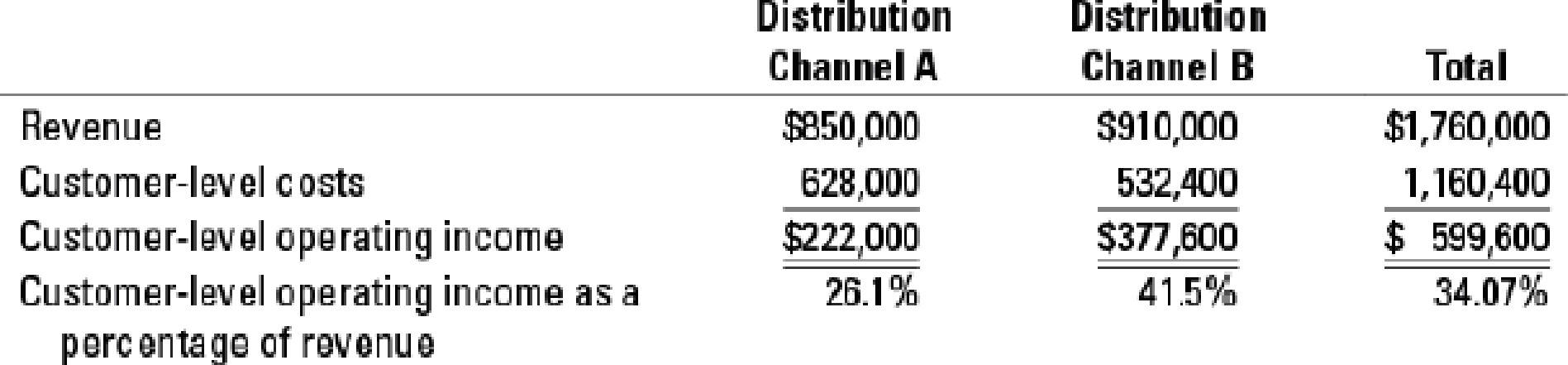

Cost-hierarchy income statement and allocation of corporate, division, and channel costs to customers. Vocal Speakers makes wireless speakers that are sold to different customers in two main distribution channels. Recently, the company’s profitability has decreased. Management would like to analyze the profitability of each channel based on the following information:

The company allocates distribution channel costs of marketing and administration as follows:

| Total | Allocation basis | |

| Distribution-channel costs | ||

| Marketing costs | $260,000 | Channel revenue |

| Administration costs | $200,000 | Customer-level costs |

Based on a special study, the company allocates corporate costs to the two channels based on the corporate resources demanded by the channels as follows: Distribution Channel A, $45,000, and Distribution Channel B, $55,000. If the company were to close a distribution channel, none of the corporate costs would be saved.

- 1. Calculate the operating income for each distribution channel as a percentage of revenue after assigning customer-level costs, distribution-channel costs, and corporate costs.

Required

- 2. Should Vocal Speakers close down any distribution channel? Explain briefly including any assumptions that you made.

- 3. Would you allocate corporate costs to divisions? Why is allocating these costs helpful? What actions would it help you take?

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Assume you are the department B manager for Marleys Manufacturing. Marleys operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only o department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation. (Hint: It may be helpful to perform a vertical analysis.)arrow_forwardCost-hierarchy income statement and allocation of corporate, division, and channel costs to customers. Vocal Speakers makes wireless speakers that are sold to different customers in two main distribution channels. Recently, the company’s profitability has decreased. Management would like to analyze the profitability of each channel based on the following information:arrow_forwardCarol Components operates a Production Division and a Packaging Division. Both divisions are evaluated as profit centers. Packaging buys components from Production and assembles them for sale. Production sells many components to third parties in addition to Packaging. Selected data from the two operations follow: Capacity (units) Sales pricea Variable costs b Fixed costs Production 50,600 $ 252 $ 108 $ 30,000,000 a For Production, this is the price to third parties. b For Packaging, this does not include the transfer price paid to Production. Packaging 25,300 $ 792 $ 300 $ 18,000,000 Suppose Production is located in Country A with a tax rate of 30 percent and Distribution in Country B with a tax rate of 10 percent. All other facts remain the same. a. Optimal transfer price b. Transfer price c. Transfer price Required: a. Current output in Production is 25,300 units. Packaging requests an additional 5,960 units to produce a special order. What transfer price would you recommend? b.…arrow_forward

- Anstell Corporation operates a Manufacturing Division and a Marketing Division. Both divisions are evaluated as profit centers. Marketing buys products from Manufacturing and packages them for sale. Manufacturing sells many components to third parties in addition to Marketing. Selected data from the two operations follow: Capacity (units) Sales price* Variable costs + Fixed costs Manufacturing 250,000 $ 280 $ 112 $ 100,000 a. Transfer price b. Transfer price Marketing 125,000 $910 For Manufacturing, this is the price to third parties. t For Marketing, this does not include the transfer price paid to Manufacturing. per unit per unit $ 336 $ 720,000 Required: a. Current output in Manufacturing is 125,000 units. Marketing requests an additional 25,000 units to produce a special order. What transfer price would you recommend? b. Suppose Manufacturing is operating at full capacity. What transfer price would you recommend? c. Suppose Manufacturing is operating at 230,000 units. What transfer…arrow_forwardCarol Components operates a Production Division and a Packaging Division. Both divisions are evaluated as profit centers. Packaging buys components from Production and assembles them for sale. Production sells many components to third parties in addition to Packaging. Selected data from the two operations follow: Capacity (units) Sales pricea Variable costs b Fixed costs Production 51,000 $ 260 $116 $ 30,000,000 a For Production, this is the price to third parties. b For Packaging, this does not include the transfer price paid to Production. a. Optimal transfer price b. Transfer price c. Transfer price Packaging 25,500 $ 800 $ 308 $ 18,000,000 Required: a. Current output in Production is 25,500 units. Packaging requests an additional 6,600 units to produce a special order. What transfer price would you recommend? b. Suppose Production is operating at full capacity. What transfer price would you recommend? c. Suppose Production is operating at 47,700 units. What transfer price would you…arrow_forwardGrouper Chance Co. sells computers and video game systems. The business is divided into two divisions along product lines. Variable costing income statements for the current year are presented below: Sales Variable costs Contribution margin Fixed costs Net income Computers $644,000 Sales mix 386,400 $257,600 VG Systems $276,000 193,200 $82,800 Contribution margin ratio Determine the sales mix and contribution margin ratio for each division. Computers Total $920,000 579,600 340,400 172,050 $168,350 70 % 60 % Weighted-average contribution margin ratio VG Systems Calculate the company's weighted-average contribution margin ratio. 30 % 30 % %arrow_forward

- Assume you are the department B manager for Marley's Manufacturing. Marley's operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation. Marley's ManufacturingIncome StatementMonth Ending August 31, 2018arrow_forwardAtascadero Industries operates a Manufacturing Division and a Marketing Division. Both divisions are evaluated as profit centers. Marketing buys products from Manufacturing and packages them for sale. Manufacturing sells many components to third parties in addition to Marketing. Selected data from the two operations follow. Manufacturing Marketing 1,020,000 %24 Capacity (units) sales price variable costs Fixed costs 502,000 1,500 4,650 $4 580 1,720 $10,200, 000 $7,220, 000 a. For Manufacturing, this is the price to third partles. For Marketing, this does not include the transfer price paid to Manufacturing. Suppose Manufacturing is located in Country X with a tax rate of 70 percent and Marketing in Country Y with a tax rate of 30 percent. All other facts remain the same, Requlred: a. Current production levels in Manufacturing are 520,000 units. Marketing requests an additional 120.000 units to produce a speclal order. What transfer price would youu recommend? b. Suppose Manufacturing…arrow_forwardProfit Margin, Investment Turnover, and return on investment The condensed income statement for the Consumer Products Division of Fargo Industries Inc. is as follows (assuming no service department charges): Sales Cost of goods sold Gross profit Administrative expenses Income from operations The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $1,950,000 of assets have been invested in the Consumer Products Division. Round the investment turnover to one decimal place. Profit margin Investment turnover Rate of return on investment Profit margin Investment turnover $1,170,000 526,500 $643,500 409,500 $234,000 b. If expenses could be reduced by $58,500 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on…arrow_forward

- Cheyenne Chance Co. sells computers and video game systems. The business is divided into two divisions along product lines. Variable costing income statements for the current year are presented below: Computers VG Systems Total Sales $ 704,000 $ 176,000 $ 880.000 Variable costs 352.000 105,600 457,600 Contribution margin $ 352,000 $ 70.400 422,400 Fixed costs 160,320 Net income $ 262,080 Determine the sales mix and contribution margin ratio for each division. Computers VG Systems Sales mix % Contribution margin ratio % Calculate the company's weighted-average contribution margin ratio. Weighted-average contribution margin ratio Calculate the company's break-even point in sales dollars. Break-even point Determine the sales level, in dollars, for each division at the break-even point. Computers VG Systems Break-even point 24arrow_forwardCullumber Company makes three models of tasers. Information on the three products is given below. Sales Variable expenses Contribution margin Fixed expenses Net income (a) Net income $ (b) Shocker Net Income Tingler $300,000 $500,000 Tingler Net Income $ Total Net Income (c) Why or why not? Compute current net income for Cullumber Company. ta Net income would 151,400 148,600 $ 119,400 S $29,200 Fixed expenses consist of $298,000 of common costs allocated to the three products based on relative sales, as well as direct fixed expenses unique to each model of $30,000 (Tingler), $80,800 (Shocker), and $34,300 (Stunner). The common costs will be incurred regardless of how many models are produced. The direct fixed expenses would be eliminated if that model is phased out. James Watt, an executive with the company, feels the Stunner line should be discontinued to increase the company's net income. Shocker 197,000 303,000 229,800 $73,200 Compute net income by product line and in total for…arrow_forwardTransfer Pricing from the Viewpoint of the Entire Company Division A manufactures electronic circuit boards. The boards can be sold either to Division B of the same company or to outside customers. Last year, the following activity occurred in Division A: Sales to Division B were at the same price as sales to outside customers. The circuit boards purchased by Division B were used in an electronic instrument manufactured by that division (one board per instrument). Division B incurred $100 in additional variable cost per instrument and then sold the instruments for $300 each. Required: 1. Prepare income statements for Division A, Division B, and the company as a whole. 2. Assume Division A’s manufacturing capacity is 20,000 circuit boards. Next year, Division B wants to purchase 5,000 circuit boards from Division A rather than 4,000. (Circuit boards of this type are not available from outside sources.) From the standpoint of the company as a whole, should Division A sell the 1,000…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College