Concept explainers

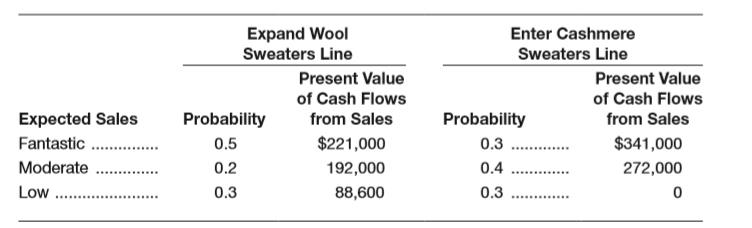

Allison’s Dresswear Manufacturers is preparing a strategy for the fall season. One alternative is to expand its traditional ensemble of wool sweaters. A second option would be to enter the cashmere sweater market with a new line of high-quality designer label products. The marketing department has determined that the wool and cashmere sweater lines offer the following probability of outcomes and related cash flows:

The initial cost to expand the wool sweater line is

a. Diagram a complete decision tree of possible outcomes similar to Table 13-6. Note that you are dealing with thousands of dollars rather than millions. Take the analysis all the way through the process of computing expected

b. Given the analysis in part a, would you automatically make the investment indicated?

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- Southland Corporation’s decision to produce a new line of recreational products resulted in the need to construct either a small plant or a large plant. The best selection of plant size depends on how the marketplace reacts to the new product line. To conduct an analysis, marketing management has decided to view the possible long-run demand as low, medium, or high. The following payoff table shows the projected profit in millions of dollars: What is the decision to be made, and what is the chance event for Southland’s problem? Construct a decision tree. Recommend a decision based on the use of the optimistic, conservative, and minimax regret approaches.arrow_forwardHudson Corporation is considering three options for managing its data warehouse: continuing with its own staff, hiring an outside vendor to do the managing, or using a combination of its own staff and an outside vendor. The cost of the operation depends on future demand. The annual cost of each option (in thousands of dollars) depends on demand as follows: If the demand probabilities are 0.2, 0.5, and 0.3, which decision alternative will minimize the expected cost of the data warehouse? What is the expected annual cost associated with that recommendation? Construct a risk profile for the optimal decision in part (a). What is the probability of the cost exceeding $700,000?arrow_forwardThe J.R. Ryland Computer Company is considering a plant expansion to enable the company to begin production of a new computer product. The companys president must determine whether to make the expansion a medium- or large-scale project. Demand for the new product is uncertain, which for planning purposes may be low demand, medium demand, or high demand. The probability estimates for demand are 0.20, 0.50, and 0.30, respectively. Letting x and y indicate the annual profit in thousands of dollars, the firms planners developed the following profit forecasts for the medium-and large-scale expansion projects. a. Compute the expected value for the profit associated with the two expansion alternatives. Which decision is preferred for the objective of maximizing the expected profit? b. Compute the variance for the profit associated with the two expansion alternatives. Which decision is preferred for the objective of minimizing the risk or uncertainty?arrow_forward

- Under pressure from its board of directors, management at Roadside is planning to enter the conventional battery-powered flashlight market. Roadside expects to sell this boring product to wholesalers for $18.16 per unit. Relevant fixed costs will total $343,600, and variable costs to make this product will be $12.15 per unit. Background research estimates the size of the market for conventional flashlights at 1.8 million units per year. If sales of this unit reach breakeven, what market share will Roadside have? Report your answer as a percent. Report 27.5%, for example, as "27.5". Rounding: tenth of a percent. Your Answer: Answerarrow_forwardAdorable Face is considering a new line of lipstick products. They would like to know if it will pay off. Estimated fixed costs are $250,000, and the manufacturing, materials, shipping and packaging cost (variable cost) per lipstick is $1.00. If they sell 80,000 lipsticks, what price should they charge (maintaining the $100,000 target profit and $200,000 advertising budget)?arrow_forwardRose Apothecary is considering expanding its business to include a second store. David Rose, the CEO, believes that a marketing study would help to determine the overall demand for the store. Part A: Without the marketing study, the company estimates that there will be an up-front cost of $100,000 to get the new store up and running. The expectation is that there is a 50% chance that the store will generate annual cash flows of $48,000 per year for the subsequent four years and a 50% chance that the store will generate annual cash flows of $22,000 per year for the subsequent four years. What is the NPV of the store expansion project, assuming a 15% cost of capital?arrow_forward

- Billingham Packaging is considering expanding its production capacity by purchasing a new machine, the XC-750. The cost of the XC-750 is $2.77 million. Unfortunately, installing this machine will take several months and will partially disrupt production. The firm has just completed a $45,000 feasibility study to analyze the decision to buy the XC-750, resulting in the following estimates: • Marketing: Once the XC-750 is operational next year, the extra capacity is expected to generate $10.05 million per year in additional sales, which will continue for the 10-year life of the machine. • Operations: The disruption caused by the installation will decrease sales by $5.09 million this year. As with Billingham's existing products, the cost of goods for the products produced by the XC-750 is expected to be 72% of their sale price. The increased production will also require increased inventory on hand of $1.11 million during the life of the project, including year 0. • Human Resources: The…arrow_forwardBillingham Packaging is considering expanding its production capacity by purchasing a new machine, the XC-750. The cost of the XC-750 is $2.77 million. Unfortunately, installing this machine will take several months and will partially disrupt production. The firm has just completed a $45,000 feasibility study to analyze the decision to buy the XC-750, resulting in the following estimates: • Marketing: Once the XC-750 is operational next year, the extra capacity is expected to generate $10.05 million per year in additional sales, which will continue for the 10-year life of the machine. • Operations: The disruption caused by the installation will decrease sales by $5.09 million this year. As with Billingham's existing products, the cost of goods for the products produced by the XC-750 is expected to be 72% of their sale price. The increased production will also require increased inventory on hand of $1.11 million during the life of the project, including year 0. • Human Resources: The…arrow_forwardBillingham Packaging is considering expanding its production capacity by purchasing a new machine, the XC-750. The cost of the XC-750 is $2.77 million. Unfortunately, installing this machine will take several months and will partially disrupt production. The firm has just completed a $45,000 feasibility study to analyze the decision to buy the XC-750, resulting in the following estimates: • Marketing: Once the XC-750 is operational next year, the extra capacity is expected to generate $10.05 million per year in additional sales, which will continue for the 10-year life of the machine. • Operations: The disruption caused by the installation will decrease sales by $5.09 million this year. As with Billingham's existing products, the cost of goods for the products produced by the XC-750 is expected to be 72% of their sale price. The increased production will also require increased inventory on hand of $1.11 million during the life of the project, including year 0. • Human Resources: The…arrow_forward

- Billingham Packaging is considering expanding its production capacity by purchasing a new machine, the XC-750. The cost of the XC-750 is $2.68 million. Unfortunately, installing this machine will take several months and will partially disrupt production. The firm has just completed a $46,000 feasibility study to analyze the decision to buy the XC-750, resulting in the following estimates: • Marketing: Once the XC-750 is operational next year, the extra capacity is expected to generate $10.20 million per year in additional sales, which will continue for the 10-year life of the machine. Operations: The disruption caused by the installation will decrease sales by $5.01 million this year. As with Billingham's existing products, the cost of goods for the products produced by the XC-750 is expected to be 69% of their sale price. The increased production will also require increased inventory on hand of $1.12 million during the life of the project, including year 0. • Human Resources: The…arrow_forwardSeattle Radiology Group plans to invest in a new CT scanner. The group estimates $1,500 net revenue per scan. Preliminary market assessments indicate that demand will be less than 5,000 scans per year. The group is considering a scanner (Scanner B) that would result in total fixed costs of $800,000 and would yield a profit of $450,000 per year at a volume of 5,000 scans. What is the estimated breakeven volume (in number of scans) for Scanner B?arrow_forwardMaize Water is considering introducing a water filtration device for its 20-ounce water bottles. Market research indicates that 1,000,000 units can be sold if the price is no more than $3. If Maize Water decides to produce the filters, it will need to invest $2,000,000 in new production equipment. Maize Water requires a minimum rate of return of 16% on all investments. Determine the target cost for the filter. Use cost-plus pricing to determine various amounts.arrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning