Concept explainers

Fixed-cost allocation. Central University completed construction of its newest administrative building at the end of 2017. The University’s first employees moved into the building on January 1, 2018. The building consists of office space, common meeting rooms (including a conference center), a cafeteria, and even a workout room for its exercise enthusiasts. The total 2018 building space of 250,000 square feet was utilized as follows:

| Usage of Space | % of Total Building Space |

| Office space (occupied) | 52% |

| Vacant office space | 8% |

| Common area and meeting space | 17% |

| Workout room | 8% |

| Cafeteria | 15% |

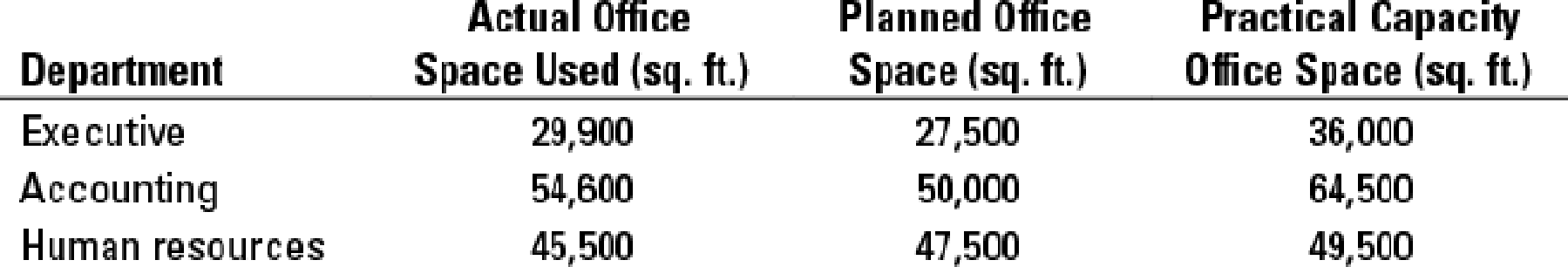

The new building cost the university $40 million and was depreciated using the straight-line method over 20 years with zero residual value so $2,000,000 per year. At the end of 2018 three departments occupied the building: executive offices of the president, accounting, and human resources. Each department’s usage of its assigned space was as follows:

- 1. How much of the total annual building cost of $2,000,000 will be allocated in 2018 to each of the departments, if the cost is allocated to each department on the basis of the following?

- a. Actual usage of the three departments

- b. Planned office space of the three departments

- c. Practical capacity of the three departments

- 2. Assume that Central University allocates the total annual building cost of $2,000,000 in the following manner:

- a. All vacant office space is absorbed by the university and is not allocated to the departments.

- b. All occupied office space costs are allocated on the basis of actual square footage used by each department.

- c. All common area costs are allocated on the basis of a department’s practical capacity. Calculate the cost allocated to each department in 2018 under this plan. Do you think the allocation method used here is appropriate? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- JUBAIL BUILDERS is constructing a multi-unit residential complex. In the prior year, JUBAIL BUILDERS entered into a contract with a customer for a specific unit that is under construction. JUBAIL has determined that the contract is a single performance obligation satisfied over time. JUBAIL BUILDERS gathered the following information for the contract during the year. JUBAIL BUILDERS-Year Ended December 31, 2018: Costs to date 10,500,000 Future expected costs 7,000,000 Work certified to date 12,600,000 Expected Sales value 22,400,000 Revenue taken in earlier period 8,400,000 Costs taken in earlier periods 6,650,000 Calculate the amounts to be included in the statement of profit or loss in respect of revenue and costs for the year ended December 31, 2018 on both methods (I) Input Method (cost basis), and (II) Output Method (Sales Basis) Calculate the total expected profit for the year 2018?arrow_forwardLee Company allocates overhead expenses to all departments on the basis of floor space (square feet) occupied by each department. The total overhead expenses for a recent year were $200,000. Department A occupied 8,000 square feet; Department B, 20,000 square feet; and Department C, 7,000 square feet. What is the overhead allocated to Department C? (Round your answer to the nearest whole dollar amount.) Overhead allocatedarrow_forwardIndigo, Reiser, and Associates, a law firm, employs ABC. The following Estimated data for each of the activity cost pools is provided for 2022: Activity Cost Pools Researching legal issues Preparing legal documents Meeting with clients Estimated Overhead $ 52,170 Total overhead applied $ 594,000 1,783,980 Estimated Use of Cost Drivers per Activity 1,110 research hours 33,000 pages 9,010 professional hours During 2022, the firm worked 870 research hours, 10,210 professional hours, and prepared 27,100 document pages. Compute the total overhead applied during the year 2022.arrow_forward

- Concord, Reiser, and Associates, a law firm, employs ABC. The following Estimated data for each of the activity cost pools is provided for 2022: Activity Cost Pools Researching legal issues Preparing legal documents Meeting with clients Estimated Use of Cost Drivers per Activity $ 49,680 1,080 research hours 32,700 8,980 professional hours Estimated Overhead 555,900 1,778,040 pages During 2022, the firm worked 840 research hours, 10,180 professional hours, and prepared 26,800 document pages. Compute the total overhead applied during the year 2022. Enter your value without a dollar sign.arrow_forwardThe following information pertains to the production of Beautiful Company for the month of January 2022: How much is the cost assigned to the transferred-out units? A. 999,750 B. 970,000 C. 996,502 D. 1,005,000arrow_forwardOn January 1, 2021, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2022. Expenditures on the project were as follows: January 1, 2021 $ 1,740,000 March 1, 2021 1,380,000 June 30, 2021 1,580,000 October 1, 2021 1,380,000 January 31, 2022 387,000 April 30, 2022 720,000 August 31, 2022 1,017,000 On January 1, 2021, the company obtained a $4,300,000 construction loan with a 12% interest rate. The loan was outstanding all of 2021 and 2022. The company's other interest-bearing debt included two long-term notes of $3,000,000 and $7,000,000 with interest rates of 8% and 10%, respectively. Both notes were outstanding during all of 2021 and 2022. Interest is paid annually on all debt. The company's fiscal year-end is December 31. Required: 1. Calculate the amount of interest that Mason should capitalize in 2021 and 2022 using the specific interest method. 2. What is the total cost of the…arrow_forward

- ABC Company has two support departments, HR and IS, and two operating departments, Production and Sales. HR department costs are allocated using number of employees, and IS department costs are allocated using Labor hours. For July 2019, the following information is given: Cost Before Allocation Number of Employees Labor Hours HR IS $90,000 $60,000 2,000 Answer: 6,000 Production $360,000 3,000 15,000 Sales $520,000 5,000 9,000 Total $1,030,000 10,000 30,000 Using the Direct method, What IS department cost will be allocated to the Sales departments?arrow_forwardRequired: Calculate the following: a. estimated total cost of completion, b. estimated profit on completion, c. estimated profit to date. Lim Construction is building Univ tower Near Unicity, Sibu. The date of commencement of construction is 1 January 2021 and the date of completion is on 31 December 2026. During the year ending 31 December 2021, the following information reported: RM Contract price Plant sent to site Purchasing of materials Wages paid Direct expenses Overhead incurred 13,000,000.00 2,000,000.00 3,000,000.00 1,500,000.00 1,000,000.00 500,000.00 At the end of December 2021, the following available: 1. Material unused on site amounted RM1,000,000.00 2. Wages owing RM500,000.00 3. Value of work certified RM6,000,000.00 4. Cost of work done but not yet certified amounted to RM500,000.00 5. Plant at site RM1,500,000.00arrow_forwardEdward ltd comprises of 3 production departments and 2 service departments. The following information is provided for Edward Ltd for 2019. Supervisor's Salary $ Machining 300,000 Assembly 200,000 Finishing 250,000 Canteen 120,000 Maintenance 150,000 $ Factory Rent 300,000 Heat & Light 200,000 General Repairs 60,000 Machine Depreciation 80,000 Machine Insurance 90,000 Business Rates 75,000 Machining Assembly Finishing Canteen Maintenance Floor Space occupied (m2) 400 200 200 150 50 Value of machinery ($'000) 300 400 200 50 50 The service department work for other departments as follows Machining Assembly Finishing Canteen Maintenance Service carried out by canteen Canteen 30% 30% 40% Maintenance 25% 50% 25% Using the overhead analysis sheet for 2019, determine the overhead allocated and apportioned to each of the five departments.arrow_forward

- Edward ltd comprises of 3 production departments and 2 service departments. The following information is provided for Edward Ltd for 2019. Supervisor's Salary $ Machining 300,000 Assembly 200,000 Finishing 250,000 Canteen 120,000 Maintenance 150,000 $ Factory Rent 300,000 Heat & Light 200,000 General Repairs 60,000 Machine Depreciation 80,000 Machine Insurance 90,000 Business Rates 75,000 Machining Assembly Finishing Canteen Maintenance Floor Space occupied (m2) 400 200 200 150 50 Value of machinery ($'000) 300 400 200 50 50 The service department work for other departments as follows Machining Assembly Finishing Canteen Maintenance Service carried out by canteen Canteen 30% 30% 40% Maintenance 25% 50% 25% Using the overhead analysis sheet for 2019, determine the overhead allocated and apportioned to each of the five departments. Calculate the total overheads included in the…arrow_forwardSelf-Construction Olson Machine Company manufactures small and large milling machines. Selling prices of these machines range from 35,000 to 200,000. During the 5-month period from August 1, 2019, through December 31, 2019, Olson manufactured a milling machine for its own use. This machine was built as part of the regular production activities. The project required a large amount of time front planning and supervisory personnel, as well as that of some of the companys officers, because it was a more sophisticated type of machine than the regular production models. Throughout the 5-month period, Olson charged all costs directly associated with the construction of the machine to a special account entitled Asset Construction Account. An analysis of the charges to this account as of December 31, 2019, follows: Olson allocates factory overhead to normal production as a percent of direct labor dollars as follows: Olson uses a flat rate of 40% of direct labor dollars to allocate general and administrative overhead. During the machine testing period, a cutter head malfunctioned and did extensive damage to the machine table and one cutter housing. This damage was not anticipated and was the result of an error in the assembly operation. Although no additional raw materials were needed to make the machine operational after the accident, the following labor for rework was required: Olson has included all these labor charges in the asset construction account. In addition, it included in the account the repairs and maintenance charges of 1,340 that it incurred as a result of the malfunction. Required: 1. Compute, consistent with GAAP and common practice, the amount that Olson should capitalize for the milling machine as of December 31, 2019, when it declares the machine operational. 2. Next Level Identify the costs you included in Requirement 1 for which there are acceptable alternative procedures. Describe the alternative procedure(s) in each case.arrow_forwardAl Sur Manufacturing LLC has furnished the following information for the month of January 2020: Materials used is RO 10,000, Direct labor is RO 20,000, Labor hours worked is 3,000, Hours of machine operation is 2000 and Overhead cost is RO 5000.The department during the period has executed an order. The relevant information is as follows: Materials used is RO 5,000, Direct labor is RO 3000, Labor hours worked is 500 and Hours of machines operation is 300. Calculate the overhead chargeable to the job based on percentage of direct labor cost. a. RO 750 b. RO 835 c. RO 2,500 d. RO 900arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning