FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

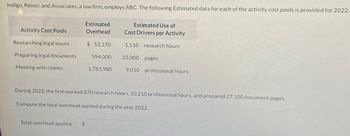

Transcribed Image Text:Indigo, Reiser, and Associates, a law firm, employs Activity-Based Costing (ABC). The following estimated data for each of the activity cost pools is provided for 2022:

| Activity Cost Pools | Estimated Overhead | Estimated Use of Cost Drivers per Activity |

|----------------------------|--------------------|--------------------------------------------|

| Researching legal issues | $52,170 | 1,110 research hours |

| Preparing legal documents | $594,000 | 33,000 pages |

| Meeting with clients | $1,783,980 | 9,010 professional hours |

During 2022, the firm worked 870 research hours, 10,210 professional hours, and prepared 27,100 document pages.

Compute the total overhead applied during the year 2022.

Total overhead applied: $ _______

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Martinez's Medical operates three support departments and two operating units, Surgery and ER. The support departments are allocated based on the hours used. The cost of operating the accounting (acct), administration (admin), and human resources (HR) departments is $261100, $156800, and $55000, respectively. Information on the hours used are as follows: Acct Admin HR Surgery ER Hours in Acct 20 48 360 220 Hours in Admin 16 8 120 80 Hours in HR 8 4 65 130 What amount of costs would be allocated from the accounting department to the other support departments (admin and HR) using the reciprocal method to allocate costs? (Do not round the intermediate calculations.) O $27522. O $28768. O $0. O $28981.arrow_forwardAyayai Company's organization chart includes the president; the vice president of production; three assembly factories-Dallas, Atlanta, and Tucson; and two departments within each factory-Machining and Finishing. Budget and actual manufacturing cost data for July 2022 are as follows. Finishing Department-Dallas: direct materials $52,700 actual, $54,560 budget; direct labor $103,416 actual, $101,680 budget; manufacturing overhead $63,240 actual, $61,008 budget. Machining Department-Dallas: total manufacturing costs $272,800 actual, $271,560 budget. Atlanta factory: total manufacturing costs $525,760 actual, $520,800 budget. Tucson factory: total manufacturing costs $612,808 actual, $615,660 budget. The Dallas factory manager's office costs were $117,800 actual and $114,080 budget. The vice president of production's office costs were $163,680 actual and $161,200 budget. Office costs are not allocated to departments and factories. (a) (b) Prepare the reports in a responsibility system…arrow_forwardIn respect of a factory the following figures have been obtained for the year 2018: Particulars Rs. Cost of Materials 12,00,000 Factory Overheads 6,00,000 Selling Overheads 4,48,000 Distribution Overheads 2,80,000 Direct Wages 10,00,000 Administrative Overheads 6,72,000 Profit 8,40,000 A work order has been executed in 2019 and the following expenses have been incurred: Materials Rs. 16,000 and Wages Rs.10,000 Assuming that on 2019 the rate of factory overheads increased by 20%, distribution overheads have gone down by 10% and selling and administrative overheads have each gone up by 12.5%. At what price should the product be sold as to earn the same rate of profit on the selling price as in 2018? Factory overheads are based on direct wages while all other overheads are based on factory cost.arrow_forward

- The Fitness Club has two operating departments- Programming & Classes and Individual fitness. There are also two service centers- Janitorial and Cafeteria. Janitorial costs are allocated based on square footage, while Cafeteria costs are allocated based on number of employees. The costs traceable to the operating and service center during 2019 were as follows: Service Centers Operating Departments Programming & Classes Individual Janitorial Cafeteria Fitness Materials 5,000 Labor МОН P 10,000 P 200,000 P 8,000 100,000 20,000 130,000 1,600 5 300,000 40,000 540,000 8,000 14 265,000 75,000 348,000 24,000 19 150,000 90,000 245,000 32,000 Total Square footage No. of Employee In addition to these costs, the Cafeteria generates revenues of P480,000. Janitorial is allocated based on square footage and Cafeteria is allocated based on the number of employees. Using the step method to allocate the service center costs, what is the total cost of Programming and Classes?arrow_forwardWant Answerarrow_forwardSwifty's Medical operates three support departments and two operating units, Surgery and ER. The support departments are allocated based on the hours used. The cost of operating the accounting (acct), administration (admin), and human resources (HR) departments is $269500, $157800, and $74100, respectively. Information on the hours used are as follows: Hours in Acct Hours in Admin Hours in HR Acct O $287494. O $285454. O $276148. O $0. 16 8 Admin 20 4 HR 48 8 Surgery 360 120 65 ER 220 80 130 What are the total costs allocated from the accounting department to the operating units? (Do not round the intermediate calculations.) 00 los " earrow_forward

- Fey Company's organization chart includes the president; the vice president of production; three assembly factories- Dallas, Atlanta, and Tucson; and two departments within each factory-Machining and Finishing. Budget and actual manufacturing cost data for July 2022 are as follows. Finishing Department-Dallas: direct materials $42,500 actual, $44,000 budget; direct labor $83,400 actual, $82,000 budget; manufacturing overhead $51,000 actual, $49,200 budget. Machining Department-Dallas: total manufacturing costs $220,000 actual, $219,000 budget. Atlanta factory: total manufacturing costs $424,000 actual, $420,000 budget. Tucson factory: total manufacturing costs $494,200 actual, $496,500 budget. The Dallas factory manager's office costs were $95,000 actual and $92,000 budget. The vice president of production's office costs were $132,000 actual and $130,000 budget. Office costs are not allocated to departments and factories. (a) Your answer is partially correct. Prepare the reports in a…arrow_forwardChecker Inc. produces automobile bumpers. Overhead is applied on the basis of machine hours required for cutting and fabricating. A predetermined overhead application rate of $12.70 per machine hour was established for 2019. Required: If 9,000 machine hours were expected to be used during 2019, how much overhead was expected to be incurred? Actual overhead incurred during 2019 totaled $121,650, and 9,100 machine hours were used during 2019. Calculate the amount of over- or underapplied overhead for 2019. (Input the amount as positive value.) Whether the overapplied or underapplied overhead for the year is normally transferred to cost of goods sold in the income statement?arrow_forwardsarrow_forward

- Carib Tings & More does hand-crafted memorabilia for the tourism industry, in which each batch of items is a job. The company has a highly machine intensive production process, so it allocates manufacturing overhead based on machine hours. Carib Tings & More pre-determined overhead application rate for 2024 was computed from the following data:Total estimated factory overheads $2,400,000Total estimated machine hours 40,000At the end of May 2024, Carib Tings & More reported work in process inventory of $176,000.During June 2024, Carib Tings & More actually used 3,000 machine hours and recorded the following transactions.i) Purchased $324,000 worth of materials on account. Separately, Carib Tings & More paid a $2,500 bill for freight in.ii) Manufacturing wages incurred $400,000iii) Materials requisitioned (includes $30,000 of indirect materials) $420,000iv) Assigned manufacturing wages, 85% direct labour, 15% indirect labour v) Depreciation expense on factory…arrow_forwardThe following data pertains to Bell Co's construction jobs, which commenced during 2021: Project 1 Project 2 Contract price 420,000 300,000 Costs incurred during 2019 240,000 280,000 Estimated additional cost to complete 120,000 40,000 What amount of gross profit/(loss) would Bell report in 2021 under the percentage of completion method, completed contract method, and zero profit method? 20,000; (20,000); (20,000) (20,000); 20,000; (20,000) 40,000; 0; 0 20,000; 0; 0arrow_forwardVinubhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education