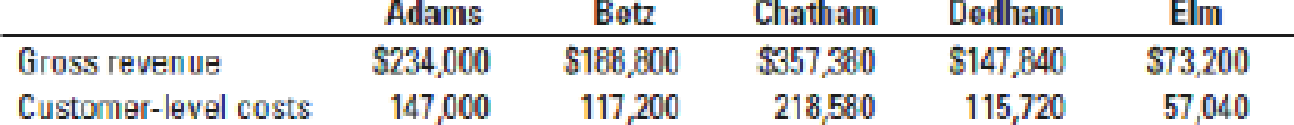

Customer-cost hierarchy, customer profitability. Louise Newman operates Interiors by Louise, an interior design consulting and window treatment fabrication business. Her business is made up of two different distribution channels, a consulting business in which Louise serves two architecture firms (Adams and Betz) and a commercial window treatment business in which Louise designs and constructs window treatments for three commercial clients (Chatham, Dedham, and Elm). Louise would like to evaluate the profitability of her two architecture firm clients and three commercial window treatment clients, as well as evaluate the profitability of each of the two channels and the business as a whole. Information about her most recent quarter follow:

On the revenues indicated above, Louise gave a 10% discount to Adams in order to lure it away from a competitor and gave a 5% discount to Elm for advance payment in cash.

- 1. Prepare a customer-cost hierarchy report for Interiors by Louise, using the format in Figure 14-6.

Required

- 2. Prepare a customer-profitability analysis for the five customers, using the format in Figure 14-4.

- 3. Comment on the results of the preceding reports. What recommendations would you give Louise?

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- CASE STUDY: INTRODUCING KBC DECORATING CO. Henri Martin and Wes Corbett have decided to go into business together and have chosen the name KBC Decorating Co. Their business will have two main divisions: a retail department to sell paint, wallpaper, and related interior decorating supplies; and a service department to do painting and decorating of office buildings, apartment blocks, and private homes. Martin and Corbett were previously in this same type of work but operated separate businesses. KBC Decorating Co. is located in Paris, Ontario, about an hour from Toronto. Martin and Corbett found a suitable location from which to operate their business, renting half of a warehouse building owned by Frank Bailes. Their space includes an office, retail space, and warehouse space. Your job is to keep the books for KBC Decorating Co. for the first calendar year (January to December). As you progress through these chapters, you will learn and do. Each chapter will introduce new concepts that…arrow_forwardVVH Training is a company that provides expert training sessions on how to run your business and make it profitable. They offer these training sessions in their offices and offer catering services during the sessions. You have been hired to complete a profitability analysis and you decided to start by completing a cost analysis of the business, in order to figure out for each training sessions, what costs are fixed and what costs are variable. You were able to gather the following information about the associated costs: Instructor: $11,000 per session Training Material: $2,500 per session and $35 per attendee Catering Services: Food: $75 per attendee Setup/cleanup: $25 per attendee Fixed fee: $5,000 per training session The catering company has also offered VVH Training a 1,000$ discount per session, if they are willing to leave their brochures on the dinner table as a form of advertising. VVH has accepted the offer saying that it is a no-brainer Required: plot a…arrow_forwardWorld View Outfitters operates a large outdoor clothing and equipment store with three main product lines: clothing, equipment, and shoes. World View Outfitters operates at capacity and allocates selling, general, and administration (S, G & A) costs to each product line using the cost of merchandise of each product line. The company wants to optimize the pricing and cost management of each product line and is wondering if its accounting system is providing it with the best information for making such decisions. Store manager Abe Barry gathers the following information regarding the three product lines: For2017,World View Outfitters budgets the following selling, general, and administration costs: 1. Suppose World View Outfitters uses cost of merchandise to allocate all S, G & A costs. Prepare budgeted product-line and total company income statements. 2. Identify an improved method for allocating costs to the three product lines. Explain. Use the…arrow_forward

