Concept explainers

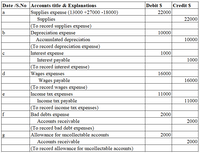

R&B Electrical began operations on 1/1/2017. Their annual reporting period ends 12/31. The

|

Account title |

Debit |

Credit |

|

Cash |

6,000 |

|

|

|

6,000 |

|

|

Allowance for uncollectable accounts |

|

1,000 |

|

Supplies |

13,000 |

|

|

Materials |

7,000 |

|

|

Equipment |

78,000 |

|

|

|

|

8,000 |

|

Land |

|

|

|

Accounts payable |

|

|

|

Wages payable |

|

|

|

Interest payable |

|

|

|

Income taxes payable |

|

|

|

Long-term notes payable |

|

|

|

Common stock (8,000 shares, $0.50 par value |

|

4,000 |

|

Additional paid-in capital |

|

80,000 |

|

|

|

17,000 |

|

Service revenue |

|

|

|

Wages expense |

|

|

|

Supplies expense |

|

|

|

|

|

|

|

Interest expense |

|

|

|

Depreciation expense |

|

|

|

Income tax expense |

|

|

|

Misc. expenses |

|

|

|

Totals |

110,000 |

110,000 |

Create an adjusted trial balance for 2019 using the given information. (The first image is

Adjustment entries are entries that are posted or passed after the trail balance is prepared but because it is part of the Financials in that particular year this needs to be don without any other question.

Step by stepSolved in 2 steps

- As of January 1, 2021, Company had a credit balance of 535,000 in its allowance for uncollectible accounts. Based on experience, 2% of the company's gross accounts receivable have been uncollectibleDuring 2021, the company wrote off 665,000 of accounts receivable . The company's gross accounts receivable as December 31, 2021, is 18,750,000 In its December 31, 2021, balance sheet, what amount should the company report as allowance for uncollectible accounts?arrow_forwardOn January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:Accounts Debit CreditCash $ 25,100Accounts Receivable 46,200Allowance for Uncollectible Accounts $ 4,200Inventory 20,000Land 46,000Equipment 15,000Accumulated Depreciation 1,500Accounts Payable 28,500Notes Payable (6%, due April 1, 2022) 50,000Common Stock 35,000Retained Earnings…arrow_forwardDuring 2021, its first year of operations, Pave Construction provides services on account of $160,000. By the end of 2021, cash collections on these accounts total $110,000. Pave estimates that 25% of the uncollected accounts will be uncollectible. In 2022, the company writes off uncollectible accounts of $10,000.Required:1. Record the adjustment for uncollectible accounts on December 31, 2021.2. Record the write-off of accounts receivable in 2022 and calculate the balance of Allowance for Uncollectible Accounts at the end of 2022 (before adjustment in 2022).3. Assume the same facts as above but assume actual write-offs in 2022 were $15,000. Record the write-off of accounts receivable in 2022 and calculate the balance of Allowance for Uncollectible Accounts at the end of 2022 (before adjustment in 2022).arrow_forward

- On November 1, 2021, a firm issues a $10,000 6% 6-month note payable. Interest is paid with the maturity of the note. The firm performs adjusting entries each month. On April 30, when the note is repaid, the entry recorded: Decreases assets by $10,000 None are true Decreases both assets and liabilities $10,300 Includes an expense of $200 Includes an expense of $300arrow_forwardjohnson company calculates its allowance for uncollectible accounts as 10% of its ending balance in gross accounts receivable. The allowance for uncollectable accounts had a credit balance of $12000 at the begining of 2024. no previously written off accounts recievable were reinstated during 2024. at 12/31/2024, gross accounts recievable totaled $200,100, and prior to recording the adjusting entry to recognize bad debt expenses for 2024, the allowance for uncollectable accounts had a debit balance of $22000. required 1. what was the balance in gross accounts recievable as of 12/31/2023? 2. what journal entry should johnson record to recognize bad debt expense for 2024? 3. assume johnson made no other adjustments of the allowance for uncollectable accounts during 2024. Determine the amount of accounts recievable written off during 2024. 4. if johnson instead used the direct write off method, what would bad debt expense be for 2024?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education