Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

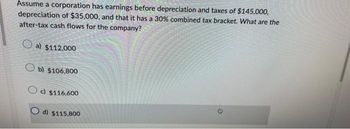

Transcribed Image Text:Assume a corporation has earnings before depreciation and taxes of $145,000,

depreciation of $35,000, and that it has a 30% combined tax bracket. What are the

after-tax cash flows for the company?

a) $112,000

Ob) $106,800

c) $116,600

Od) $115,800

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the FCFF of a firm with revenues of $229 million, operating profit margin of 47%, tax rate of 22%, depreciation and amortization expense of $29 million, capital expenditures of $31 million, acquisition expenses of $9 million and change in net working capital of $11 million? Answer in millions, rounded to one decimal place (e.g., $245,684,235 = 245.7). (Assume non- operating income and expenses are zero, so that EBIT = Operating income.) Type your numeric answer and submitarrow_forwardFind the operating cash flow for the year for Marathon and Sons if it had sales revenue o\f $80,200,000, cost of goods sold of $35,700,000, sales and administrative costs of $6,800,000, depreciation expense of $4,000,000, and a tax rate of 30%.arrow_forwardNeed answer pleasearrow_forward

- Kirkwood Corp has the following financial information: • EBITDA = $200 • Interest Expense = $20 • Tax Rate = 30% • Depreciation/ Amortization = $50 • Capital Expenditures = $30 • Change in NWC = = $15 Calculate operating free cash flow. (Note this cash flow is sometimes referred to as Enterprise FCF or Unlevered FCF) Round to nearest whole numberarrow_forwardYou have gathered this information on a firm: $500,000 sales, $10,000 cash dividends, $300,000 cost of goods sold, $20,000 administrative expense, $20,000 depreciation expense, $40,000 interest expense, $40,000 purchase of productive equipment, no changes in working capital, and a tax rate of 21%. What is the free cash flow?arrow_forwardThe Moore Enterprise has gross profit of $1,140,000 with amortization expense of $490,000. The Kipling Corporation has $1,140,000 in gross profits but only $73,000 in amortization expense. The selling and administration expenses are $133,000; the same for each company. If the tax rate is 40 percent, calculate the cash flow for each company. Moore Kipling Cash flow $ $ Calculate the difference in cash flow between the two firms? Difference in cash flow $arrow_forward

- Please solvearrow_forwardConsider the following information from the Income Statement of Production Ltd. on 31st December 2022 (accounting year-end): Operating profit equals £30,000 and depreciation expense equals £2,000. In addition, consider the following information from the Statement of Financial Position of Production Ltd.: Trade Receivables Trade Payables 31st December 2021 31st December 2022 £ £ 2,500 9,000 32,000 12,000 Additional information: • Tax paid on cash during the current accounting year amounts to £12,500 • Gain on asset disposal equals £1,000. Considering all the previous information from Production Ltd., which of the following statements is true on 31st December 2022? O a. Production Ltd. shows a negative net cash flow from operating activities which equals -£8,000. O b. Production Ltd. shows a positive net cash flow from operating activities which equals £3,000. O c. The net cash flow from operating activities equals £0 O d. None of the answers is true.arrow_forwardForaker Inc. has sales of $46,200, costs of $23,100, depreciation expense of $2200, and interest expense of $1700. If tax rate is 22%, the operating cash flow (OCF) is:arrow_forward

- Give me answer for this questionarrow_forwardBelow you will find the operating cash flows (Free Cash Flow) for ABC Corp. The company has a 11% weighted average cost of capital. Assuming that you are using an exit multiple approach to analyze ABC Corp, what is the Enterprise Value using an exit multiple of 7 (EV/EBITDA = 7x)? Dollars in millions Sales -Cash COGS and SG&A EBITDA -Tax basis D&A Operating Income -Taxes Net Operating Profit After Taxes +Depreciation & Amortization -Capex for PP&E -Working Capital Changes Operating Cash Flow Cost of Capital Present Value of Cash Flows $879.16 million $921.69 million $904.77 million $924.61 million 2023 500 400 100 14.1 85.9 21.48 64.43 14.1 17.2 2.2 59.13 Projected FYE 12/31 2024 560 448 112 16.2 95.8 23.95 71.85 16.2 19.26 2.46 66.32 2025 627.2 501.76 125.44 18.4 107.04 26.76 80.28 18.4 21.58 2.76 74.34 2026 702.46 561.97 140.49 20.6 119.89 29.97 89.92 20.6 24.16 3.09 83.26 2027 786.76 629.41 157.35 18.4 138.95 34.74 104.21 18.4 27.06 3.46 92.09arrow_forwardA firm has recorded EBIT at $1,800, depreciation at $600, EBT at $1,700 and a tax rate of 40%. Find the operating cash flows for this firm. Hin #1t: Operating CF = EBIT + depreciation - tax. Hint #2: Tax = EBT * tax rate.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education