FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

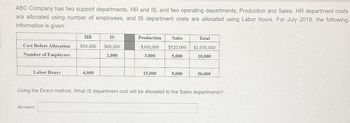

Transcribed Image Text:ABC Company has two support departments, HR and IS, and two operating departments, Production and Sales. HR department costs

are allocated using number of employees, and IS department costs are allocated using Labor hours. For July 2019, the following

information is given:

Cost Before Allocation

Number of Employees

Labor Hours

HR

IS

$90,000 $60,000

2,000

Answer:

6,000

Production

$360,000

3,000

15,000

Sales

$520,000

5,000

9,000

Total

$1,030,000

10,000

30,000

Using the Direct method, What IS department cost will be allocated to the Sales departments?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How do I determine the cost of one unit each of SW100 and SG150, assuming a company wide overhead rate is used based on total machine hours? Round rate to two decimal places.arrow_forward5) Hakan&Ahmet Manufacturing Company uses applied overhead rate for allocating its manufacturing overhead to its products. The following information is estimated for the upcoming year of 2024: BUDGETED COSTS AND ESTIMATED ACTIVITY LEVELS Budgeted MOH Budgeted Direct Materals Cost Budgeted Direct Labor Cost Estimated Direct Labor Hours Estimated Machine Hours AMOUNTS and HOURS $ 720,000 $ 600,000 $ 480,000 72,000 dlh 120,000 mh At the end of the first week of January 2024, the company completed only one job order. Actual costs and actual usage of dlh and mh for this unit were as follows: Job Order Direct Material Cost ($) 100 GRS-34 Direct Labor Direct Labor Cost ($) 150 Hours 15 Machine Hours 30 Q1) Calculate a predetermined manufacturing overhead rate (applied overhead rate) by using each of the cost drivers of "direct materials cost", "direct labor hours", "direct labor costs" and "machine hours". Q2) By using each of these rates, calculate the unit cost of this job order.arrow_forwardsarrow_forward

- During 2022, Carla Vista Company incurred the following direct labor costs: January $19,200 and February $28,800. Carla Vista uses a predetermined overhead rate of 120% of direct labor cost. Estimated-overhead for the 2 months, respectively, totaled $18,720 and $34,272. Actual overhead for the 2 months, respectively, totaled $24,000 and $32,160. Calculate overhead applied. January February $ Determine if overhead is over- or underapplied for each of the two months and the respective amounts. January $ February Iarrow_forwardVinubhaiarrow_forwardFor 2020, Roy manufacturing used job costing. The company uses machine-hours as the overhead cost-allocation base. The records show the following information: Estimated Actual Manufacturing overhead costs £800,000 £840,000 Machine-hours 50,000 60,000 The budgeted manufacturing overhead rate for 2020 is ? a. £16 per machine-hour b. £14 per machine-hour c. £16.8 per machine-hour d. £13.3 per machine-hourarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education