Concept explainers

(a)

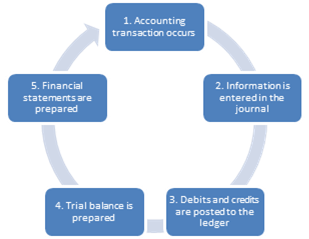

The Accounting Information System is a system that a business uses for collecting, storing, and processing the data of the accounting transactions and provides the financial information to the decision makers.

Accounting information cycle:

Figure (1)

To indicate: The proper flow of accounting information, as Person B is confused about the accounting information flows.

(b)

To indicate: The proper flow of accounting information, as Person B is confused about the accounting information flows.

(c)

To indicate: The proper flow of accounting information, as Person B is confused about the accounting information flows.

(d)

To indicate: The proper flow of accounting information, as Person B is confused about the accounting information flows.

(e)

To indicate: The proper flow of accounting information, as Person B is confused about the accounting information flows.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Financial Accounting: Tools for Business Decision Making, 8th Edition

- A company has decided to purchase equipment, needing to borrow $100,000 from its local bank to make the purchase. The bank gives the company two options: (a) 60-month installment note with 4% interest or (b) 120-month installment note with 8% interest. Lenders often charge a higher interest rate for longer-term loans to compensate for additional risk of lending for a longer time period. Record $100,000 cash received from the issuance of the 120-month installment note with 8% interest.Record $100,000 cash received from the issuance of the 120-month installment note with 8% interest. Select the options to display a 120-month installment note with 12% interest. How much of the principal amount is due after the 60th payment?arrow_forward!??arrow_forwardaccounting questionarrow_forward

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College