Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

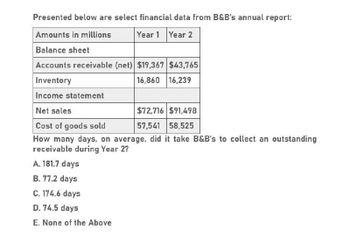

Transcribed Image Text:Presented below are select financial data from B&B's annual report:

Amounts in millions

Year 1 Year 2

Balance sheet

Accounts receivable (net) $19,367 $43,765

Inventory

Income statement

16,860 16,239

Net sales

Cost of goods sold

$72,716 $91,498

57,541 58,525

How many days, on average, did it take B&B's to collect an outstanding

receivable during Year 2?

A. 181.7 days

B. 77.2 days

C. 174.6 days

D. 74.5 days

E. None of the Above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Last year, Tobys Hats had net sales of 45,000,000 and cost of goods sold of 29,000,000. Tobys had the following balances: Refer to the information for Tobys on the previous page. Required: Note: Round answers to one decimal place. 1. Calculate the average accounts receivable. 2. Calculate the accounts receivable turnover ratio. 3. Calculate the accounts receivable turnover in days.arrow_forwardThe following selected information is taken from the financial statements of Arnn Company for its most recent year of operations: During the year, Arnn had net sales of 2.45 million. The cost of goods sold was 1.3 million. Required: Note: Round all answers to two decimal places. 1. Compute the current ratio. 2. Compute the quick or acid-test ratio. 3. Compute the accounts receivable turnover ratio. 4. Compute the accounts receivable turnover in days. 5. Compute the inventory turnover ratio. 6. Compute the inventory turnover in days.arrow_forwardWhalen Company had net sales of 125,500,250,000. Whalen had the following balances: Required: Note: Round answers to two decimal places. 1. Calculate the average accounts receivable. 2. Calculate the accounts receivable turnover ratio. 3. Calculate the accounts receivable turnover in days.arrow_forward

- COMPUTE FOR THE FOLLOWING ACCOUNTS: (THE BALANCE SHEET SHOULD BALANCE) (In Pesos) Annual Credit Sales 1,800,000 Cash 32,720 Gross Profit Margin 25% Marketable Sec. 25,000 Inventory Turnover 6 Accounts Receivable ? No. of days in a year 365 Inventories ? Average Collection Period 45 days Total Current Assets ? Current Ratio 1.6 Net Fixed Assets ? Total Asset Turnover Ratio 1.2 Total Assets ? Debt ratio 60% Accounts Payable 120,000 Notes Payable ? Accruals 20,000 Gross Profit ? Total Current Liabilities ? Long Term Debt ? *ALL SALES ARE CREDIT SALES Stockholders' Equity 600,000 Total Liab. And Equity ?arrow_forwardA company reports the following: Sales $572,320Average accounts receivable (net) 20,440Determine (a) the accounts receivable turnover and (b) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. a. Accounts receivable turnover fill in the blank 1b. Number of days' sales in receivables fill in the blank 2 daysarrow_forwardJinx Company provided the following information for the current year in relation to accounts receivable: Accounts receivable, January 1 1,300,000Credit sales 5,500,000Sales return 150,000Accounts written off 100,000Collections from customers 5,000,000Estimated future sales return on December 31 50,000Estimated uncollectible accounts per aging at year-end 250,000 What amount should be reported as net realizable value of accounts receivable on December 31?arrow_forward

- The following data was generated as of December 31Accounts receivable, Jan 1 550,000.00Accounts receivable collected 875,000.00Cash Sales 350,000.00Inventory, January 1 450,000.00Inventory, December 31 275,000.00Purchases 950,000.00Gross Margin on Sales 375,000.00 a.) How much is the total sales?b.) How much is the cost of sales?c.) How much is the ending Receivable as of Dec 31?d.) How is the credit sales?arrow_forwardA company reports the following: Sales $1,180,410 Average accounts receivable (net) 56,210 Determine (a) the accounts receivable turnover and (b) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. a. Accounts receivable turnover ___________ b. Number of days' sales in receivables ___________ daysarrow_forwardPlease helparrow_forward

- A company reports the following: Sales $956,300 Average accounts receivable (net) 73,000 Round your answers to one decimal place. Assume a 365-day year. a. Determine the accounts receivable turnover.fill in the blank 1 b. Determine the number of days' sales in receivables.fill in the blank 2arrow_forwardHow much is the gross profit for the year? a. 120,000 b. 130,000 C. 132,000 d. 146,000arrow_forwardA company reports the following: Sales $890,600 Average accounts receivable (net) 44,530 Determine (a) the accounts receivable turnover and (b) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. a. Accounts receivable turnover 20 b. Number of days' sales in receivables 18 X daysarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning