Principles of Accounting

12th Edition

ISBN: 9781133626985

Author: Belverd E. Needles, Marian Powers, Susan V. Crosson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 4P

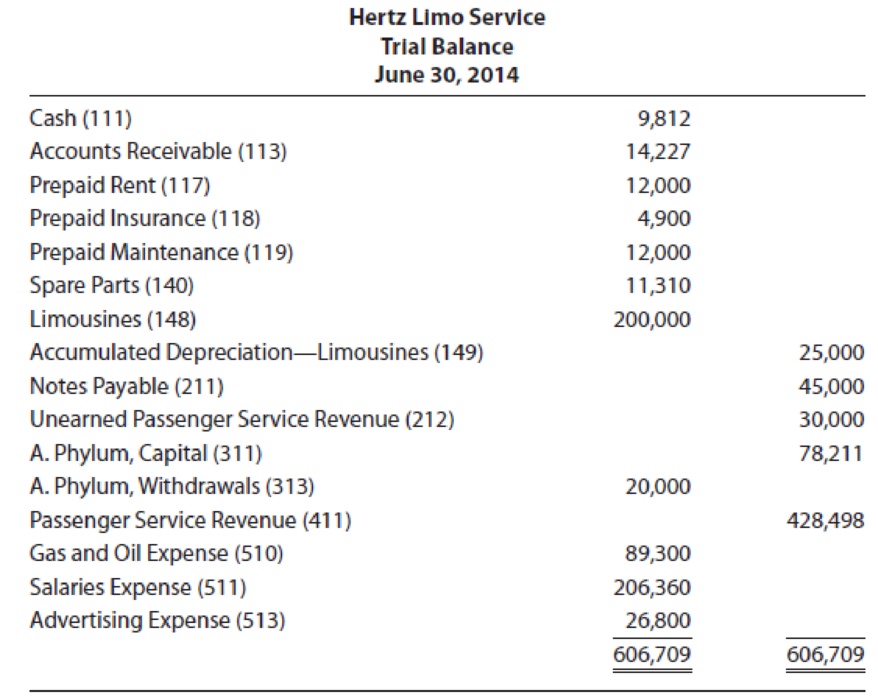

Hertz Limo Service was organized to provide limousine service between the airport and various suburban locations. It has just completed its second year of business. Its

The following information is also available:

- a. To obtain space at the airport, Hertz paid two years’ rent in advance when it began the business.

- b. An examination of insurance policies reveals that $2,800 expired during the year.

- c. To provide regular maintenance for the vehicles, Hertz deposited $12,000 with a local garage. An examination of maintenance invoices reveals charges of $10,944 against the deposit.

- d. An inventory of spare parts shows $1,902 on hand.

- e. Hertz depreciates all of its limousines at the rate of 12.5 percent per year. No limousines were purchased during the year. (Round answer to the nearest dollar.)

- f. A payment of $1,500 for one full year’s interest on notes payable is now due.

- g. Unearned Passenger Service Revenue on June 30 includes $17,815 for tickets that employers purchased for use by their executives but which have not yet been redeemed.

REQUIRED

- 1. Determine the

adjusting entries and enter them in the general journal (Page 14). - 2. Open ledger accounts for the accounts in the trial balance plus the following: Interest Payable (213); Rent Expense (514); Insurance Expense (515); Spare Parts Expense (516);

Depreciation Expense—Limousines (517); Maintenance Expense (518); and Interest Expense (519). Record the balances shown in the trial balance. - 3.

Post the adjusting entries from the general journal to the ledger accounts, showing proper references. - 4. Prepare an adjusted trial balance, an income statement, a statement of owner’s equity, and a balance sheet. The owner made no investments during the period.

- 5. ACCOUNTING CONNECTION ▶ What effect do the adjusting entries have on the income statement?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Hero had a delivery van which was destroyed in an accident. On that date, the carying amount of the van was P3, 000, 000. On

july 15, the entity receieved and recorded a P50, 000 invoice for a new engine installed in the van in May, and another 100, 000

invoice for various repairs. In August, the entity receieved P4, 200, 000 under an insurance policy on the vn which it plans to use

to replace the van. What amount should be reported as gain on disposal of the van in the income statement?

A) 800,000

B) o

c) 700,000

d) 600,000

Craig has decided to start snow plowing during the winter months. He purchased a heavy-duty dump truck with plow and salter from Power Equipment for $40,000 on October 1st, 2026. He paid $1,000 as a down payment and the remaining balance on a 5% -7 year note to Power Equipment. You will be completing several accounting activities in regards to this purchase.

What would the journal entry be for the check

1. Use the write check function in QB Online to record the entire purchase (down payment and capitalization of the truck and related liability). Use check number 171. Create accounts as needed in QB Online. You may find it helpful to write out the journal entry first before completing it in QB Online.

Walker Motel recently purchased new exercise equipment for its exercise room. The followinginformation refers to the purchase and installation of this equipment:

1. The list price of the equipment was $40,000; however, Walker qualified for a “special dis-count” of $5,000. It paid $10,000 cash for the equipment, and issued a three-month, 12 percent

note payable for the remaining balance. The note, plus accrued interest charges of $750, waspaid promptly at the maturity date.2. In addition to the amounts described in 1, Walker paid sales taxes of $2,100 at the date ofpurchase.3. Freight charges for delivery of the equipment totaled $600.4. Installation and training costs related to the equipment amounted to $900.5. During installation, one of the pieces of equipment was accidentally damaged by an employee.It cost the motel $400 to repair this damage.6. As soon as the equipment was installed, the motel paid $3,200 to print brochures featuring theexercise room’s new, state-of-the-art…

Chapter 3 Solutions

Principles of Accounting

Ch. 3 - Prob. 1DQCh. 3 - Will the carrying value of a long-term asset...Ch. 3 - If, at the end of the accounting period, you were...Ch. 3 - Prob. 4DQCh. 3 - Prob. 5DQCh. 3 - Prob. 6DQCh. 3 - Match the concepts of accrual accounting that...Ch. 3 - The Prepaid Insurance account began the year with...Ch. 3 - The Supplies account began the year with a balance...Ch. 3 - Prob. 4SE

Ch. 3 - Prob. 5SECh. 3 - During the month of August, deposits in the amount...Ch. 3 - Prob. 7SECh. 3 - Malesherbes Companys adjusted trial balance on...Ch. 3 - Prob. 9SECh. 3 - Prob. 10SECh. 3 - Carlos Companys accountant makes the assumptions...Ch. 3 - Four conditions must be met before revenue should...Ch. 3 - Prob. 3EACh. 3 - Prob. 4EACh. 3 - Prob. 5EACh. 3 - Prob. 6EACh. 3 - Prob. 7EACh. 3 - Prob. 8EACh. 3 - Prepare year-end adjusting entries for each of the...Ch. 3 - Prob. 10EACh. 3 - Prob. 11EACh. 3 - Wipro Companys income statement included the...Ch. 3 - At the end of the first three months of operation,...Ch. 3 - On November 30, the end of the current fiscal...Ch. 3 - Kinokawa Consultants Companys trial balance on...Ch. 3 - Hertz Limo Service was organized to provide...Ch. 3 - At the end of its fiscal year, Berwyn Cleaners...Ch. 3 - Brave Advisors Services trial balance on December...Ch. 3 - Prob. 7PCh. 3 - Prob. 8PCh. 3 - Prob. 9APCh. 3 - On March 31, the end of the current fiscal year,...Ch. 3 - Lee Technology Corporations trial balance on...Ch. 3 - Prob. 12APCh. 3 - Prob. 13APCh. 3 - Scoop Consulting Services trial balance on...Ch. 3 - Prob. 15APCh. 3 - Prob. 16APCh. 3 - Never Flake Company provided a rust-prevention...Ch. 3 - Prob. 2CCh. 3 - Prob. 3CCh. 3 - Prob. 4CCh. 3 - Prob. 5CCh. 3 - Prob. 6C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mr X enrolls in a 12-month customer service assistance program for a computer software from CYBER COMPANY costing P1,200 per month on August 1, 20x8. Given that the computer assistance occurs evenly throughout the year, CYBER COMPANY uses the “proportion of time” as its measure for membership revenue, what is the amount of sales revenue to be recognized on December 31?arrow_forwardIn June 2021, A.B. Malinaw established a photography business. Transactions that transpired during the month follow: AB Malinaw invested P250,000 cash in his business named Malinaw Photography. Paid P5,000 for the municipal permit/license. Received proceeds of loan from UniBank and executed a promissory note amounting P150,000. Paid in advance the shop's six month rental to commence the following month, P60,000. Bought P80,000 worth of furniture for cash. Purchased equipments (cameras, tripods, lightings, laptop & printer) with total cost of P350,000, paid P150,000 cash and 3 4 the balance on account. Bought for cash photo supplies costing P25,000. Received advance payment of P50,000 from a couple who will get marry on July, 2021. Received P75,000 cash for photo services rendered to various customers. Billed a customer for the balance of unpaid photo service rendered, P40,000. Paid utility bills totalling P15,000. 12 Paid the month's salaries of employees, P55,000. 13 Made partial…arrow_forwardFaraday Electronic Service repairs stereos and DVD players. During the year, Faraday engaged in the following activities: On September 1, Faraday paid Wausau Insurance $4,860 for its liability insurance for the next 12 months. The full amount of the prepayment was debited to prepaid insurance. At December 31, Faraday estimates that $1,520 of utility costs are unrecorded and unpaid. Faraday rents its testing equipment from JVC. Equipment rent in the amount of $1,440 is unpaid and unrecorded at December 31. In late October, Faraday agreed to become the sponsor for the sports segment of the evening news program on a local television station. The station billed Faraday $4,350 for 3 months' sponsorship—November, December, and January—in advance. When these payments were made, Faraday debited prepaid advertising. At December 31, 2 months’ advertising has been used and 1 month remains unused. 1. Prepare adjusting entries at December 31 for these four activities. If an amount box…arrow_forward

- Precision Construction entered into the following transactions during a recent year.January 2 Purchased a bulldozer for $250,000 by paying $20,000 cash and signing a$230,000 note due in five years.January 3 Replaced the steel tracks on the bulldozer at a cost of $20,000, purchased onaccount.January 30 Wrote a check for the amount owed on account for the work completed onJanuary 3.February 1 Replaced the seat on the bulldozer and wrote a check for the full $800 cost.March 1 Paid $3,600 cash for the rights to use computer software for a two-year period.Required:1. Analyze the accounting equation effects and record journal entries for each of the transactions.2. For the tangible and intangible assets acquired in the preceding transactions, determine theamount of depreciation and amortization that Precision Construction should report for thequarter ended March 31. The equipment is depreciated using the double-declining-balancemethod with a useful life of five years and $40,000 residual…arrow_forwardCraig has decided to start snow plowing during the winter months. He purchased a heavy-duty dump truck with plow and salter from Power Equipment for $40,000 on October 1st, 2026. He paid $1,000 as a down payment and the remaining balance on a 5% -7 year note to Power Equipment. You will be completing several accounting activities in regards to this purchase. 1. Prepare the Deprecation schedule in Excel for this dump truck with plow. Use the suggested life from an IRS publication 946, Chapter 4, Under Property Classes. Craig believes the salvage (residual) value will be $10,000 after its useful life. Craig will use the straight-line depreciation method for accounting purposes. Hint: In the first year and last year you will have partial depreciation. Include a column for Accumulated Depreciation and Book Value. Be sure your table is professional and fits on one page.arrow_forwardTriton Limited purchases a new delivery truck for $80,000. The insurance cost during transit from the motor vehicle dealer to Triton is $3,000. The logo of the company is painted on the side of the truck for $500. The recurring annual truck registration is $700 and a 12 month accident insurance policy is $1,100. The truck undergoes the initial safety testing to make sure it is road worthy for the first time is $330. What does Triton Limited record as the cost of the new truck? Select the one correct answer: O $85,630. O $80,000. O $83,830. O $83,000.arrow_forward

- The following needs to entered in the copied spreadshet. 2. The following transactions occurred during the year. Record these transactions.HHL took out a long-term loan for $3 million.HHL purchased $1 million in inventory with cash.HHL purchased equipment that cost $150,000 on account. The equipment is expected to last 15 years and has no salvage value.$540,865,000 (net of allowances and charity care) was billed for patient services. The hospital estimates that 5% of these bills will be bad debt.$875,000 of inventory was used.Donations of $400,000 were received in cash.HHL pays in cash for a 2-year malpractice insurance premium at a cost of $5 million. One-half of the premium is for next year, and the other is for the following year.HHL pays $12,560,000 in accounts payable.HHL workers earned $259 million in wages for the year. The hospital paid out $282 million in cash. It also paid out $60 million in benefits, all in cash.The equipment purchased in transaction c was paid for in…arrow_forwardMr. George opened a janitorial services business called “George Johnny” on November 1, 20x1 and uses a calendar year. The following were the transactions during the year. Mr. George made an investment of P100,000 to the business. The total business permit and other licenses amounted to P4,800. The business acquired janitorial equipment for P30,000 on account on November 1, 20x1. The equipment has a useful life of 5 years. The business purchased supplies worth P60,000. The business uses the asset method in recording prepayments. The business obtained a 12%, one-year, bank loan for P50,000 on November 1, 20x1. Principal and interest are due at maturity date. The business paid six months’ rent in advance amounting to P9,000 on November 1, 20x1. The business took one-year insurance for P6,000 on December 1, 20x1. Total service fees billed to clients, on account, amounted to P400,000. Total collections on accounts receivable amounted to P270,000. Mr. George took P30,000 cash from the…arrow_forwardBlue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and disbursements journal. At the end of the year (2019), the company hires you to convert the cash receipts and disbursements into accrual basis revenues and expenses. The total cash receipts are summarized as follows. The accounts receivable from customers at the end of the year are 120,000. You note that the accounts receivable at the beginning of the year were 190,000. The cash sales included 30,000 of prepayments for services to be provided over the period January 1, 2019, through December 31, 2021. a. Compute the companys accrual basis gross income for 2019. b. Would you recommend that Blue use the cash method or the accrual method? Why? c. The company does not maintain an allowance for uncollectible accounts. Would you recommend that such an allowance be established for tax purposes? Explain.arrow_forward

- Hassad owns a rental house on Lake Tahoe. He uses a real estate firm to screen prospective renters, but he makes the final decision on all rentals. He also is responsible for setting the weekly rental price of the house. During the current year, the house rents for 1,500 per week. Hassad pays a commission of 150 and a cleaning fee of 75 for each week the property is rented. During the current year, he incurs the following additional expenses related to the property: a. What is the proper tax treatment if Hassad rents the house for only 1 week (7 days) and uses it 50 days for personal purposes? b. What is the proper tax treatment if Hassad rents the house for 8 weeks (56 days) and uses it 44 days for personal purposes? c. What is the proper tax treatment if Hassad rents the house for 25 weeks (175 days) and uses it 15 days for personal purposes?arrow_forwardLowell Company sells swimming pool supplies and equipment. The majority of Lowell's customers are small, family-owned businesses. Assume that Lowell Corporation completed the following transactions during the current year. Lowell's fiscal year ends on December 31. September 15 October 1 October 5 October 15 December 12 December 31 Required: Paid a supplier $129,500 for inventory previously purchased on credit. Borrowed $904,500 from Mass Bank for general use; signed an 11-month, 5% annual interest-bearing note for the money. Received a $42,250 customer deposit from Jim Scanlon for services to be performed in the future. Performed $19,800 of the services paid for by Mr. Scanlon. Received electric bill for $12,450. Lowell plans to pay the bill in early January. Determined wages of $52,900 earned but not yet paid on December 31 (disregard payroll taxes). 1.&2. Prepare journal entries for each of these transactions.arrow_forwardA company purchased a machine at the cost of $759,600 on March 1 of year 1. On the same day, the business paid the shipping company $5,600 to deliver the machine and paid $14,500 to another business to install and test the new machine. The annual insurance policy for the new machine is $8,600. The company’s fiscal year end is November 30. The company’s accounting policy is to depreciate all machines using the double diminishing balance method. The machine has an expected useful lifespan of five-years and an estimated residual value of $30,000. However, the company discovered the machine did not meet its business requirements, so it sold the machine on September 1, year 3, for $156,500. Perform all your calculations to the nearest dollar. Show all your work. Instructions: Write you answers by hand, scan your working papers and upload to the link on the main page of the Moodle website as a PDF file. Show any calculations. Printing the problem information is permitted but only for…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY