Concept explainers

Customer profitability and ethics. KC Corporation manufactures an air-freshening device called GoodAir, which it sells to six merchandising firms. The list price of a GoodAir is $30, and the full

KC Corporation makes products based on anticipated demand. KC carries an inventory of GoodAir, so rush orders do not result in any extra manufacturing costs over and above the $18 per unit. KC ships finished product to the customer at no additional charge for either regular or expedited delivery. KC incurs significantly higher costs for expedited deliveries than for regular deliveries. Customers occasionally return shipments to KC, and the company subtracts these returns from gross revenue. The customers are not charged a restocking fee for returns.

Budgeted (expected) customer-level cost driver rates are:

| Order taking (excluding sales commission) | $15 per order |

| Product handling | $1 per unit |

| Delivery | $1.20 per mile driven |

| Expedited (rush) delivery | $175 per shipment |

| Restocking | $50 per returned shipment |

| Visits to customers | $125 per customer |

Because salespeople are paid $10 per order, they often break up large orders into multiple smaller orders. This practice reduces the actual order-taking cost by $7 per smaller order (from $15 per order to $8 per order) because the smaller orders are all written at the same time. This lower cost rate is not included in budgeted rates because salespeople create smaller orders without telling management or the accounting department. All other actual costs are the same as budgeted costs.

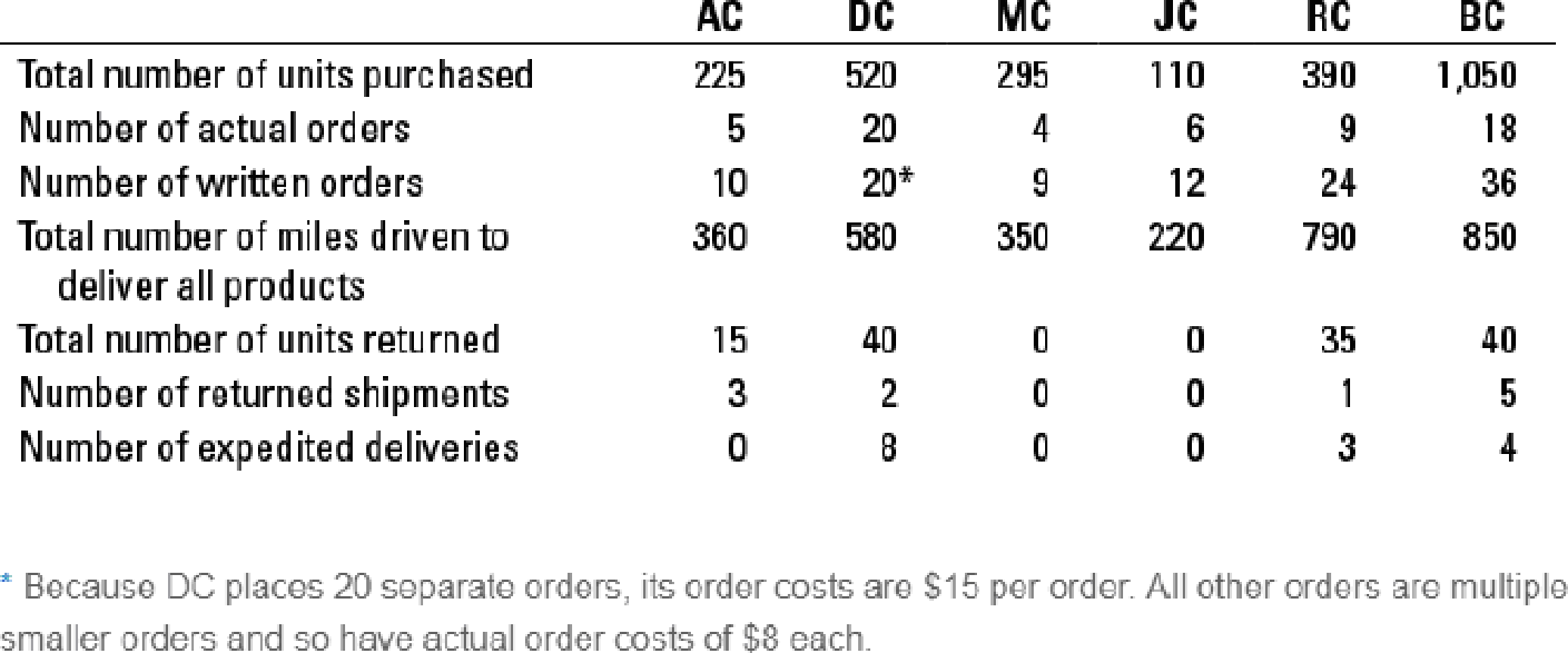

Information about KC’s clients follows:

- 1. Classify each of the customer-level operating costs as a customer output unit–level, customer batch-level, or customer-sustaining cost.

Required

- 2. Using the preceding information, calculate the expected customer-level operating income for the six customers of KC Corporation. Use the number of written orders at $15 each to calculate expected order costs.

- 3. Recalculate the customer-level operating income using the number of written orders but at their actual $8 cost per order instead of $15 (except for DC, whose actual cost is $15 per order). How will KC Corporation evaluate customer-level operating cost performance this period?

- 4. Recalculate the customer-level operating income if salespeople had not broken up actual orders into multiple smaller orders. Don’t forget to also adjust sales commissions.

- 5. How is the behavior of the salespeople affecting the profit of KC Corporation? Is their behavior ethical? What could KC Corporation do to change the behavior of the salespeople?

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Customer profitability in a manufacturing firm. Mississippi Manufacturing makes a component called B2040. This component is manufactured only when ordered by a customer, so Mississippi keeps no inventory of B2040. The list price is $112 per unit, but customers who place “large” orders receive a 10% discount on price. The customers are manufacturing firms. Currently, the salespeople decide whether an order is large enough to qualify for the discount. When the product is finished, it is packed in cases of 10. If the component needs to be exchanged or repaired, customers can come back within 14 days for free exchange or repair. The full cost of manufacturing a unit of B2040 is $95. In addition, Mississippi incurs customer-level costs. Customer-level cost-driver rates are:arrow_forwardMarwick’s Pianos, Inc., purchases pianos from a large manufacturer and sells them at the retail level. Thepianos cost, on the average, $2,450 each from the manufacturer. Marwick’s Pianos, Inc., sells the pianosto its customers at an average price of $3,125 each. The selling and administrative costs that the companyincurs in a typical month are presented below:Costs Cost FormulaSelling:Advertising ................................................ $700 per monthSales salaries and commissions .............. $950 per month, plus 8% of salesDelivery of pianos to customers ............... $30 per piano soldUtilities ...................................................... $350 per monthDepreciation of sales facilities .................. $800 per monthAdministrative:Executive salaries .................................... $2,500 per monthInsurance .................................................. $400 per monthClerical ..................................................... $1,000 per month, plus…arrow_forwardStable Paper Delivery has decided to analyze the profitability of five new customers. It buys recycled paper at $12 per case and sells to retail customers at a list price of $14.80 per case. Data pertaining to the five customers are: E (Click the icon to view the data.) Stable Paper Delivery's five activities and their cost drivers are as follows: E (Click the icon to view the activities and cost drivers.) Read the requirements. Requirement 1. Compute the customer-level operating income of each of the five retail Begin by calculating each customer's gross margin. Then calculate the operating incom minus sign for operating losses.) Requirements 1 2 1. Compute the customer-level operating income of each of the five retail customers now being examined (1, 2, 3, 4, and 5). Comment on the results. 2. What insights do managers gain by reporting both the list selling price and the actual selling price for each customer? 3. What factors should managers consider in deciding whether to drop one…arrow_forward

