What is the Capital Asset Pricing Model?

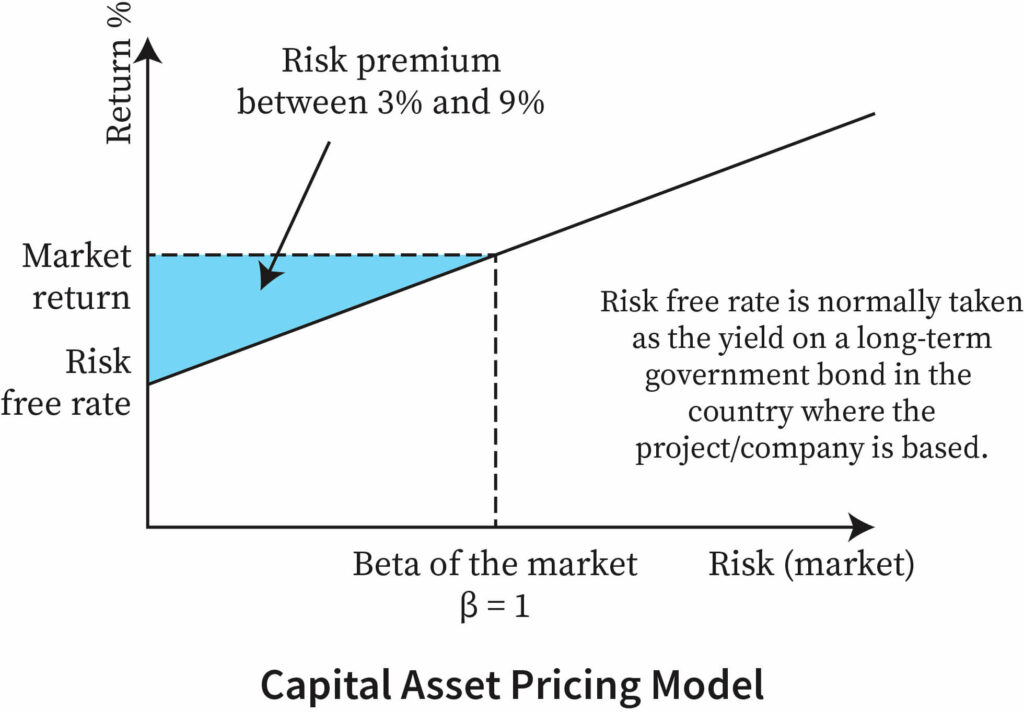

Capital asset pricing model, also known as CAPM, shows the relationship between the expected return of the investment and the market at risk. This concept is basically used particularly in the case of stocks or shares. It is also used across finance for pricing assets that have higher risk identity and for evaluating the expected returns for the assets given the risk of those assets and also the cost of capital.

Assumptions of the Capital Asset Pricing Model

In order to understand the notion of the capital asset pricing model, we need to first know that what are the assumption based on which this concept is evaluated:

- The investor is having the sole objective to maximize the usefulness of the money he is having in the form of savings or even if it is the money that he wants to make investments with.

- The investor is having the same kind of expectations of risk and return. In other words, we can say that he is having homogeneous expectations of risk and return.

- Whenever the investor is making any kind of investment decision it is based on risk and returns.

- All investors have the same kind of time horizon. We can also say that the investors want to invest their money for a particular period of time and this period of time is the same for all the investors.

- The investors are having perfect knowledge about the market because the information is freely available to them.

Features of the Capital Asset Pricing Model

- It gives us an idea of the expected all required return from the investment that an individual does compare with the risk involved.

- It also considers the asset's sensitivity to market risk which is represented with the symbol beta. Also, it takes into account the expected return which the individual investor is supposed to get from the market, and also the expected return from a risk-free asset.

- This concept is mainly used to evaluate the cost of equity and cost of capital.

Risk-free rate means the rate of interest arising from the secured assets or risk-free assets like the government bonds mutual fund etc. Beta is the sensitivity or the fluctuation in the asset that takes place due to the change in the market. The expected return is nothing but the estimated return or the return that the investor expects from the stock market as a result of his investment.

Equation for the Capital Asset Pricing Model

The CAPM formula is as follows:

E(Rj) = Rf + β [E (Rm ) - Rf

Where,

E(Ri) = expected return on security j

Rf = risk free return

β = beta of security j

E (Rm ) = expected return on market portfolio

This will be easier to understand with the help of an example:

Calculate the return on a stock with the help of the capital asset pricing model when the expected return of the market is 15%; risk-free interest is 5%; Equity beta is 1.2%.

E(Rj) = Rf + β [E (Rm) - Rf

= 5 + 1.2 (15-5)

= 12%

Practice Question

Calculate the expected rate of return for the stock with the help of the capital asset pricing model when the risk-free return is 15%, expected return on the market portfolio is 5% and a beta of the stock is 4.2.

Don't mean object if of capital asset pricing model is to analyze that whether a stock is fairly valued or not when the risk and the time value of money are compared to the expected return.

Limitations of the CAPM Model

There are many critics behind the capital asset pricing model which tells that this model is inefficient in showing up the reality to the investors. Behind this theory there are mainly two assumptions:

- Security markets are itself very competitive and efficient, as because it follows the principle of a perfectly competitive market. This means that relevant information about the company is spread simultaneously among the investors in an efficient manner. Therefore, there is very little need for such a model in reality.

- The securities market is mainly dominated by risk-averse investors whose main aim is just to get a return without taking much risk in the investment.

- It is based on unrealistic assumptions because the beta does not constant.

Despite these critical issues, the capital is it pricing model still continues to be the most used tool because this helps and makes the process of comparing investment alternatives very simple and easy.

Since we know that the capital asset pricing model formula is used for evaluating the expected return of an asset, it is very important to know that the formula is based on the idea of systematic risk that investors need to be compensated in the form of risk premium. Now comes the question that what does risk premium mean? Simply putting it, a risk premium is the rate of return that is greater than the risk-free rate. When the investors are investing, they desire a higher risk premium when they are taking up more than one risky investment.

The concept of the capital asset pricing model is also extremely important in calculating the weighted average cost of capital as this concept includes the cost of equity. The weighted average cost of capital is widely used as the discount rate in investment along with some assumptions:

- The investment project is relatively small when compared to the investing organization.

- The activity of the investment project and the business are quite similar to the activities of the business undertaken by the investing organization.

- The finance provider who is already a part of the investing company does not usually change their required rate of return as a result of which the investment project has been undertaken.

If the investment project involves a business risk that is different from the business risk of the investing organization, the capital asset pricing model can also be used to analyze and evaluate the particular project discount rate or in other words, project-specific discount rate.

In conclusion, we can see that though the capital asset pricing model is having a well good number of criticisms still it continues to be the most used toolkit that the investors use while investing in the security market. This is because of the fact that it makes the procedure of comparing risky assets or two different investments quite easy.

The CAPM formula is extremely important in determining that what would be the benefits of the investment that has been undertaken by the individual investor. The CAPM formula also helps in evaluating and reducing unsystematic risk and systematic risk. As a result of which the total risk is also reduced. The main motive of the individual investor is always to reduce the total risk by taking into consideration the non-systematic or unsystematic risk along with systematic risk.

Context and Applications

This topic is significant in the professional exams for both undergraduate and graduate courses, especially for

- B.B.A

- M.B.A in Finance

Want more help with your finance homework?

*Response times may vary by subject and question complexity. Median response time is 34 minutes for paid subscribers and may be longer for promotional offers.

Capital Asset Pricing Model Homework Questions from Fellow Students

Browse our recently answered Capital Asset Pricing Model homework questions.