FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

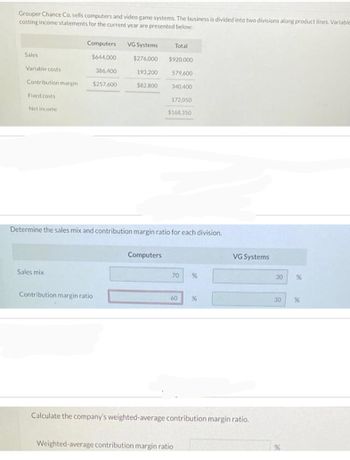

Transcribed Image Text:Grouper Chance Co. sells computers and video game systems. The business is divided into two divisions along product lines. Variable

costing income statements for the current year are presented below:

Sales

Variable costs

Contribution margin

Fixed costs

Net income

Computers

$644,000

Sales mix

386,400

$257,600

VG Systems

$276,000

193,200

$82,800

Contribution margin ratio

Determine the sales mix and contribution margin ratio for each division.

Computers

Total

$920,000

579,600

340,400

172,050

$168,350

70 %

60 %

Weighted-average contribution margin ratio

VG Systems

Calculate the company's weighted-average contribution margin ratio.

30 %

30 %

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jackson Manufacturing, Inc., makes two types of industrial component parts—the XT-100 and the LT-200. An absorption costing income statement for the most recent period is shown: Jackson Manufacturing Inc. Income Statement Sales $2,100,000 Cost of goods sold 1,600,000 Gross margin 500,000 Selling and administrative expenses 550,000 Net operating loss $ (50,000) Table Summary: Income statement with two-line heading. Descriptions of income items are in first column and dollar values in second column. Jackson produced and sold 70,000 units of XT-100 at a price of $20 per unit and 17,500 units of LT-200 at a price of $40 per unit. The company’s traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company’s two product lines is shown below:XT-100 LT-200 Total Direct materials $436,300 $251,700 $ 688,000 Direct labor $200,000 $104,000 304,000 Manufacturing…arrow_forwardShamrock Co. manufactures three types of computer desks. The income statement for the three products and the whole company is shown below: Sales Variable costs Fixed costs Total costs Operating income (loss) Product A Product B Product C $110,000 $135,000 75,000 125,000 $88,000 46,000 25,200 71,200 $16,800 18,000 93,000 $17,000 18,000 143,000 $(8,000) Total $333,000 246,000 61,200 307.200 $25,800 The company produces 1.000 units of each product. The company's capacity is 17,000 machine hours. The machine hours for each product are 7 hours for Product A, 5 hours for Product B, and 5 hours for Product C. Fixed costs are allocated based on machine hours.arrow_forwardUsing the following data for Ace Guitar Company: A Region Sales Cost of goods sold Selling expenses Support department expenses: Purchasing Payroll accounting $781,000 296,800 187,400 A Region Operating Income B Region Operating Income B Region $639,000 242,800 153,400 $238,600 159,000 Allocate support department expenses proportional to the sales of each region. Determine the divisional operating income for the A and B regions.arrow_forward

- Hi-Tek Manufacturing, Incorporated, makes two types of industrial component parts-the B300 and the T500. An absorption costing income statement for the most recent period is shown: Hi-Tek Manufacturing Incorporated Income Statement Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating loss $1,766,100 1,243,888 522,212 640,000 $ (117,788) Hi-Tek produced and sold 60,100 units of B300 at a price of $21 per unit and 12,600 units of T500 at a price of $40 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company's two product lines is shown below: Direct materials Direct labor Manufacturing overhead Cost of goods sold B300 $ 400,500 $ 120,000 T500 $ 162,000 $ 42,700 Total $ 562,500 162,700 518,688 $1,243,888 The company has created an activity-based costing system to evaluate the profitability of…arrow_forwardA company produces and sells two products. It sells these products through different channels, and makes them in separate factories. The products have no shared costs. This year there were 42,000 units of each product sold. Contribution margin income statements follow. Sales Variable costs Contribution margin Fixed costs Income Product 1 Complete this question by entering your answers in the tabs below. Product 2 Product 1 $ 735,000 441,000 294,000 110,500 $ 183,500 Numerator For Product 1, compute the contribution margin ratio, the break-even point in dollar sales, and the degree of operating leverage. If sales in dollars increase by 10% for this product, compute income. Numerator Product 2 $ 735,000 73,500 661,500 478,000 $ 183,500 1 Contribution Margin Ratio Denominator Break-Even Point in Dollars Denominator = Contribution margin ratio Break-even point in dollars 0arrow_forwardBuckley Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. BUCKLEY COMPANY Income Statements for Year 2 Segment A B C Sales $ 330,000 $ 480,000 $ 500,000 Cost of goods sold (242,000 ) (184,000 ) (190,000 ) Sales commissions (30,000 ) (44,000 ) (44,000 ) Contribution margin 58,000 252,000 266,000 General fixed operating expenses (allocation of president’s salary) (92,000 ) (92,000 ) (92,000 ) Advertising expense (specific to individual divisions) (6,000 ) (20,000 ) 0 Net income (loss) $ (40,000 ) $ 140,000 $ 174,000 Required Prepare a schedule of relevant sales and costs for Segment A. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. Options for required A table are: Advertising…arrow_forward

- Jay Company is divided into the South and North Divisions. Assume the data given in the table below for the South Division. What is the divisional income from operations for the South Division. S Sales $1,500,000 C Cost of good sold 825,000 Selling expenses 425,000 S Service department allocations 75,000 In Income from operations ? Group of answer choices $350,000 $175,000 $50,000 none of thesearrow_forwardSevero S.A. of Sao Paulo, Brazil, is organized into two divisions. The company's contribution format segmented income statement (in terms of the Brazilian currency, the real, R) for last month is given below: Sales Variable expenses Contribution margin Traceable fixed expenses: Advertising Selling and administrative Depreciation Total traceable fixed expenses Divisional segment margin Common fixed expenses Operating income Sales Traceable fixed expenses: Total Company R 3,675,000 1,745,500 1,929,500 Traceable fixed expenses: R Advertising Selling and administrative Depreciation Variable expenses as a percentage of sales Total traceable fixed expenses 634,000 449,000 233,000 1,316,000 Common fixed expenses: Top management can't understand why the Leather Division has such a low segment margin when its sales are only 25% less than sales in the Cloth Division. As one step in isolating the problem, management has directed that the Leather Division be further segmented into product lines.…arrow_forwardssarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education