- The Fashion Shoe Company operates a chain of women's shoe shops that carry many styles of shoes that are all sold at the same price. Sales personnel in the shops are paid a sales commission on each pair of shoes sold plus a small base salary. The following data pertains to Shop 48 and is typical of the company's many outlets: Per Pair of Shoes $ 20.00 Selling price Variable expenses: Invoice cost Sales commission Total variable expenses. Fixed expenses: Advertising Rent Salaries Total fixed expenses $6.50 5.50 $ 12.00 Break-even point in unit sales Break-even point in dollar sales Annual Required: 1. What is Shop 48's annual break-even point in unit sales and dollar sales? Note: Do not round intermediate calculations. $ 726,900 X $ 42,000 32,000 160,000 $ 234,000 X Answer is complete but not entirely correct. 36,345 pairsarrow_forwardThe Fashion Shoe Company operates a chain of women's shoe shops that carry many styles of shoes that are all sold at the same price. Sales personnel in the shops are paid a sales commission on each pair of shoes sold plus a small base salary. The following data pertains to Shop 48 and is typical of the company's many outlets: Per Pair of Shoes $ 20.00 Selling price Variable expenses: Invoice cost Sales commission Total variable expenses Fixed expenses: Advertising Rent Salaries Total fixed expenses $ 5.00 5.00 $ 10.00 Net operating income Annual $ 36,000 25,000 125,000 $ 186,000 Required: 5. Refer to the original data. As an alternative to (4) above, the company is considering paying the Shop 48 store manager 45 cents commission on each pair of shoes sold in excess of the break-even point. If this change is made, what will be Shop 48's net operating income (loss) if 21,600 pairs of shoes are sold? Note: Do not round intermediate calculations.arrow_forwardTim’s Bicycle Shop sells 21-speed bicycles. For purposes of a cost-volume-profit analysis, the shop owner has divided sales into two categories, as follows: product type sales price price invoice cost sales commission high quality 1850 840 100 medium quality 920 620 40 Three-quarters of the shop’s sales are medium-quality bikes. The shop’s annual fixed expenses are $270,400. (In the following requirements, ignore income taxes.)a. What is the shop’s break-even sales volume in dollars? Assume a constant sales mix.b. How many bicycles of each type must be sold to earn a target net income of $126,750? Assume a constant sales mix.arrow_forward

- Tim’s Bicycle Shop sells 21-speed bicycles. For purposes of a cost-volume-profit analysis, the shop owner has divided sales into two categories, as follows: Product Type Sales Price Invoice Cost Sales Commission High-quality $ 500 $ 275 $ 25 Medium-quality 300 135 15 Three-quarters of the shop’s sales are medium-quality bikes. The shop’s annual fixed expenses are $65,000. (In the following requirements, ignore income taxes.) Required: 1. Compute the unit contribution margin for each product type. 2. What is the shop’s sales mix? 3. Compute the weighted-average unit contribution margin, assuming a constant sales mix. 4. What is the shop’s break-even sales volume in dollars? Assume a constant sales mix.arrow_forwardBetter Finance (previously Bill Float), based in San Francisco, California, provides leasing and credit solutions to consumers and small businesses. If Better Finance wants to distribute $38,000 worth of overhead by sales. New customer sales (NCS) Current customer new sales (CCNS) Current customer loan extension sales $ 4,235,000 4,235,000 3,630,000 (CCLES) $12,100,000 Calculate the overhead expense for each department. Overhead expense New customer sales Current customer new sales Current customer loan extension salesarrow_forwardYarn Basket, Ltd., sells handminus−knit scarves. Each scarf sells for $35. The company pays $350 to rent a vending space for one day. The variable costs are $10 per scarf. What total revenue amount does the company need to earn to break even?arrow_forward

- The Fashion Shoe Company operates a chain of women's shoe shops that carry many styles of shoes that are all sold at the same price. Sales personnel in the shops are paid a sales commission on each pair of shoes sold plus a small base salary. The following data pertains to Shop 48 and is typical of the company's many outlets: Per Pair of Shoes $ 40.00 Selling price Variable expenses: Invoice cost Sales commission Total variable expenses Fixed expenses: Advertising Rent Salaries Total fixed expenses $ 16.00 4.00 $ 20.00 Annual $ 45,000 31,000 155,000 $ 231,000 Required: 5. Refer to the original data. As an alternative to (4) above, the company is considering paying the Shop 48 store manager 55 cents commission on each pair of shoes sold in excess of the break-even point. If this change is made, what will be Shop 48's net operating income (loss) if 13,550 pairs of shoes are sold? Note: Do not round intermediate calculations.arrow_forwardRoe manufactures and sells cloth facial masks. Per unit direct material and direct labor costs are $1 and $2 respectively. Other than these costs, Roe pays $1,000 for rent, $1,500 for the floor manager's salary, and recognizes $300 depreciation on the equipment every month. Roe sells each mask at $10. If Roe sells 500 masks, what would be Roe's total revenue and total costs? Group of answer choices Total revenue: 5,000; Total costs: 1,500 Total revenue: 5,000; Total costs: 4,300 Total revenue: 3,500; Total costs: 1,500 Total revenue: 3,500; Total costs: 2,800arrow_forwardJava Joe’s operates a chain of coffee shops. The company pays rent of $12,000 per year for each shop. Supplies (napkins, bags and condiments) are purchased as needed. The manager of each shop is paid a salary of $2,000 per month, and all other employees are paid on an hourly basis. Relative to the number of customers for a shop, the cost of rent is which kind of cost? cFixed cost Variable cost Mixed cost Relevant costarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning