Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 15.27P

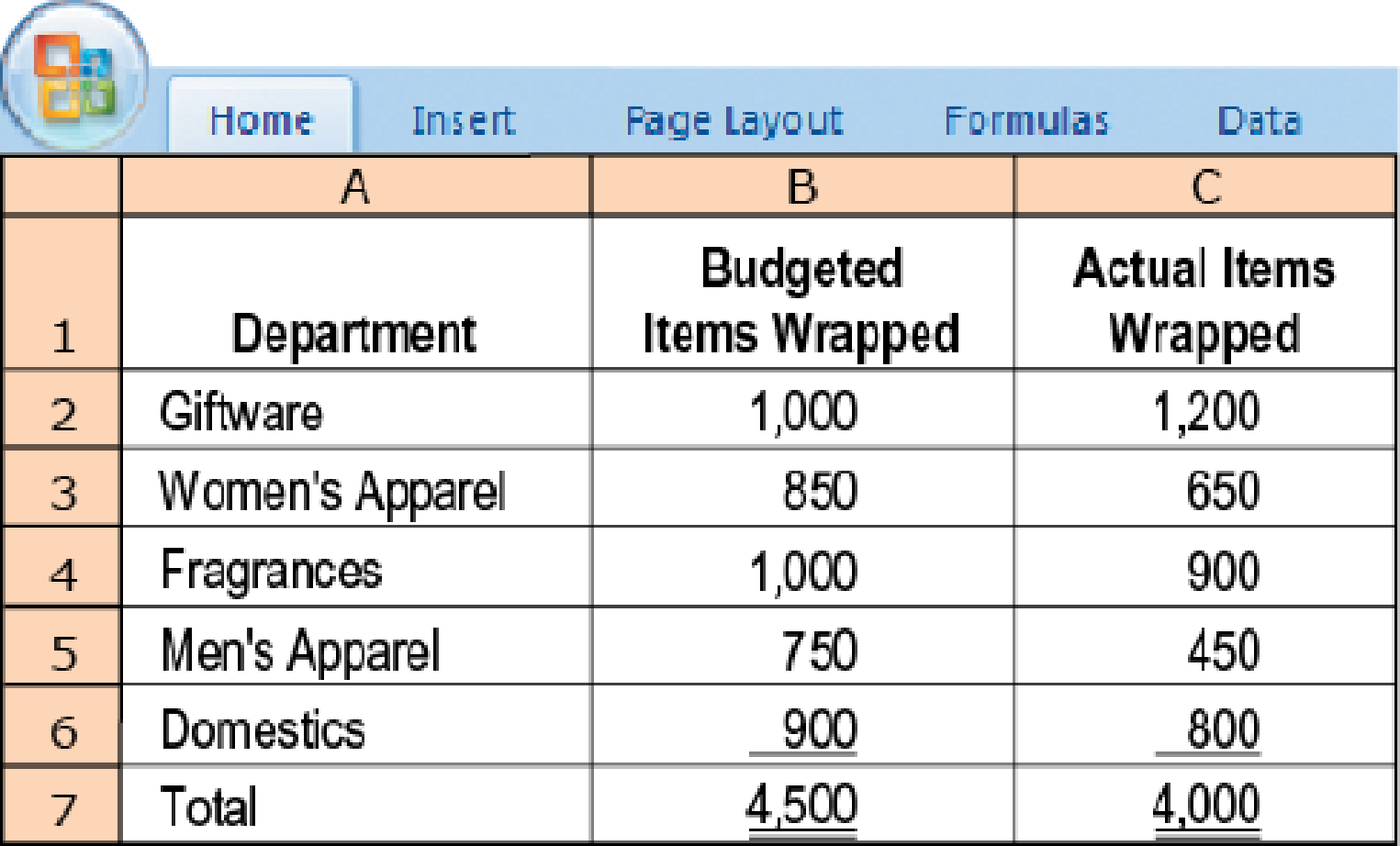

Single-rate, dual-rate, and practical capacity allocation. Preston Department Store has a new promotional program that offers a free gift-wrapping service for its customers. Preston’s customer-service department has practical capacity to wrap 5,000 gifts at a budgeted fixed cost of $4,950 each month. The budgeted variable cost to gift-wrap an item is $0.35. During the most recent month, the department budgeted to wrap 4,500 gifts. Although the service is free to customers, a gift-wrapping service cost allocation is made to the department where the item was purchased. The customer-service department reported the following for the most recent month:

- 1. Using the single-rate method, allocate gift-wrapping costs to different departments in these three ways:

Required

- a. Calculate the budgeted rate based on the budgeted number of gifts to be wrapped and allocate costs based on the budgeted use (of gift-wrapping services).

- b. Calculate the budgeted rate based on the budgeted number of gifts to be wrapped and allocate costs based on actual usage.

- c. Calculate the budgeted rate based on the practical gift-wrapping capacity available and allocate costs based on actual usage.

- 2. Using the dual-rate method, compute the amount allocated to each department when (a) the fixed-cost rate is calculated using budgeted fixed costs and the practical gift-wrapping capacity, (b) fixed costs are allocated based on budgeted fixed costs and budgeted usage of gift-wrapping services, and (c) variable costs are allocated using the budgeted variable-cost rate and actual usage.

- 3. Comment on your results in requirements 1 and 2. Discuss the advantages of the dual-rate method.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Accounting. Devidaon corp. Produces a single product:

6. Tettleton Corporation is a medium-sized furniture manufacturer. In order to

manufacture its product, Tettleton purchases lumber and other supplies it needs in

production from selected vendors. These vendors require Tettleton to pay for one-third

of the supplies in the month of purchase; the remaining payment is due the following

month. Tettleton pays according to this policy, since late payments are assessed

additional interest charges. Assume that, based on the direct materials purchases

budget, Tettleton expects to make purchases in the following amounts during the first

quarter:

January

February.

March...

$24,000

$36,000

$21,000

In addition to these purchases. Tettleton expects to incur a total of $30,000 of other

expenses each month. These expenses are paid as they are incurred. Prepare Tettleton's

cash disbursements budget for the first quarter assuming that accounts payable related

to purchases was $28,000 on December 31st.

Answer both of the required questions!

Chapter 15 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 15 - Prob. 15.1QCh. 15 - Describe how the dual-rate method is useful to...Ch. 15 - How do budgeted cost rates motivate the...Ch. 15 - Give examples of allocation bases used to allocate...Ch. 15 - Why might a manager prefer that budgeted rather...Ch. 15 - To ensure unbiased cost allocations, fixed costs...Ch. 15 - Prob. 15.7QCh. 15 - What is conceptually the most defensible method...Ch. 15 - Distinguish between two methods of allocating...Ch. 15 - What are the challenges of using the incremental...

Ch. 15 - Prob. 15.11QCh. 15 - What is one key way to reduce cost-allocation...Ch. 15 - Describe how companies are increasingly facing...Ch. 15 - Distinguish between the stand-alone and the...Ch. 15 - Identify and discuss arguments that individual...Ch. 15 - Single-rate versus dual-rate methods, support...Ch. 15 - Single-rate method, budgeted versus actual costs...Ch. 15 - Dual-rate method, budgeted versus actual costs and...Ch. 15 - Support-department cost allocation; direct and...Ch. 15 - Support-department cost allocation, reciprocal...Ch. 15 - Direct and step-down allocation. E-books, an...Ch. 15 - Reciprocal cost allocation (continuation of...Ch. 15 - Allocation of common costs. Evan and Brett are...Ch. 15 - Allocation of common costs. Gordon Grimes, a...Ch. 15 - Revenue allocation, bundled products. Couture Corp...Ch. 15 - Allocation of common costs. Jim Dandy Auto Sales...Ch. 15 - Single-rate, dual-rate, and practical capacity...Ch. 15 - Prob. 15.28PCh. 15 - Fixed-cost allocation. Central University...Ch. 15 - Allocating costs of support departments; step-down...Ch. 15 - Support-department cost allocations;...Ch. 15 - Common costs. Tate Inc. and Booth Inc. are two...Ch. 15 - Prob. 15.33PCh. 15 - Support-department cost allocations;...Ch. 15 - Revenue allocation, bundled products. Boca Resorts...Ch. 15 - Support-department cost allocations; direct,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is $250,000 and 50,000 sales orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. b. Determine the amount of sales order processing cost associated with 30,000 sales orders.arrow_forwardA summary of the usage of the service department services by other service departments as well as by the two producing departments is as follows: Equipment Building Production Dept. Service Cost Center Supervision Maintenance Occupancy Dept.1 Dept. 2 Supervision Equipment maint. Building occunpany 10% Direct costs in the various departments are as follows: 10% 5% 40% 45% 45% 55% 10% 35% 45% Direct Cost P 35,000 Label si S2 Department Supervision Équipment maintenance Building occupancy Production Dept. No. 1 Production Dept. No. 2 If the direct method of allocation is used, how much of the supervision departinent's eost would be allocated to the building occupancy department? (Start with Building occupancy, then Supervision) 30,000 90,000 350,000 450,000 S3 PI P2 а. 0 b. P1,750 с. Р3,500 d. P5,250arrow_forwardA car rental agency has a budget of $2.38 million to purchase at most 110 new cars. The agency will purchase either subcompact cars at $17,000 each or midsized cars at $34,000 each. From past rental patterns, the agency decides to purchase at most 50 midsized cars and expects an annual profit of $7,500 per subcompact car and $14,000 per midsized car. How many of each type of car should be purchased to obtain the maximum profit while satisfying budgetary and other planning constraints? Subcompact Cars- Midsize cars - Maximum profit -arrow_forward

- Don't give solution in image format..arrow_forwardThe Fortise Corporation manufactures two types of vacuum cleaners, the Victor for commercial building use and the House-Mate for residences. Budgeted and actual operating data for the year 2019 were as follows: Static Budget Victor House-Mate Total Number sold 6,000 24,000 30,000 Contribution margin $1,560,000 $3,120,000 $4,680,000 Actual Results Victor House-Mate Total Number sold 5,000 35,000 40,000 Contribution margin $1,400,000 $4,130,000 $5,530,000 What is the total sales-volume variance in terms of the contribution margin? a. $1,170,000 favorable b. $850,000 unfavorable c. $1,260,000 favorable d. $320,000 unfavorablearrow_forwardMagnolia, Inc., manufactures bedding sets. The budgeted production is for 25,500 comforters this year. Each comforter requires 7 yards of material. The estimated January 1 beginning inventory is 5,380 yards with the desired ending balance of 5,000 yards of material. If the material costs $7.40 per yard, determine the materials budget for the year.arrow_forward

- Almost all of the sales revenues of the oxygen equipment are credit card sales; cash sales are negligible. The credit card company deposits 97% of the revenues recorded each day into HealthMart’s account overnight. For the servicing of home oxygen equipment, 60% of oxygen services billed each month is collected in the month of the service, and 40% is collected in the month following the service. Q. HealthMart has budgeted expenditures for May of $11,000 and requires a minimum cash balance of $250 at the end of each month. It has a cash balance on May 1 of $400. a. Given your answer to requirement 1, will HealthMart need to borrow cash to cover its payments for May and maintain a minimum cash balance of $250 at the end of May? b. Assume (independently for each situation) that (1) May total revenues might be 10% lower or that (2) total costs might be 5% higher. Under each of those two scenarios, show the total net cash for May and the amount HealthMart would have to borrow to cover its…arrow_forwardUse the following information for questions 5 & 6: Dilly Farm Supply is in a small town in the rural west. Data regarding the store's operations follow: • Sales are budgeted at $290,000 for November, $310,000 for December, and $210,000 for January. • Collections are expected to be 65% in the month of sale and 35% in the month following the sale. • The cost of goods sold is 80% of sales. • The company desires to have an ending merchandise inventory at the end of each month equal to 70% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase. • Other monthly expenses to be paid in cash are $21,100. ● Monthly depreciation is $21,000. • Ignore taxes. Assets Cash A/R Inventory PP&E, net of $624,000 accumulated depreciation Total assets Liabilities and Stockholders' Equity A/P Common Stock Retained Earnings Total liabilities and stockholders' equity 5. 6. Balance Sheet October 31 a. b. Expected cash collections in December are: C. d. a. b.…arrow_forwardThe Deli-Sub Shop owns and operates six stores in and around Minneapolis. You are given the following corporate budget data for next year:Revenues $11,000,000 Fixed costs $ 3,000,000 Variable costs $ 7,500,000 Variable costs change based on the number of subs sold. Compute the budgeted operating income for each of the following deviations from the original budget data. (Consider each case independently.) Q1. A 10% increase in contribution margin, holding revenues constant Q2. A 10% decrease in contribution margin, holding revenues constant Q3. A 5% increase in fixed costs Q4. A 5% decrease in fixed costs Q5. A 5% increase in units sold Q6. A 5% decrease in units sold Q7. A 10% increase in fixed costs and a 10% increase in units sold Q8. A 5% increase in fixed costs and a 5% decrease in variable costs Q9. Which of these alternatives yields the highest budgeted operating income? Explain why this is the case.arrow_forward

- Revenues, production, and purchases budgets. The Yucatan Co. in Mexico has a division that manufactures bicycles. Its budgeted sales for Model XG in 2018 are 95,000 units. Yucatan’s target ending inventory is 7,000 units, and its beginning inventory is 11,000 units. The company’s budgeted selling price to its distributors and dealers is 3,500 pesos per bicycle. Yucatan buys all its wheels from an outside supplier. No defective wheels are accepted. Yucatan’s needs for extra wheels for replacement parts are ordered by a separate division of the company. The company’s target ending inventory is 14,000 wheels, and its beginning inventory is 16,000 wheels. The budgeted purchase price is 400 pesos per wheel. Required: Compute the budgeted revenues in pesos. Compute the number of bicycles that Yucatan should produce. Compute the budgeted purchases of wheels in units and in pesos. What actions can Yucatan’s managers take to reduce budgeted purchasing costs of wheels assuming the same budgeted…arrow_forwardHigh Trails manufactures backpacks for adventurers. Totals sales for the year are budgeted at 2,400 backpacks, at a price of $90 each. Variable selling expenses include commissions ( 3% of sales price) and delivery costs ( $12 per backpack). Annual fixed selling and administrative expenses include general liability insurance ( $9,000), sales fleet depreciation ( $135,000), administrative salaries ( $270,000), and rent on the office building ( $63,000). High Trails pays all costs as they are incurred. What is the amount of cash budgeted for Selling and Administrative expenses for the year? Select one: a. $377,280 b. $368,280 c. $477,000 d. $512,280 e. None of these options are correct.arrow_forwardMagnolia, Inc., manufactures bedding sets. The budgeted production is for 22,100 comforters this year. Each comforter requires 7 yards of material. The estimated January 1 beginning inventory is 4,970 yards with the desired ending balance of 4,500 yards of material. If the material costs $6.50 per yard, determine the materials budget for the year.$fill in the blank 1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

What is Risk Management? | Risk Management process; Author: Educationleaves;https://www.youtube.com/watch?v=IP-E75FGFkU;License: Standard youtube license