Loose Leaf for Foundations of Financial Management Format: Loose-leaf

17th Edition

ISBN: 9781260464924

Author: BLOCK

Publisher: Mcgraw Hill Publishers

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 1P

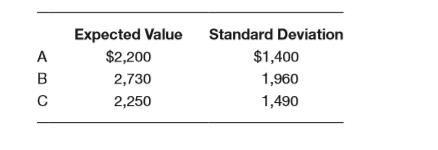

Assume you are risk-averse and have the following three choices. Which project will you select? Compute the coefficient of variation for each.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

By using the formula of risk and return, find the answer:

QUESTION 5

Invest in any or all of the four projects whose relevant cash flows are given in the following table.

The firm has RM7,000,000 budgeted to fund these projects, all of which are known to be

acceptable. Initial investment for each project is the same for all projects which is RM1,600,000.

The rate of retum for all projects is equivalent to 8%.

Operating cash outflow

Project X

Project Y

Year 1

Cash Outflow

RM1,600,000 (for each project)

RM

440,000

340,000

220,000

(110,000)

( 95,000 )

105,000

Operating Cash Inflows

RM

140,000

180,000

250,000

260,000

370,000

460,000

1

2.

3.

4.

5.

6.

7.

220,000

388,000

8.

9.

Use this table for PROJECT X and Y

Period

PVIF 8%

0.9259

0.8573

3

0.7938

4

0.7350

0.6806

0.6302

7

0.5835

8

0.5403

0.5002

10

0.4632

If three investment alternatives all have some degree of risk and different expected returns, which of the following measures could best be used to rank the risk levels of the projects?

Group of answer choices

The standard deviation of returns

The coefficient of correlation

The coefficient of variation

The net present value

Chapter 13 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

Ch. 13 - Prob. 1DQCh. 13 - Discuss the concept of risk and how it might be...Ch. 13 - When is the coefficient of variation a better...Ch. 13 - Explain how the concept of risk can be...Ch. 13 - If risk is to be analyzed in a qualitative way,...Ch. 13 - Assume a company, correlated with the economy, is...Ch. 13 - Assume a firm has several hundred possible...Ch. 13 - Explain the effect of the risk-return trade-off on...Ch. 13 - What is the purpose of using simulation analysis?...Ch. 13 - Assume you are risk-averse and have the following...

Ch. 13 - Myers Business Systems is evaluating the...Ch. 13 - Prob. 3PCh. 13 - Prob. 4PCh. 13 - Prob. 5PCh. 13 - Possible outcomes for three investment...Ch. 13 - Prob. 7PCh. 13 - Prob. 8PCh. 13 - Prob. 9PCh. 13 - Prob. 10PCh. 13 - Prob. 12PCh. 13 - Waste Industries is evaluating a 70,000 project...Ch. 13 - Prob. 14PCh. 13 - Debby’s Dance Studios is considering the...Ch. 13 - Prob. 17PCh. 13 - Prob. 18PCh. 13 - Allison’s Dresswear Manufacturers is preparing a...Ch. 13 - Prob. 20PCh. 13 - Prob. 21PCh. 13 - Prob. 22PCh. 13 - Ms. Sharp is looking at a number of different...Ch. 13 - Prob. 25P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose the net present values of projects A and B show a distribution as follows. a) Compare the projects by expected value criteria?b) Compare the projects by standard deviation criteria?c) Evaluate A and B projects according to the coefficient of variation criterion?Calculate on paper.arrow_forwardDefine the following terms, using graphs or equations to illustrate youranswers wherever feasible: b. Indifference curve; optimal portfolioarrow_forward1. Calvulate the internal rate of return(IRR) of each project and based on this criterion. Indicate which project you would recommend or acceptance.arrow_forward

- What must be true about the sign of the risk aversion coefficient, A, for a risk lover? Draw the indifference curve for a utility level of .05 for a risk lover.arrow_forwardThe decision tree below describes a “sure thing” investment and a “risky” investment. Use backward induction to evaluate which is the better investment. Assume all values are already given in present value terms.arrow_forwardDraw a graph showing the feasible set of risky assets, the efficientfrontier, the risk-free asset, and the CMLarrow_forward

- The best investment ____________________. Select one or more: a. maximizes reward b. maximizes Sharpe c. minimizes risk d. eliminates riskarrow_forwardAnother name for the expected value of an investment would be: Answer a. The mean value b. The upper-end value c. The certain value d. The risk-free valuearrow_forwardGiven the following probability distribution for assets X and Y, compute the expected rate of return, variance, standard deviation, and coefficient of variation for the two assets. Which asset seems to be a better investment?arrow_forward

- Describe the advantages of using CAPM model to determine the expected return.arrow_forwardYou are considering three alternative investments:arrow_forwardan efficient portolio ...... 1) minimise return for a given level of risk 2) minimise risk for a given level of return 3) minimize both risk and return 4) all the options choose the correct statementarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Portfolio return, variance, standard deviation; Author: MyFinanceTeacher;https://www.youtube.com/watch?v=RWT0kx36vZE;License: Standard YouTube License, CC-BY