began the year with...Ch. 3 - The Supplies account began the year with a balance...Ch. 3 - Prob. 4SE

Ch. 3 - Prob. 5SECh. 3 - During the month of August, deposits in the amount...Ch. 3 - Prob. 7SECh. 3 - Malesherbes Companys adjusted trial balance on...Ch. 3 - Prob. 9SECh. 3 - Prob. 10SECh. 3 - Carlos Companys accountant makes the assumptions...Ch. 3 - Four conditions must be met before revenue should...Ch. 3 - Prob. 3EACh. 3 - Prob. 4EACh. 3 - Prob. 5EACh. 3 - Prob. 6EACh. 3 - Prob. 7EACh. 3 - Prob. 8EACh. 3 - Prepare year-end adjusting entries for each of the...Ch. 3 - Prob. 10EACh. 3 - Prob. 11EACh. 3 - Wipro Companys income statement included the...Ch. 3 - At the end of the first three months of operation,...Ch. 3 - On November 30, the end of the current fiscal...Ch. 3 - Kinokawa Consultants Companys trial balance on...Ch. 3 - Hertz Limo Service was organized to provide...Ch. 3 - At the end of its fiscal year, Berwyn Cleaners...Ch. 3 - Brave Advisors Services trial balance on December...Ch. 3 - Prob. 7PCh. 3 - Prob. 8PCh. 3 - Prob. 9APCh. 3 - On March 31, the end of the current fiscal year,...Ch. 3 - Lee Technology Corporations trial balance on...Ch. 3 - Prob. 12APCh. 3 - Prob. 13APCh. 3 - Scoop Consulting Services trial balance on...Ch. 3 - Prob. 15APCh. 3 - Prob. 16APCh. 3 - Never Flake Company provided a rust-prevention...Ch. 3 - Prob. 2CCh. 3 - Prob. 3CCh. 3 - Prob. 4CCh. 3 - Prob. 5CCh. 3 - Prob. 6C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. Required 1. Prepare a work sheet for the fiscal year ended June 30. Ignore this step if using CLGL. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. Check Figure Net income, 14,066arrow_forwardThe balance in the unearned rent account for Jones Co. as of December 31 is $1 ,20(). If Jones Co. failed to record the adjusting entry for $600 of rent earned during December, the effect on the balance sheet and income statement for December would 1w: A. Assets understated by $600; net income overstated by $600. B. Liabilities understated by $600; net income understated by $600. C. Liabilities overstated by $600; net income understated by $600. D. Liabilities overstated by $600; net income overstated by $600.arrow_forwardR&B Electrical began operations on 1/1/2017. Their annual reporting period ends 12/31. The trial balance on 1/1/2019 follows: Account title Debit Credit Cash 6,000 Accounts receivable 6,000 Allowance for uncollectable accounts 1,000 Supplies 13,000 Materials 7,000 Equipment 78,000 Accumulated Depreciation 8,000 Land Accounts payable Wages payable Interest payable Income taxes payable Long-term notes payable Common stock (8,000 shares, $0.50 par value 4,000 Additional paid-in capital 80,000 Retained earnings 17,000 Service revenue Wages expense Supplies expense Bad debt expense Interest expense Depreciation expense Income tax expense Misc. expenses Totals 110,000 110,000 Create an adjusted trial…arrow_forward

- R&B Electrical began operations on 1/1/2017. Their annual reporting period ends 12/31. The trial balance on 1/1/2019 follows: Account title Debit Credit Cash 6,000 Accounts receivable 6,000 Allowance for uncollectable accounts 1,000 Supplies 13,000 Materials 7,000 Equipment 78,000 Accumulated Depreciation 8,000 Land Accounts payable Wages payable Interest payable Income taxes payable Long-term notes payable Common stock (8,000 shares, $0.50 par value 4,000 Additional paid-in capital 80,000 Retained earnings 17,000 Service revenue Wages expense Supplies expense Bad debt expense Interest expense Depreciation expense Income tax expense Misc. expenses Totals 110,000 110,000 Adjusting entries: $18,000…arrow_forwardAt December 31, the unadjusted trial balance of H&R Tacks reports Equipment of $25,500 and zero balances in Accumulated Depreciation and Depreciation Expense. Depreciation for the period is estimated to be $5,100. Required: 1. Prepare the adjusting journal entry on December 31. 2. Post the beginning balances and adjusting entries to the following T-accounts. Complete this question by entering your answers in the tabs below. Required 11 Required 2 Post the beginning balances and adjusting entries to the following T-accounts. Accumulated Depreciation Beginning Balance Debit Ending Balance Credit Answer is not complete. 5,100 5,100 Beginning Balance Debit Ending Balance Creditarrow_forwardFrom the following given data, prepare adjusting journal entries for the year ended December 31, 2021: Purchase of supplies for P3,000. At the end of the year, P1,000 cost of supplies were actually used. Expense method was used in payment of supplies. A P48,000 6%, 120-day note was received from a client dated November 1, 2021. The interest was not yet collected at the end of the accounting period. Before adjustments, the balance of laundry supplies inventory was P35,000. Physical count of supplies inventory was P15,000. An office equipment was acquired on May 31, 2021 for P150,000. The office equipment has an estimated life of 5 years without scrap value. A copying machine was rented on November 30, 2021 at P1.00/copy of production. It reported to have produced 300 copies as of December 31, 2021. No payment was made as of this date. Signed an advertising contract on December 1, 2021 with a radio station for P3,500. The contract will commence upon payment on December 15. 2021 and will…arrow_forward

- Prepare the journal entries for the following transactions provided by MPM as at January 31, 2011 and post them to their respective general ledger accounts. a. Depreciation $100 b. Prepaid rent expired $400 c. Interest expense accrued $900 d. Employee salaries owed for Monday to Thursday for a five day workweek: weekly payroll $14,000 e. Unearned service revenue $800arrow_forwardMarcellus Purse conduct cleaning business on the credit basis. He provides the collects the sccount receivable in 60 days. The Allowance October 2019 is $3,993. The following information is available Douchd D 1. The business uses aging of account receivable method to count the bad de 2. The accountant is required to update the balance of allowance of dosud des OURE at the end of each month 3. On 5 October 2019 a total of $1.997 ewed by Lucy Frone has been deemed w uncollectable and therefore written off 4. The total sales recorded during 1 October 2019 to 31 October 2019 is $812577 The balance in the Account receivable on 31 October 2019 is $198.300 5. 6. On 31 October 2019 the accountant estimates that 3% of the account receivable is estimated as doubtful. Q3 Required (a) Prepare the Accounting Entries for the transactions or events relating to bad debt for the month ended 31 October 2019, ignore GST ( (b) Prepare and balance the T-account for Allowance for Doubtful Debts accounts as…arrow_forwardSuppose a customer rents a vehicle for three months from Franklin Rental on November 1, paying $3,750 ($1,250/month). Required: 1.&2. Record the necessary entries in the Journal Entry Worksheet below. 3. Calculate the year-end adjusted balances of Deferred Revenue and Service Revenue (assuming the balance of Deferred Revenue at the beginning of the year is $0).arrow_forward

- The trial balance for K and J Nursery, Inc., listed the following account balances at December 31, 2021, the end of its fiscal year: cash, $16,000; accounts receivable, $11,000; inventory, $25,000; equipment (net), $80,000; accounts payable, $14,000; salaries payable, $9,000; interest payable, $1,000; notes payable (due in 18 months), $30,000; common stock, $50,000. Calculate total current assets and total current liabilities that would appear in the company’s year-end balance sheet.arrow_forwardThe information necessary for preparing the 2021 year-end adjusting entries for Winter Storage appears below. Winter's fiscal year-end is December 31.Depreciation on the equipment for the year is $7,000.Salaries earned by employees (but not paid to them) from December 16 through December 31, 2021, are $3,400.On March 1, 2021, Winter lends an employee $12,000 and a note is signed requiring principal and interest at 6% to be paid on February 28, 2022.On April 1, 2021, Winter pays an insurance company $15,000 for a one-year fire insurance policy. The entire $15,000 is debited to prepaid insurance at the time of the purchase.$1,500 of supplies are used in 2021.A customer pays Winter $4,200 on October 31, 2021, for six months of storage to begin November 1, 2021. Winter credits deferred revenue at the time of cash receipt.On December 1, 2021, $4,000 rent is paid to a local storage facility. The payment represents storage for December 2021 through March 2022, at $1,000 per month. Prepaid…arrow_forwardThe trial balance for K and J Nursery, Inc., listed the following account balances at December 31, 2021, the end of its fiscal year: cash, $16,000; accounts receivable, $11,000; inventory, $25,000; equipment (net), $80,000; accounts payable, $14,000; salaries payable, $9,000; interest payable, $1,000; notes payable (due in 18 months), $30,000; common stock, $50,000.Prepare a classified balance sheet for K and J Nursery, Inc. The equipment originally cost $140,000. (Amounts to be deducted should be indicated by a minus sign.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License