- As the managing partner of Swifty Accounting Services, Adam is trying to compare the profitability results of the firm's three different business lines: Audit, Tax, and Advisory Services. These three operating divisions are supported by three support departments: Billing, Human Resources, and IT. The cost drivers (or allocation bases) for each of the support departments, along with each department's usage of those services and its own original costs, are as follows. 1) Rank the three support departments by their original costs, and then allocate the support department costs using the step method. (Round intermediate calculations to 4 decimal places, e.g. 15.2516 and final answers to 2 decimal places, e.g. 15.25.) 2) Rank the three support departments based on the percentage of their service provided to other support departments, and then allocate their costs using the step method. (Round intermediate calculations to 4 decimal places, eg. 15.2516 and final answers to 2 decimal places,…arrow_forwardIdentify the type of responsibility center (revenue center, cost center, profit center, or investment center) for each of the following situations. A. the legal department for Avon Manufacturing B. the Macys store in Mansfield, Ohio C. the food and beverage division of the Best Western D. the marketing department of the Hershey Company E. the Walmart #5030 on Central Avenue in Toledo, Ohio F. Apples Braeburn Capital Inc., where most of Apples billions of dollars are invested G. Zappos department store H. the mens clothing department in the Walmart #5030 in Toledo, Ohioarrow_forwardWhich of the following would most appropriately be evaluated as a “profit center”? Group of answer choices a)Maintenance operations for American Airlines b)A warehouse operation for Amazon c)A hotel restaurant that caters to both hotel guests and non-guests d)Sales division for a large publisherarrow_forward

- Cathy’s Classic Clothes is a retailer that sells to professional women in the northeast. The firm leases space for stores in upscale shopping centers, and the organizational structure consists of regions, districts, and stores. Each region consists of two or more districts; each district consists of three or more stores. Each store, district, and region has been established as a profit center. At all levels, the company uses a responsibility-accounting system focusing on information and knowledge rather than blame and control. Each year, managers, in consultation with their supervisors, establish financial and nonfinancial goals, and these goals are integrated into the budget. Actual performance is mea-sured each month.The New England Region consists of the Coastal District and the Inland District. The Coastal District includes the New Haven, Boston, and Portland stores. The Coastal District’s performance has not been up to expectations in the…arrow_forwardIdentify the type of responsibility center (revenue center, cost center, profit center, or investment center) for each of the following situations. the legal department for Avon Manufacturing. Cost center the Macy’s store in Mansfield, Ohio Investment center the food and beverage division of the Best Western the marketing department of the Hershey Company the Walmart #5030 on Central Avenue in Toledo, Ohio Apple’s Braeburn Capital Inc., where most of Apple’s billions of dollars are invested Zappo’s department store the men’s clothing department in the Walmart #5030 in Toledo, Ohioarrow_forwardTaylor Construction builds custom homes in Dallas, Texas. Brandon Taylor knows that his future depends on the quality of the homes he builds and the service he provides to customers. Most new-customer sales arise from word-of-mouth advertising by former customers. Enter an X in the appropriate columns to indicate whether the following measures are leading or lagging and financial or nonfinancial indicators of Taylor Construction's fınancial performance: Leading Lagging Financial Nonfinancial а. Number of customer complaints b. Employee turnover С. Net profit per house constructed d. Turnaround time on customer design changes е. Hours of training per employee f. Average labor cost per house g. Dollars invested in new equipment h. Grade (quality) of brass fixtures i. Variances between budgeted and actual costs of building a house > > > > > > > > > > > > > > > > > > > > > > > > > > > > > > >arrow_forward

- XYZ Inc. is a BPO company that caters to different services; call center, finance and information technology. Name atleast five possible indirect costs to be incurred by the company and the activity drivers use to be able to allocate to each type of service.arrow_forwardCamila’s Classic Clothes is a retailer that sells to professional women in the northeast. The firm leases space for stores in upscale shopping centers, and the organizational structure consists of regions, districts, and stores. Each region consists of two or more districts; each district consists of three or more stores. Each store, district, and region has been established as a profit center. At all levels, the company uses a responsibility-accounting system focusing on information and knowledge rather than blame and control. Each year, managers, in consultation with their supervisors, establish financial and nonfinancial goals, and these goals are integrated into the budget. Actual performance is measured each month. The New England Region consists of the Coastal District and the Inland District. The Coastal District includes the New Haven, Boston, and Portland stores. The Coastal District’s performance has not been up to expectations in the past. For the month of May, the district…arrow_forwardCathy's Classic Clothes is a retailer that sells to professional women in the northeast. The firm leases space for stores in upscale shopping centers, and the organizational structure consists of regions, districts, and stores. Each region consists of two or more districts; each district consists of three or more stores. Each store, district, and region has been established as a profit center. At all| levels, the company uses a responsibility-accounting system focusing on information and knowledge rather than blame and control. Each year, managers, in consultation with their supervisors, establish financial and nonfinancial goals, and these goals are integrated into the budget. Actual performance is measured each month. The New England Region consists of the Coastal District and the Inland District. The Coastal District includes the New Haven, Boston, and Portland stores. The Coastal District's performance has not been up to expectations in the past. For the month of May, the district…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub