FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

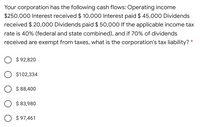

Transcribed Image Text:Your corporation has the following cash flows: Operating income

$250,000 Interest received $ 10,00o0 Interest paid $ 45,000 Dividends

received $ 20,000 Dividends paid $ 50,000 If the applicable income tax

rate is 40% (federal and state combined), and if 70% of dividends

received are exempt from taxes, what is the corporation's tax liability?

$ 92,820

$102,334

$ 88,400

$ 83,980

O $ 97,461

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 1 "Consider a C corporation. The corporation earns $4 per share before taxes. After the corporation has paid its corresponding taxes, it will distribute 50% of its earnings to its shareholders as a dividend. The corporate tax rate is 30%, the tax rate on dividend income is 20%, and the personal income tax rate is set at 28%. What are the shareholder's earnings from the corporation after all corresponding taxes are paid? Note: Express your answers in strictly numerical terms. For example, if the answer is 5%, enter 0.05 as an answer; or if the answer is $500, write enter 500 as an answer."arrow_forward8. A closely-held corporation, deemed committed unreasonably accumulating its income, shows the following data: Paid-up capital Accumulated Earnings - unrestricted Accumulated Earnings - restricted Income tax per annual income tax return Income tax for the first three quarters Final tax on passive income at 20% Capital gains tax at 15% Compute the amount of improperly accumulated earnings tax (IAET). P 10,000,000 8,000,000 2,000,000 300,000 240,000 60,000 45,000 8arrow_forward1. If a corporation’s tax return shows taxable income of $98,300 for Year 2 and a tax rate of 40%, how much will appear on the December 31, Year 2, balance sheet for “Income taxes payable” if the company has made estimated tax payments of $35,600 for Year 2? 2. An income statement that reports current tax expense of $81,800 and deferred tax benefit of $23,700 will report total income tax expense of $? If total tax expense is $47,500 and deferred tax expense is $64,900, then the current portion of the expense computation is referred to as current tax expense of $ ?arrow_forward

- Compute the taxable income & Earnings and profit for a corporation receipts from services receipts from services 75,000 dividend income 5000 interest from municipal bonds 2,000 additional capital from shareholders 10,000 wages & rent 30,000 fines 2,000 section 179 exp 20,000 estimated fed tav pd 5,000arrow_forward8. What is the after-tax return to a corporation that buys a share of preferred stock at $45, sells it at year-end at $45, and receives a $5 year-end dividend? The firm is in the 20% tax bracket. Revenue = $5 For a company, taxable = $5 * 30% = $1.5 Tax = $1.5* 20% = $0.3 After tax income = $5 - $0.3= $4.7 Return $4.7/$45= 10.44%arrow_forwardGiven an asset with a net book value (NBV) of $35,000. a. What are the after-tax proceeds for a firm in the 33% tax bracket if this asset is sold for $47,000 cash? After-tax proceeds $ 43,040 b. What are the after-tax proceeds for this same firm if the asset is sold for $21,000 cash? After-tax proceedsarrow_forward

- A company recently reported $9.8 million of net income. Its EBIT was $15 million, and its federal tax rate was 22%(ignore any possible state corporate taxes).What was its EBT? Blank 1What was its Tax liability? Blank 2What was its interest expense? Blank 3arrow_forwardThe tax bracket and holdings of your client are as follows: Federal tax bracket = 33% Investment Annual Income June 30, Last Year's Purchase Price June 30, This Year's Market Price Money fund $6,500 $100,000 $100,000 11% T bonds $11,000 $100,000 $140,000 S&P 500 Index Fund $6,000 $100,000 $160,000 Computer stock fund $3,000 $100,000 $85,000 *There have been no capital gain distributions. During the 12 months from June 30 last year, through June 30 this year, the portfolio earned in annual yield and before-tax appreciation, respectively: 5.5% yield and 17.5% appreciation 5.5% yield and 21.3% appreciation 6.6% yield and 17.5% appreciation 6.6% yield and 21.3% appreciationarrow_forwardProblem: Happy realized income of P97.000 before interest and income taxes, with Assets of ..P517.000 Liabilities 220,000 SE 297,000 os Income Tax Rate 32% he corporation want to have additional capital of P300.000 in order to add its operating incom y P150.000. Two options are presented: 1) Obtain P300.000 loan having interest of 30%. 2) Additional of 1270 shares of capital stocks with market price of P 1200 10,000 (Par value P100) Compute: both options 1) Net Income 2) Earnings per share 3) Rate of return on Owner's Equity 4) Which option is advantageous to Happy Corporation?arrow_forward

- 1 Calculate the Tax implications if the company has earnings before taxes of $ 350,000.00 Both if the company is a Corporation or Sole proprietorship What is the total taxes, average rate and the marginal tax rate Corporate Tax Rate: Total Taxes as Coorporation Personal Marginal Income Tax Rates: Single: Taxable Income Over--- 0 9,525 38,700 82,500 157,500 200,000 500,000 Total Tax Paid Marginal Tax Rate Average Tax Rate Taxable Income 350000 But not over Over--- 0 9,525 38,700 82,500 157,500 200,000 500,000 === 9,525 38,700 82,500 157,500 200,000 500,000 But not over --- 9,525 38,700 82,500 157,500 200,000 500,000 Marginal Tax Rate 10% 12% 22% 24% 32% 35% 37% Marginal Tax Rate 10% 12% 22% 24% 32% 35% 37% 21% Difference Incremental Taxes Cumulative Taxesarrow_forwardXYZ Corporation, a calendar year C Corporation, has $100,000 gross business receipts, $5,000 interest income from corporate bonds, $20,000 qualified dividend income from a 5% owned C Corporation, $110,000 business expenses, and $2,000 charitable contribution. How much is XYZ's taxable income (or net operating loss) for the current year?\\n\\nGroup of answer choices\\n\\n$0 Taxable income.\\n\\n$3,000 Taxable income.\\n\\n$6,500 Taxable income.\\n\\n$6,750 Taxable income.arrow_forwardMy problem with questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education