Principles of Accounting

12th Edition

ISBN: 9781133626985

Author: Belverd E. Needles, Marian Powers, Susan V. Crosson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 1P

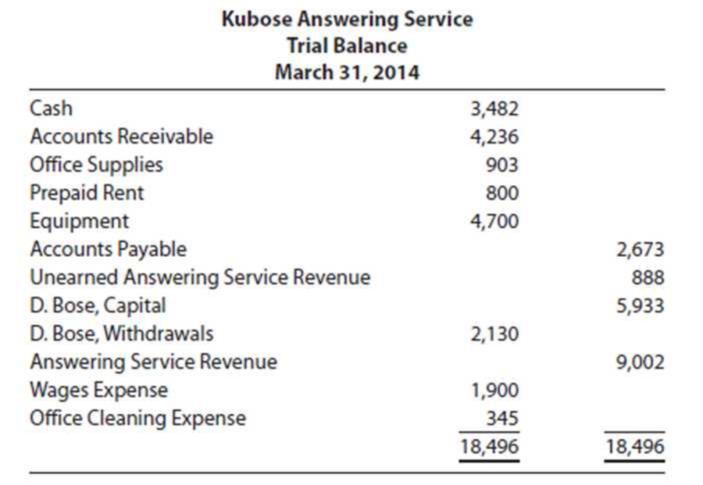

At the end of the first three months of operation, Kubose Answering Service’s

- a. An inventory of office supplies reveals supplies on hand of $133.

- b. The Prepaid Rent account includes the rent for the first three months plus a deposit for April’s rent.

- c. Depreciation on the equipment for the first three months is $208.

- d. The balance of the Unearned Answering Service Revenue account represents a 12-month service contract paid in advance on February 1.

- e. On March 31, accrued wages total $80.

REQUIRED

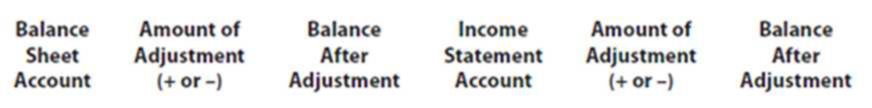

All adjustments affect one

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Academic Dishonesty Investigations Ltd. operates a

plagiarism detection service for universities and

colleges.

Required:

1. Prepare journal entries for each transaction below. (If

no entry is required for a transaction/event, select "No

journal entry required" in the first account field.)

a. On March 31, ten customers were billed for detection

services totalling $40,000.

b. On October 31, a customer balance of $2,400 from a

prior year was determined to be uncollectible and was

written off.

c. On December 15, a customer paid an old balance of

$1,650, which had been written off in a prior year.

d. On December 31, $1,050 of bad debts were estimated

and recorded for the year.

2. Complete the following table, indicating the amount.

Ignore income taxes. (Enter any decreases with a minus

sign.)

Net Receivables

a.bcd

Net Sales

Income from

Operations

You have been recently hired as an assistant controller for XYZ Industries, a large, publically held manufacturing company. Your immediate supervisor is the controller who also reports directly to the VP of Finance. The controller has assigned you the task of preparing the year-end adjusting entries. In the receivables area, you have prepared an aging accounts receivable and have applied historical percentages to the balances of each of the age categories. The analysis indicates that an appropriate estimated balance for the allowance for uncollectible accounts is $180,000. The existing balance in the allowance account prior to any adjusting entry is a $20,000 credit balance.

After showing your analysis to the controller, he tells you to change the aging category of a large account from over 120 days to current status and to prepare a new invoice to the customer with a revised date that agrees with the new category. This will change the required allowance for uncollectible accounts…

You have been recently hired as an assistant controller for XYZ Industries, a large, publically held manufacturing company. Your immediate supervisor is the controller who also reports directly to the VP of Finance. The controller has assigned you the task of preparing the year-end adjusting entries. In the receivables area, you have prepared an aging accounts receivable and have applied historical percentages to the balances of each of the age categories. The analysis indicates that an appropriate estimated balance for the allowance for uncollectible accounts is $180,000. The existing balance in the allowance account prior to any adjusting entry is a $20,000 credit balance.3.What is the ethical dilemma you face? What are the ethical considerations? Consider your options and responsibilities as assistant controller.4.Identify the key internal and external stakeholders. What are the negative impacts that can happen if you do not follow the instructions of your supervisor?5.What are the…

Chapter 3 Solutions

Principles of Accounting

Ch. 3 - Prob. 1DQCh. 3 - Will the carrying value of a long-term asset...Ch. 3 - If, at the end of the accounting period, you were...Ch. 3 - Prob. 4DQCh. 3 - Prob. 5DQCh. 3 - Prob. 6DQCh. 3 - Match the concepts of accrual accounting that...Ch. 3 - The Prepaid Insurance account began the year with...Ch. 3 - The Supplies account began the year with a balance...Ch. 3 - Prob. 4SE

Ch. 3 - Prob. 5SECh. 3 - During the month of August, deposits in the amount...Ch. 3 - Prob. 7SECh. 3 - Malesherbes Companys adjusted trial balance on...Ch. 3 - Prob. 9SECh. 3 - Prob. 10SECh. 3 - Carlos Companys accountant makes the assumptions...Ch. 3 - Four conditions must be met before revenue should...Ch. 3 - Prob. 3EACh. 3 - Prob. 4EACh. 3 - Prob. 5EACh. 3 - Prob. 6EACh. 3 - Prob. 7EACh. 3 - Prob. 8EACh. 3 - Prepare year-end adjusting entries for each of the...Ch. 3 - Prob. 10EACh. 3 - Prob. 11EACh. 3 - Wipro Companys income statement included the...Ch. 3 - At the end of the first three months of operation,...Ch. 3 - On November 30, the end of the current fiscal...Ch. 3 - Kinokawa Consultants Companys trial balance on...Ch. 3 - Hertz Limo Service was organized to provide...Ch. 3 - At the end of its fiscal year, Berwyn Cleaners...Ch. 3 - Brave Advisors Services trial balance on December...Ch. 3 - Prob. 7PCh. 3 - Prob. 8PCh. 3 - Prob. 9APCh. 3 - On March 31, the end of the current fiscal year,...Ch. 3 - Lee Technology Corporations trial balance on...Ch. 3 - Prob. 12APCh. 3 - Prob. 13APCh. 3 - Scoop Consulting Services trial balance on...Ch. 3 - Prob. 15APCh. 3 - Prob. 16APCh. 3 - Never Flake Company provided a rust-prevention...Ch. 3 - Prob. 2CCh. 3 - Prob. 3CCh. 3 - Prob. 4CCh. 3 - Prob. 5CCh. 3 - Prob. 6C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You have been recently hired as an assistant controller for XYZ Industries, a large, publically held manufacturing company. Your immediate supervisor is the controller who also reports directly to the VP of Finance. The controller has assigned you the task of preparing the year-end adjusting entries. In the receivables area, you have prepared an aging accounts receivable and have applied historical percentages to the balances of each of the age categories. The analysis indicates that an appropriate estimated balance for the allowance for uncollectible accounts is $180,000. The existing balance in the allowance account prior to any adjusting entry is a $20,000 credit balance. After showing your analysis to the controller, he tells you to change the aging category of a large account from over 120 days to current status and to prepare a new invoice to the customer with a revised date that agrees with the new category. This will change the required allowance for uncollectible accounts…arrow_forwardYou have been recently hired as an assistant controller for XYZ Industries, a large, publically held manufacturing company. Your immediate supervisor is the controller who also reports directly to the VP of Finance. The controller has assigned you the task of preparing the year-end adjusting entries. In the receivables area, you have prepared an aging accounts receivable and have applied historical percentages to the balances of each of the age categories. The analysis indicates that an appropriate estimated balance for the allowance for uncollectible accounts is $180,000. The existing balance in the allowance account prior to any adjusting entry is a $20,000 credit balance. After showing your analysis to the controller, he tells you to change the aging category of a large account from over 120 days to current status and to prepare a new invoice to the customer with a revised date that agrees with the new category. This will change the required allowance for uncollectible accounts…arrow_forwardRay, the owner of a small company, asked Holmes, CPA, to conduct an audit of the company’s records. Ray told Holmes that the audit must be completed in time to submit audited financial statements to a bank as part of a loan application. Holmes immediately accepted the engagement and agreed to provide an auditor’s report within three weeks. Ray agreed to pay Holmes a fixed fee plus a bonus if the loan was granted. Holmes hired two accounting students to conduct the audit and spent several hours telling them exactly what to do. Holmes told the students not to spend time reviewing the controls but to concentrate on proving the mathematical accuracy of the ledger accounts and to summarize the data in the accounting records that support Ray’s financial statements. The students followed Holmes’ instructions and after two weeks gave Holmes the financial statements, which did not include footnotes because the company did not have any unusual transactions. Holmes reviewed the statements and prepared an unqualified auditor’s report. The report, however, did not refer to GAAP or to the year-to-year application of such principles. Briefly describe each of the ten standards included in the PCAOB guidance and indicate how the action(s) of Holmes resulted in a failure to comply with each standard.arrow_forward

- Prepare journal entries to record the following transactions that occurred in March: A. on first day of the month, purchased building for cash, $75,000 B. on fourth day of month, purchased inventory, on account, $6,875 C. on eleventh day of month, billed customer for services provided, $8,390 D. on nineteenth day of month, paid current month utility bill, $2,000 E. on last day of month, paid suppliers for previous purchases, $2,850arrow_forwardSecure Home provides house-sitting for people while they are away on vacation. Some of its customers pay immediately after the job is finished. Some customers ask that the business send them a bill. As of the end of the year, Secure Home has collected $1,920 from cash-paying customers. Secure Home’s remaining customers owe the business $2,660. Secure Home recorded $1,920 of service revenue for the year. correct If Secure Home had recorded their service revenue using the other method, how much service revenue would they have recorded for the year?arrow_forwardLike New Steam Cleaning performs services on account. When a customer account becomes four months old, Like New converts the account to a note receivable. During 2018,the company completed the following transactions: Record the transactions in Like New's journal. Round to the nearest dollar. (Use a 365-day year for computations. Record debits first, then credits. Select the explanation on the last line of the journal entry table.)arrow_forward

- Judy Smith owed the Flower Company $3,200 on account by February 25. After several attempts to the collect the money that was owed, Flower Company wrote off Judy's account as uncollectible on August 31. On December 15 Flower Company received a check from Judy Smith for the full $3,200 that she had owed the company. The company's fiscal year ended on December 31. Which of the following journal entries is recorded to reinstate the account when using the direct write-off method? a.Debit Accounts Receivable $3,200 and credit Uncollectible Accounts Recovered $3,200 b.Debit Bad Debt Expense $3,200 and credit Accounts Receivable $3,200 c.Debit Accounts Receivable $3,200 and credit Bad Debt Expense $3,200 d.Debit Allowance for Doubtful Accounts $3,200 and credit Bad Debt Expense $3,200arrow_forwardThe accounting records and bank statement of Orison Supply Store provide the following information at the end of April. The closing 'Cash' account balance was $28,560, and the bank statement shows a closing balance of $32,000. On reviewing the bank statement it is found an account customer has deposited $2,000 into the bank account for a March sale and the monthly insurance premium of $4,500 was automatically charged to the account. Interest of $5,10 was paid by the bank and a bank fee of $50 was charged to the account. A payment of $1,500 to a supplier has been recorded twice in the accounts. After the ,calculation of the "ending reconciled cash balance", what is the balance of the 'cash' account?arrow_forwardSafe Home provides house-sitting for people while they are away on vacation. Some of its customers pay immediately after the job is finished. Some customers ask that the business send them a bill. As of the end of the year, Safe Home has collected $1,130 from cash-paying customers. Safe Home's remaining customers owe the business $320. Safe Home recorded $1,130 of service revenue for the year. Cash basis If Safe Home had recorded their service revenue using the other method, how much service revenue would they have recorded for the year? Splendid Occasions received $2,080 for services to be performed for the next 8 months on March 31 and recorded this transaction using the Unearned Revenue account. Accrual basis If Splendid Occasions had recorded their service revenue using the other method, how much service revenue would they have recorded for the year?arrow_forward

- Secure Home provides house-sitting for people while they are away on vacation. Some of its customers pay immediately after the job is finished. Some customers ask that the business send them a bill. As of the end of the year, Secure Home has collected $1,720 from cash-paying customers. Secure Home’s remaining customers owe the business $3,080. Secure Home recorded $1,720 of service revenue for the year. (Cash basis) If Secure Home had recorded their service revenue using the other method, how much service revenue would they have recorded for the year?arrow_forwardThe accounting records and bank statement of Jeff's Seashell Store provide the following information at the end of April. The closing 'Cash' account balance was $29000, and the bank statement shows a closing balance of $31000. On reviewing the bank statement it is found an account customer has deposited $2500 into the bank account for a March sale and the monthly insurance premium of $550 was automatically charged to the account. Interest of $1500 was paid by the bank and a bank fee of $50 was charged to the account. A payment of $950 to a supplier has been recorded twice in the accounts. After the calculation of the "ending reconciled cash balance", what is the balance of the 'cash' account?A. 33,350 B. None of the other answers C. 31,450 D. 29,000 E. 35,350arrow_forwardProtection Home provides house-sitting for people why they are away on vactation. Some of its customers pay immediately after the job is finished. Some customers ask that the business sends them a bill. As of the end of the year, Protection Home has collected $900 from cash-paying customers. Protection Home's remaining customers owe the business $1,300. A. Cash Basis? B. Accrual Basis?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub  Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY