Loose Leaf for Foundations of Financial Management Format: Loose-leaf

17th Edition

ISBN: 9781260464924

Author: BLOCK

Publisher: Mcgraw Hill Publishers

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 16P

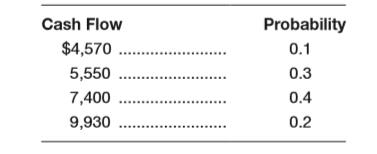

Debby’s Dance Studios is considering the purchase of new sound equipment that will enhance the popularity of its aerobics dancing. The equipment will cost

a. What is the expected value of the cash flow? The value you compute will apply to each of the five years.

b. What is the expected

c. Should Debby buy the new equipment?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The owner of a number of gas stations is considering installing coffee machines in his

gas stations. It will cost $290,000 to install the coffee machines, and they are

expected to boost cash flows by $124,286 per year for their five-year working life.

What must the cost of capital be if this investment has a profitability index of 1?

O A. 4.69%

O B. 5.86%

O C. 1.17%

O D. 2.34%

La VieLimited is considering investing in a new project called Dometircs to

manufacture Boost robotics for kids. The initial capital outlay is $1,200,000 and

is expected to generate cash flows over 5 years, which is detailed as follows:

Year

1

2

3

$

180,000

260,000

360,000

400,000

480,000

4

5

Assuming the required rate of return is 9% and management requires a

payback period of 4 years for all projects.

Required:

(i) Calculate the payback period.

Year Cash Flow Cumulative Cash Flow

$

$

Note: Copy the above table and complete the calculations in the answer

booklet.

(ii) Calculate the net present value.

Year

Cash Flow

Discount Factor at Present Value

(to fill the

discount factor)

$

Note: Copy the above table and complete the calculations in the answer

booklet.

(iii) Advise the management as to whether they should proceed to procure the

new equipment.

(iv) La Vie Limited is presented with Project Sunny and Project Cloudy.

Project Sunny has a payback period of 4.4 years, while Project…

FastTrack Bikes, Inc. is thinking of developing a new composite road bike. Development will take six years and the cost is $200,000 per year. Once in production, the bike is expected to make $300,000 per year for 10 years. Assume the cost of capital is 10%.

a. Calculate the NPV of this investment opportunity, assuming all cash flows occur at the end of each year. Should the company make the investment?

b. By how much must the cost of capital estimate deviate to change the decision?

(Hint:

Use Excel to calculate the IRR.)

c. What is the NPV of the investment if the cost of capital is

14%?

Note:

Assume that all cash flows occur at the end of the appropriate year and that the inflows do not start until year 7.

Chapter 13 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

Ch. 13 - Prob. 1DQCh. 13 - Discuss the concept of risk and how it might be...Ch. 13 - When is the coefficient of variation a better...Ch. 13 - Explain how the concept of risk can be...Ch. 13 - If risk is to be analyzed in a qualitative way,...Ch. 13 - Assume a company, correlated with the economy, is...Ch. 13 - Assume a firm has several hundred possible...Ch. 13 - Explain the effect of the risk-return trade-off on...Ch. 13 - What is the purpose of using simulation analysis?...Ch. 13 - Assume you are risk-averse and have the following...

Ch. 13 - Myers Business Systems is evaluating the...Ch. 13 - Prob. 3PCh. 13 - Prob. 4PCh. 13 - Prob. 5PCh. 13 - Possible outcomes for three investment...Ch. 13 - Prob. 7PCh. 13 - Prob. 8PCh. 13 - Prob. 9PCh. 13 - Prob. 10PCh. 13 - Prob. 12PCh. 13 - Waste Industries is evaluating a 70,000 project...Ch. 13 - Prob. 14PCh. 13 - Debby’s Dance Studios is considering the...Ch. 13 - Prob. 17PCh. 13 - Prob. 18PCh. 13 - Allison’s Dresswear Manufacturers is preparing a...Ch. 13 - Prob. 20PCh. 13 - Prob. 21PCh. 13 - Prob. 22PCh. 13 - Ms. Sharp is looking at a number of different...Ch. 13 - Prob. 25P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Bouvier Restaurant is considering an investment in a grill that costs $140,000, and will produce annual net cash flows of $21,950 for 8 years. The required rate of return is 6%. Compute the net present value of this investment to determine whether Bouvier should invest in the grill.arrow_forwardBuena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a net cash inflow one year from now of 810,000. Assume the cost of capital is 10 percent. Required: 1. Break the 810,000 future cash inflow into three components: a. The return of the original investment b. The cost of capital c. The profit earned on the investment 2. Now, compute the present value of the profit earned on the investment. 3. Compute the NPV of the investment. Compare this with the present value of the profit computed in Requirement 2. What does this tell you about the meaning of NPV?arrow_forwardFastTrack Bikes, Inc. is thinking of developing a new composite road bike. Development will take six years and the cost is $200,000 per year. Once in production, the bike is expected to make $300,000 per year for 10 years. Assume the cost of capital is 10%. a. Calculate the NPV of this investment opportunity, assuming all cash flows occur at the end of each year. Should the company make the investment? b. By how much must the cost of capital estimate deviate to change the decision? (Hint: Use Excel to calculate the IRR.) c. What is the NPV of the investment if the cost of capital is 14%? Note: Assume that all cash flows occur at the end of the appropriate year and that the inflows do not start until year 7.arrow_forward

- Management of Blossom Home Furnishings is considering acquiring a new machine that can create customized window treatments. The equipment will cost $225,550 and will generate cash flows of $97,750 over each of the next six years. If the cost of capital is 12 percent, what is the MIRR on this project?arrow_forwardManagement of Sunland Home Furnishings is considering acquiring a new machine that can create customized window treatments. The equipment will cost $266,550 and will generate cash flows of $81,750 over each of the next six years. If the cost of capital is 15 percent, what is the MIRR on this project? - MMR = ? %arrow_forwardXYZ, which currently sells art products, is considering project Q, which would involve teaching art lessons For most of its existence, XYZ sold art products, taught art lessons, and painted murals Project Q Would require an initial investment of $87,300 today and is expected to produce annual cash flows of $10,200 each year forever with the first annual cash flow expected in 1 year What is the NPV of project Q. based on the information in this paragraph and the following table and applying the pure play approach to detemining a project's cost of capital? Firm XYZ Frisco Frescos NorCal Art Art Factory Line of business Sells art products Paints murals at residential and commercial sights Teaches art lessons Sells art products, teaches art lessons, & paints murals WACC 144 percent 82 percent 95 percent 77 percent O a. $20,068 (plus or minus $10) Ob. $144,518 (plus or minus $10) OC. $37,090 (plus or minus $10) O d. $45,168 (plus or minus $10) O e. None of the above is within $10 of the…arrow_forward

- 6) Suppose two entrepreneurial engineers have an idea for a new product that they plan to launch 3 years from now. In three years, each engineer will need $10,000 to purchase equipment needed during that launch year. If each engineer wants to save enough money over the next three years to have $10,000, how much should be invested each year if the interested rate is 7%? Draw the cash flow diagram from the perspective of the engineers.arrow_forwardA garage is installing a new 'bubble-wash' car wash, which requires an initial investment of $280,000 in year 0. It will promote the car wash as a fun activity for the family and it is expected that the novelty of this approach will boost sales in the medium term. The garage plans on using an opportunity cost of capital of 10% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projections: Year 1 Year 2 Revenues Costs of Goods Sold Gross Profit Selling, General and Admin Depreciation EBIT Income tax (30%) Profit after tax Changes in NOWC 120 000 -60 000 60 000 -6 000 -70 000 -16 000 4 800 -11 200 The net present value (NPV) for this project is closest to: a. $76,607 b. $119,888 c. -$145,283 d. -$214,525 -5,000 400 000 -200 000 200 000 -6 000 -70 000 124 000 -37 200 86 800 -5,000 Year 3 400 000 -200 000 200 000 -6 000 -70 000 124 000 -37 200 86 800 -5,000 Year 4 300 000 -150 000 150 000 -6 000 -70 000 74 000 -22 200 51 800 -5,000arrow_forwardManagement of Crane Home Furnishings is considering acquiring a new machine that can create customized window treatments. The equipment will cost $209,550 and will generate cash flows of $83,750 over each of the next six years. If the cost of capital is 11 percent, what is the MIRR on this project?arrow_forward

- A garage is installing a new 'bubble-wash' car wash, which requires an initial investment of $280,000 in year 0. It will promote the car wash as a fun activity for the family and it is expected that the novelty of this approach will boost sales in the medium term. The garage plans on using an opportunity cost of capital of 10% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projections: Year 1 Year 2 Year 3 Year 4 Revenues 120 000 400 000 400 000 300 000 -Cost of goods sold -66 000 -206 000 -206 000 -156 000 -Depreciation -70 000 -70 000 -70 000 -70 000 +EBIT -16 000 124 000 124 000 74 000 -Taxes (30%) 4 800 -37 200 -37 200 -22 200 =Profit after tax -11 200 86 800 86 800 51 800 Changes in NOWC -5 000 -5 000 -5 000 -5 000 The net present value (NPV) for this project is closest to: a. -$145,283 O b. $76,607 O c. -$214,525 ○ d. $119,888arrow_forwardMr.Andi is a manager at an automation company. As part of his future planning, Mr.Andi plan to manage an investment IDR 100 thousand in the first year and increase this amount is 10% annually. To solve this problem, you have to create a spreadsheet from the data provided to complete your calculations along with the cash flow. Based on the data given: (a) How long will Mr.Andi's account have value in the future of IDR 3,000,000 at a rate of return of 6% per annum? (b) If Mr.Andi counts up to the next 30 years, find the nominal amount in the next 10, 20, and 30 years that Mr. Andi will achieve. The calculation spreadsheet can describe the amount deposited annually.arrow_forwardThe net present value method is used to evaluate capital investments. Imagine you are considering purchasing a new delivery truck for your business. The truck should be useable for 5 years and the company's discount rate is 10%. Consider the factors below: Initial purchase price: $80,000 You can sell the truck for $5,000 at the end of 5 years The new truck will provide $25,000 in cash flows each year How would you account for each of the three factors in your net present value calculation? Why does it makes sense to account for each the way you described? Note, I am not asking for the calculation although you can provide this if it helps aid your explanation. Please number your responses (1-3) when discussing the how and why. No generic answers please.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License