a)

Determine the expected net income when 500 people buy the ticket

a)

Explanation of Solution

Given information:

The sale price of ticket is $28. Fee is $10,000 fixed.

The formula to calculate the net income:

Compute the net income:

Hence, the net income is $4,000.

The price of the speaker will remain same irrespective of fixed fee or fee of $20 per ticket sold.

b)1.

Determine the net income and percentage change in net income if the sale of tickets is 10% higher than expected

b)1.

Explanation of Solution

Given information:

Refer above part for net income:

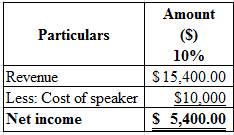

Compute the net income:

The net income is $5,400.

Compute the percentage growth in net income:

Hence, the percentage growth in net income is 35%.

2.

Determine the net income and percentage change in net income if the sale of tickets is 10% lower than expected and the fixed fee is $10,000.

2.

Explanation of Solution

Given information:

Refer part a) for net income:

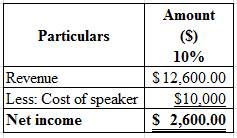

Compute the net income:

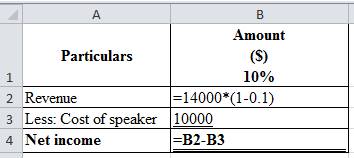

Excel spread sheet:

Excel workings:

The net income is $2,600.

Compute the percentage growth in net income:

Hence, the percentage growth in net income is 35%.

3.

Determine the net income and percentage change in net income if School P pays Person L $20 per ticket sold. The sale of tickets is 10% higher than expected.

3.

Explanation of Solution

Given information:

Refer part a) for net income:

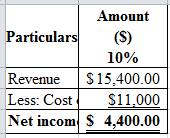

Compute the net income:

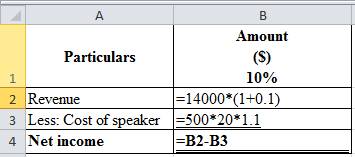

Excel spread sheet:

The net income is $4,400.

Excel workings:

Compute the percentage growth in net income:

Hence, the percentage growth in net income is 10%.

4)

Determine the net income and percentage change in net income if School P pays Person L $20 per ticket sold and the sale of tickets is 10% lower than expected.

4)

Explanation of Solution

Given information:

Refer part a) for net income:

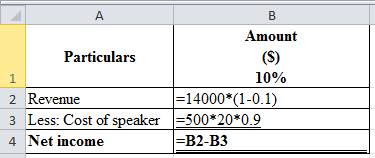

Compute the net income:

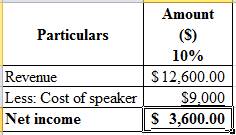

Excel spread sheet:

The net income is $3,600.

Excel workings:

Compute the percentage growth in net income:

Hence, the percentage growth in net income is 10%.

c)

Discuss the discrepancies if any arises on the computation presented at the board by the spokesperson and by the other groups.

c)

Explanation of Solution

There are no discrepancies in the computation presented at the board by the spokesperson and by the other groups.

d)1.

The kind of cost structure produces the greater growth potential in the profitability of the company.

d)1.

Explanation of Solution

The fixed cost structure produces the higher growth potential in company’s profitability.

This is because of operating leverage.

2.

The type of cost structure produces the higher risk of company’s declining profitability.

2.

Explanation of Solution

The fixed cost structure produces the higher risk of company’s declining profitability.

This is because of operating leverage.

3.

The circumstances under which the company pursue to establish a fixed cost structure

3.

Explanation of Solution

The circumstances where the sales of the company expected to raise are where the fixed cost structure is established.

4.

The circumstances under which the company pursues to establish a variable cost structure

4.

Explanation of Solution

The circumstances where the sales of the company expected to drop are where the variable cost structure is established.

Want to see more full solutions like this?

Chapter 11 Solutions

Survey Of Accounting

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education