Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Your corporation has the following

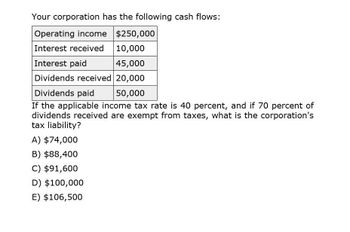

Transcribed Image Text:Your corporation has the following cash flows:

Operating income $250,000

Interest received

10,000

Interest paid

45,000

Dividends received 20,000

Dividends paid

50,000

If the applicable income tax rate is 40 percent, and if 70 percent of

dividends received are exempt from taxes, what is the corporation's

tax liability?

A) $74,000

B) $88,400

C) $91,600

D) $100,000

E) $106,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Berndt Corporation expects to have sales of 12 million. Costs other than depreciation are expected to be 75% of sales, and depreciation is expected to be 1.5 million. All sales revenues will be collected in cash, and costs other than depreciation must be paid for during the year. Berndts federal-plus-state tax rate is 40%. Berndt has no debt. a. Set up an income statement. What is Berndts expected net income? Its expected net cash flow? b. Suppose Congress changed the tax laws so that Berndts depreciation expenses doubled. No changes in operations occurred. What would happen to reported profit and to net cash flow? c. Now suppose that Congress changed the tax laws such that, instead of doubling Berndts depreciation, it was reduced by 50%. How would profit and net cash flow be affected? d. If this were your company, would you prefer Congress to cause your depreciation expense to be doubled or halved? Why?arrow_forwardRhodes Corporations financial statements are shown after part f. Suppose the federal-plus-state tax corporate tax is 25%. Answer the following questions. a. What is the net operating profit after taxes (NOPAT) for 2020? b. What are the amounts of net operating working capital for both years? c. What are the amounts of total net operating capital for both years? d. What is the free cash flow for 2020? e. What is the ROIC for 2020? f. How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term investments? (Hint: Remember that a net use can be negative.) Rhodes Corporation: Income Statements for Year Ending December 31 (Millions of Dollars) Rhodes Corporation: Balance Sheets as of December 31 (Millions of Dollars)arrow_forwardYour corporation has the following cash flows: Operating income $250,000 Interest received $ 10,00o0 Interest paid $ 45,000 Dividends received $ 20,000 Dividends paid $ 50,000 If the applicable income tax rate is 40% (federal and state combined), and if 70% of dividends received are exempt from taxes, what is the corporation's tax liability? $ 92,820 $102,334 $ 88,400 $ 83,980 O $ 97,461arrow_forward

- Your corporation has the following cash flows: Give true answer this accounting questionarrow_forwardAssume a corporation has earnings before depreciation and taxes of $145,000, depreciation of $35,000, and that it has a 30% combined tax bracket. What are the after-tax cash flows for the company? a) $112,000 Ob) $106,800 c) $116,600 Od) $115,800 0arrow_forwardPlease provide solutionarrow_forward

- Please give answerarrow_forwardIn corporation receives solve this accounting questionsarrow_forwardAssume a corporation has earnings before depreciation and taxes of $82,000, depreciation of $45,000, and that it has a 25% combined tax bracket. What are the after-tax cash flows for the company?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT