Concept explainers

a)

The computation of magnitude of operating leverage utilising contribution margin approach of each firm.

a)

Answer to Problem 27P

the operating leverage of L Company and B Company are 1.5 times and 3 times.

Explanation of Solution

Given information:

The formula to calculate the magnitudes of operating leverage are as follows:

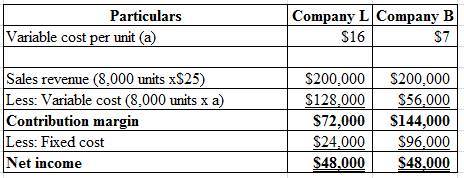

Calculate the magnitude of operating leverage of L Company and B Company:

Hence, the operating leverage of L Company and B Company are 1.5 times and 3 times.

b)

Determine the change in net income in amount and change in percentage of net income

b)

Explanation of Solution

Given information:

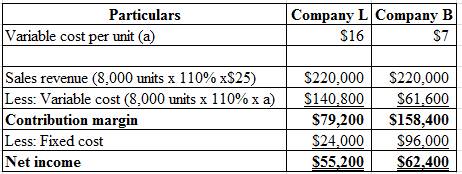

The sales increased by 10% for both Company L and Company B and selling price remain unchanged.

The formula to calculate the percentage change in net income:

Compute the change in net income in dollars:

Calculate the percentage change in net income of Company L and Company B:

Hence, the percentage change of net income of Company L and Company B is 15% and 30%

c)

Determine the change in net income in amount and change in percentage of net income.

c)

Explanation of Solution

Given information:

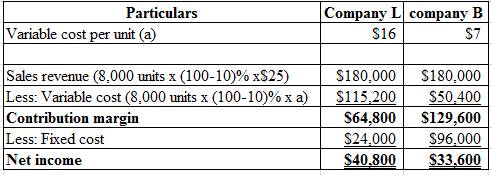

The sales decreased by 10% for both Company L and Company B and selling price remain unchanged.

The formula to compute the percentage change in net income:

Compute the change in net income in dollars:

Calculate the percentage change in net income of Company L and Company B:

Hence, the percentage change of net income of Company L and Company B is −15% and −30%

d)

Write a memo regarding the analyses and advice by Person JD.

d)

Explanation of Solution

To,

Person A

From,

Person JD

Subject:

Analysis and recommendation regarding the investment

Date: 11/29/2018

The rewards and risk of both the companies are different even though they have same amount of sales and net income. From the analysis of Person JD the operating leverage is 1.5 for Company L and 3 for Company B.

The analytical data indicates that income of Company B is more volatile than Company L.

Investment in Company B will be the better choice in a economy boom situation. Otherwise, Company L is considering better. An aggressive investor can choice Company B and a conservative investor can go for Company L.

Want to see more full solutions like this?

Chapter 11 Solutions

Survey Of Accounting

- 23. Mohammed LLC interested to know the Average profit of the company. It asks you to calculate the Average Profit from the given details. The total cost is RO 40000, Sales RO 80000 and Original Investment is RO 30000. a. RO 40000 b. None of the options c. RO 90000 d. RO 120000arrow_forwardQuestion 3) Textbook Exercise 13-29: Cost-plus operating income/return on investment pricing. 13-29 Cost-plus, target return on investment pricing. Zoom-o-licious makes candy bars for vending machines and sells them to vendors in cases of 30 bars. Although Zoom-o-licious makes a variety of candy, the cost differences are insignificant, and the cases all sell for the same price. Zoom-o-licious has a total capital investment of $15,000,000. It expects to produce and sell 300,000 cases of candy next year. Zoom-o-licious requires a 10% target return on investment. Expected costs for next year are: Variable production costs $4.00 per case Variable marketing and distribution costs $1.00 per case Fixed production costs $300,000 Fixed marketing and distribution costs $400,000 Other fixed costs $200,000 Zoom-o-licious prices the cases of candy at full cost plus markup to generate profits equal to the target return on capital.…arrow_forwardH1. Account Rahul has an amount of N 300,000 which is invested in a business. He desires 15% return on his fund. It is known from the past cost data analysis that fixed costs are N 150,000 per annum and variable costs of operation are 60% of sales. Determine sales volume to get 15% return. Also tell shut down point of the business, if he would spend N 50,000 even if business must be closed.arrow_forward

- Golden Goodness (GG) has an investment center that had the following data: Operating Income $28,000 Sales $350,000 Invested assets $175,000 PMB has set a minimum acceptable rate of return at 14%. Using the information, answer the following questions. You must include what type of number it is (%, $, etc.) Part A: What is the residual income? Part B: Show calcualtions on how you got answerarrow_forwardSub : FinancePls answer very fast.I ll upvote CORRECT ANSWER . Thank You( Dnt use CHATGPT ) If a business unit generated $3,600,000 in BEFORE TAX PROFIT and had invested capital of $18,000,000 BUT had excellent terms with its suppliers so had CREDITORS of $2,000,000 and the Weighted Average Cost of Capital (WACC) for this business is 16%. Calculate the Economic Value Add (EVA) for this business unit and select which of the following is correct. (Assume a tax rate of 30%) Positive $40,000 - performance is acceptable because EVA is greater than zero and therefore adding value b. $2,520,000 Acceptable because EVAt is greater than zero c. Negative $40,000 unacceptable because EVA is less than zero d. $2,560,000 acceptable because EVA is greater than zeroarrow_forwardQUESTION 27 Top management is trying to determine which would be the best choice of the following investment opportunities: Data of investment choices: 2 Sales $9,000,000 Operating income 300,000 Average operating assets 3,000,000 Required: Compute the Return on investment 8% 10% 12% 9%arrow_forward

- eBook Problem 22-09 Management of a firm with a cost of capital of 9 percent is considering a $108,000 investment with annual cash flow of $43,430 for three years. Use Appendix A and Appendix D to answer the questions. What are the investment’s net present value and internal rate of return? Use a minus sign to enter a negative value, if any. Round your answers for the net present value to the nearest dollar and for the internal rate of return to the nearest whole number. NPV: $ IRR: % The internal rate of return assumes that each cash flow is reinvested at the internal rate of return. If that reinvestment rate is achieved, what is the total value of the cash flows at the end of the third year? Use the rounded internal rate of return from part a. Round your answer to the nearest dollar. $ The net present value technique assumes that each cash flow is reinvested at the firm’s cost of capital. What would be the total value of the cash flows at the end of the third year, if the…arrow_forward14. I need help with finance home work question asap please A company is considering a project that would require a cash outflow in the amount of $1,000,000 at the beginning. The company expects the project to generate average annual cash inflows in the amount of $40,000. The average book value for the project is expected to be $250,000 and average annual net income is expected to be $55,000. The company requires a return of 15.25%. What is the average accounting return for this project?arrow_forwardtudent question Time to preview question: 00:09:18 Seeking for accounting rate of return for Option 1, 2, & 3 (info below). The senior VP in charge has asked that you make a recommendation for the purchase of new equipment.Ideally, the company wants to limit its capital investment to $500,000. However, if an asset meritsspending more, an investment exceeding this limit may be considered. You assemble a team to helpyou. Your goal is to determine which option will result in the best investment for the company. Toencourage capital investments, the government has exempted taxes on profits from new investments.This legislation is to be in effect for the foreseeable future.The average reported operating income for the company is $1,740,000.The company uses a 10% discount rate in evaluating capital investments.The team is considering the following optionsOption 1:The asset cost is $300,000.The asset is expected to have an 8-year useful life with no salvage value.Straight-line…arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning