Principles of Accounting

12th Edition

ISBN: 9781133626985

Author: Belverd E. Needles, Marian Powers, Susan V. Crosson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 10AP

On March 31, the end of the current fiscal year, the following information is available to assist Zun Cleaning Company’s accountants in making

- a. Zun’s Supplies account shows a beginning balance of $5,962. Purchases during the year were $10,294. The end-of-year inventory reveals supplies on hand of $3,105.

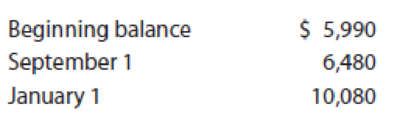

- b. The Prepaid Insurance account shows the following on March 31:

The beginning balance represents the unexpired portion of a one-year policy purchased in January of the previous year. The September 1 entry represents a new oneyear policy, and the January 1 entry represents additional coverage in the form of a three-year policy.

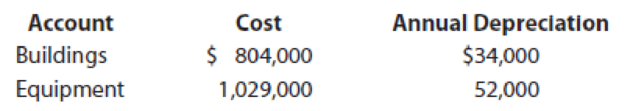

- c. The following table contains the cost and annual depreciation for buildings and equipment, all of which Zun purchased before the current year:

- d. On December 1, the company completed negotiations with a client and accepted an advance of $32,000 for services to be performed monthly for a year. The $32,000 was credited to Unearned Services Revenue. (Round to the nearest dollar.)

- e. The company calculated that, as of March 31, it had earned $9,200 on a $17,000 contract that would be completed and billed in January.

- f. Among the liabilities of the company is a note payable in the amount of $600,000. On March 31, the accrued interest on this note amounted to $17,470.

- g. On Saturday, April 3, the company, which is on a six-day workweek, will pay its regular employees their weekly wages of $22,000. (Round to the nearest dollar.)

- h. On March 31, the company completed negotiations and signed a contract to provide services to a new client at an annual rate of $19,000, beginning April 1.

REQUIRED

- 1. Prepare adjusting entries for each item listed above.

- 2. CONCEPT ▶ Explain how the conditions for revenue recognition are applied to transactions e and h.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The ledger of Bonita Industries at the end of the current year shows Accounts Receivable $76,200; Credit Sales $833,360; and Sales Returns and Allowances $39,190.

(a) If Bonita Industries uses the direct write-off method to account for uncollectible accounts, journalize the adjusting entry at December 31, assuming Bonita Industries determines that Matisse's $834 balance is uncollectible.

(b) If Allowance for Doubtful Accounts has a credit balance of $1,135 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 11% of accounts receivable.

(c) If Allowance for Doubtful Accounts has a debit balance of $530 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 8% of accounts receivable.

(Credit account titles are automatically indented when amount is entered. Do not indent manually.)

No. Account Titles and Explanation

Credit

Debit

(a)

(b)

(c)

The ledger of Pina Colada Corp. at the end of the current year shows Accounts Receivable $108,000; Sales Revenue

$832,000; and Sales Returns and Allowances $18,100.

If Pina Colada uses the direct write-off method to account for uncollectible accounts, journalize the adjusting entry at

(a)

December 31, assuming Pina Colada determines that L. Dole's $1,000 balance is uncollectible.

If Allowance for Doubtful Accounts has a credit balance of $2,000 in the trial balance, journalize the adjusting entry at

(b)

December 31, assuming bad debts are expected to be 11% of accounts receivable.

If Allowance for Doubtful Accounts has a debit balance of $199 in the trial balance, journalize the adjusting entry

(c)

December 31, assuming bad debts are expected to be 8% of accounts receivable.

The ledger of Sheffield Corp. at the end of the current year shows Accounts Receivable $80,300; Credit Sales

$769,390; and Sales Returns and Allowances $41,700.

If Sheffield Corp. uses the direct write-off method to account for uncollectible accounts, journalize the

adjusting entry at December 31, assuming Sheffield Corp. determines that Matisse's $820 balance is

(a)

uncollectible.

If Allowance for Doubtful Accounts has a credit balance of $1,112 in the trial balance, journalize the

adjusting entry at December 3L, assuming bad debts are expected to be 11% of accounts receivable.

(b)

If Allowance for Doubtful Accounts has a debit balance of $450 in the trial balance, journalize the

adjusting entry at December 31, assuming bad debts are expected to be 9% of accounts receivable.

(c)

(Credit account titles are automatically Indented when amount s entered. Do not Indent manually.)

No. Account Titles and Explanation

Debit

Credit

(a)

VA 3:00

Chapter 3 Solutions

Principles of Accounting

Ch. 3 - Prob. 1DQCh. 3 - Will the carrying value of a long-term asset...Ch. 3 - If, at the end of the accounting period, you were...Ch. 3 - Prob. 4DQCh. 3 - Prob. 5DQCh. 3 - Prob. 6DQCh. 3 - Match the concepts of accrual accounting that...Ch. 3 - The Prepaid Insurance account began the year with...Ch. 3 - The Supplies account began the year with a balance...Ch. 3 - Prob. 4SE

Ch. 3 - Prob. 5SECh. 3 - During the month of August, deposits in the amount...Ch. 3 - Prob. 7SECh. 3 - Malesherbes Companys adjusted trial balance on...Ch. 3 - Prob. 9SECh. 3 - Prob. 10SECh. 3 - Carlos Companys accountant makes the assumptions...Ch. 3 - Four conditions must be met before revenue should...Ch. 3 - Prob. 3EACh. 3 - Prob. 4EACh. 3 - Prob. 5EACh. 3 - Prob. 6EACh. 3 - Prob. 7EACh. 3 - Prob. 8EACh. 3 - Prepare year-end adjusting entries for each of the...Ch. 3 - Prob. 10EACh. 3 - Prob. 11EACh. 3 - Wipro Companys income statement included the...Ch. 3 - At the end of the first three months of operation,...Ch. 3 - On November 30, the end of the current fiscal...Ch. 3 - Kinokawa Consultants Companys trial balance on...Ch. 3 - Hertz Limo Service was organized to provide...Ch. 3 - At the end of its fiscal year, Berwyn Cleaners...Ch. 3 - Brave Advisors Services trial balance on December...Ch. 3 - Prob. 7PCh. 3 - Prob. 8PCh. 3 - Prob. 9APCh. 3 - On March 31, the end of the current fiscal year,...Ch. 3 - Lee Technology Corporations trial balance on...Ch. 3 - Prob. 12APCh. 3 - Prob. 13APCh. 3 - Scoop Consulting Services trial balance on...Ch. 3 - Prob. 15APCh. 3 - Prob. 16APCh. 3 - Never Flake Company provided a rust-prevention...Ch. 3 - Prob. 2CCh. 3 - Prob. 3CCh. 3 - Prob. 4CCh. 3 - Prob. 5CCh. 3 - Prob. 6C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The general ledger of the Jumper Incorporated is showing an Accounts Receivable balance of $80,000, Sales Revenue of $650,000, and Sales Returns and Allowances of $30,000. If Jumper Inc used the direct write-off method to account for uncollectible accounts, do the adjusting journal entry on December 31st, assuming Jumper Inc determines that John Hancock's $2,500 balance is uncollectable.arrow_forwardcompany’s accounting records provide the following information concerning certain account balances and changes in the account balances during the current year. Transaction information is missing from each of the below. Prepare the journal entry to record the information for each account. b. Allowance for Doubtful Accounts: Jan. 1 balance, $1,500; Dec. 31 balance, $2,200; adjusting entry increasing allowance on Dec. 31, $4,800. Record write-off uncollectible accounts receivable. c. Inventory of office supplies: Jan. 1 balance, $1,500; Dec. 31 balance, $1,350; office supplies expense for the year, $9,500. Record purchase of office supplies. d. Equipment: Jan. 1 balance, $20,500; Dec. 31 balance, $18,000; equipment costing $8,000 was sold during the year. Record purchase of equipment. e. Accounts Payable: Jan. 1 balance $9,000; Dec. 31 balance, $11,500; purchases on - account for the year, $48,000. Record cash payments. Please dont provide solution in image thnxarrow_forwardThe ledger of Pina Colada Corp. at the end of the current year shows Accounts Receivable $108,000; Sales Revenue $832,000; and Sales Returns and Allowances $18,100. (a) If Pina Colada uses the direct write-off method to account for uncollectible accounts, journalize the adjusting entry at December 31, assuming Pina Colada determines that L. Dole’s $1,000 balance is uncollectible. (b) If Allowance for Doubtful Accounts has a credit balance of $2,000 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 11% of accounts receivable. (c) If Allowance for Doubtful Accounts has a debit balance of $199 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 8% of accounts receivable. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit (a) enter an account title…arrow_forward

- 1. Present entries to record the following for a business that uses the Allowance Method:a) Record the adjusting entry at 12/31/19, the end of the fiscal year to provide for doubtful accounts. The accounts receivable account has a balance of $100,000 and the contra asset account, before adjustment has a debit balance of $700. Analysis of receivables indicates doubtful accounts of $4,500b) In March of the following fiscal year $610 owed by the Filthy Disgusting Yankees Inc was written off.c) Six months later the $610 is reinstated and payment of that amount received2. What is the estimated realizable value of the accounts receivable as reported on the Balance Sheet prepared as of 12/31/193. Assuming that the business had been following the direct write off method for accounting for uncollectibles, present the entry to record the write-off in (1b)4. Record the entry for the reinstatement of the account written off in (3) under the direct write-off methodarrow_forwardFor a business that uses the allowance method of accounting for uncollectible receivables: Journalize the entries to record the following: Use correct journal format. Just use the month for the date. Record the adjusting entry at December 31, the end of the first fiscal year, to record the bad debt expense. The accounts receivable account has a balance of $850,000, and the contra asset account before adjustment has a debit balance of $4000. Analysis of the receivables (aging) indicates uncollectible receivables of $17,200. In March of the next year, the $720 owed by Fronk Co. on account is written off as uncollectible. In November of the next year, $400 of the Fronk Co. account 1s reinstated and payment of that amount is received. In December of the next year, $250 is received on the $800 owed by Dodger Co. and the remainder is written off as uncollectible.arrow_forwardPresent entries to record the following (a,b,c) for a business that uses the Allowance Method: a: Record the adjusting entry at 12/31/19, the end of the fiscal year to provide for doubtful accounts. The accounts receivable account has a balance of $100,000 and the contra asset account, before adjustment has a debit balance of $700. Analysis of receivables indicates doubtful accounts of $4,500. b: In March of the following fiscal year $610 owed by the Filthy Disgusting Yankees Inc was written off. c: Six months later the $610 is reinstated and payment of that amount received What is the estimated realizable value of the accounts receivable as reported on the Balance Sheet prepared as of 12/31/19 Assuming that the business had been following the direct write off method for accounting for uncollectibles, present the entry to record the write-off in (1b) Record the entry for the reinstatement of the account written off in (3) under the direct write-off method Assignment: Record the…arrow_forward

- Johnson company’s financial year ended on December 31, 2010. All thetransactions related to the company’s uncollectible accounts are can be found below: The accounts receivable account had a balance of $114,630 and the beginning balance in the allowance for uncollectible accounts was $6,200.Required:1. Prepare journal entries for each transaction.2. Prepare the Allowance for Uncollectible and the Accounts Receivable accounts based on the information presented and balance off each account.3. Prepare the balance sheet extract as at Dec 31 to show the net realizable value for the Accounts Receivable. 4. Assume that the aging of accounts receivable method was used by the company and that $7,050 of the accounts receivable as of December 31 were estimated to be uncollectible. You are now required to:a. Determine the amount to be charged to uncollectible expense (show your workings for the computation of this figure).b. Prepare the balance sheet extract to show the net realizable value of the…arrow_forwardJohnson company’s financial year ended on December 31, 2010. All thetransactions related to the company’s uncollectible accounts are can be found below: The accounts receivable account had a balance of $114,630 and the beginning balance in the allowance for uncollectible accounts was $6,200. Required:1. Prepare journal entries for each transaction.2. Prepare the Allowance for Uncollectible and the Accounts Receivable accounts based on the information presented and balance off each account.arrow_forwardWarner Company's year-end unadjusted trial balance shows accounts receivable of $118,000, allowance for doubtful accounts of $790 (credit), and sales of $470,000. Uncollectibles are estimated to be 1.50% of accounts receivable. 1. Prepare the December 31 year-end adjusting entry for uncollectibles. 2. What amount would have been used in the year-end adjusting entry if the allowance account had a year-end unadjusted debit balance of $1,250? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the December 31 year-end adjusting entry for uncollectibles. View transaction list Journal entry worksheetarrow_forward

- Warner Company’s year-end unadjusted trial balance shows accounts receivable of $118,000, allowance for doubtful accounts of $790 (credit), and sales of $470,000. Uncollectibles are estimated to be 1.50% of accounts receivable. 1. Prepare the December 31 year-end adjusting entry for uncollectibles.2. What amount would have been used in the year-end adjusting entry if the allowance account had a year-end unadjusted debit balance of $1,250?arrow_forwardAt December 31, before adjusting and closing the accounts had occurred, the Allowance for Doubtful Accounts of Seaboard Corporation showed a debit balance of $3,200. An aging of the accounts receivable indicated the amount probably uncollectible to be $2,100. Under these circumstances, a year-end adjusting entry for uncollectible accounts expense would include a: A. Debit to Uncollectible Accounts Expense of $5,300. B. Debit to the Allowance for Doubtful Accounts for $1,100. C. Debit to Uncollectible Accounts Expense of $2,100. D. Credit to the Allowance for Doubtful Accounts for $1,100.arrow_forwardAt the end of the current year, Accounts Receivable has a balance of $890,000; Allowance for Doubtful Accounts has a debit balance of $8,000; and sales for the year total $4,010,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $41,600. a. Determine the amount of the adjusting entry for uncollectible accounts.$fill in the blank 1 b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $fill in the blank 2 Allowance for Doubtful Accounts $fill in the blank 3 Bad Debt Expense $fill in the blank 4 c. Determine the net realizable value of accounts receivable.$fill in the blank 5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY