Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Provide answer please

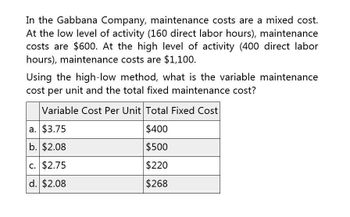

Transcribed Image Text:In the Gabbana Company, maintenance costs are a mixed cost.

At the low level of activity (160 direct labor hours), maintenance

costs are $600. At the high level of activity (400 direct labor

hours), maintenance costs are $1,100.

Using the high-low method, what is the variable maintenance

cost per unit and the total fixed maintenance cost?

Variable Cost Per Unit Total Fixed Cost

a. $3.75

$400

b. $2.08

$500

c. $2.75

$220

d. $2.08

$268

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Total costs for ABC Distributing are $250,000 when the activity level is 10,000 units. If variable costs are $5 per unit, what are their fixed costs? $240,000 $200,000 $260,000 Their fixed costs cannot be determined from the information presented.arrow_forwardDeidoro Company has provided the following data for maintenance cost: Machine hours Maintenance cost Multiple Choice Maintenance cost is a mixed cost with variable and fixed components. The fixed and variable components of maintenance cost are closest to: (Round your intermediate calculations to 2 decimal places.) O O Prior Year 17,100 20,100 $ 29,400 $ 34,200 $29,400 per year; $1.701 per machine hour Current Year $2,040 per year; $1.701 per machine hour $2,040 per year; $1.600 per machine hour $29,400 per year; $1.600 per machine hourarrow_forwardSuppose that Patron Company sells a product for $24. Unit costs are as follows: Direct materials $4.98 Direct labor 2.58 Variable factory overhead 1.00 Variable selling and administrative expense 2.00 Total fixed factory overhead is $30,000 per year, and total fixed selling and administrative expense is $11,664. Required: 1. Calculate the variable cost per unit and the contribution margin per unit. 2. Calculate the contribution margin ratio and the variable cost ratio. 3. Calculate the break-even units. 4. Prepare a contribution margin income statement at the break-even number of units. Enter all amounts as positive numbers.arrow_forward

- The following costs related to Lillian Company: Variable Costs per unit: Direct materials $2.50 Direct labor $0.75 Overhead $1.25 Selling & Administrative $1.50 Fixed Costs: Overhead $10,000 Selling & Administrative $5,000 Each unit sells for $15.00. At a sales volume of 15,000 units, what is Lillian Company’s total cost?arrow_forwardSuppose that Larimer Company sells a product for $20. Unit costs are as follows: Direct materials $1.70 Direct labor 1.60 Variable factory overhead 2.00 Variable selling and administrative expense 1.50 Total fixed factory overhead is $55,240 per year, and total fixed selling and administrative expense is $38,480. Required: 1. Calculate the variable cost per unit and the contribution margin per unit. 2. Calculate the contribution margin ratio and the variable cost ratio. 3. Calculate the break-even units. 4. Prepare a contribution margin income statement at the break-even number of units. Enter all amounts as positive numbers.arrow_forwardX Company accumulates the following data about maintenance costs, a mixed cost, using hours as the activity level: Hours Cost April 30,000 $150,000 Мay 20,000 125,000 June 25,000 137,500 July 10.000 100,000 August 15,000 112,500 Based on the above, in applying the high-low method, what is the unit variable cost? * $2.5 O $5 O $10 ) None of the abovearrow_forward

- The Miramichi Company uses the high-low method to estimate its cost function. The information for the current year is provided below: Highest observation of cost driver Lowest observation of cost driver $12,500 Machine-hours a. O b. $0 O C. $25,000 O d. $125,000 O e. $225,000 2,000 1,000 What is the constant for the estimating cost equation? Costs $225,000 $125,000arrow_forwardA. APPLY THE CONCEPTS: Determine the mixed costs Costs that display characteristics of both fixed and variable costs simultaneously are called "mixed costs." The rental agreement on a piece of machinery stipulates an annual fee of $6,000 plus $2 for each hour of use. To illustrate, assume the manager wants to know what mixed costs will be at 7,000 hours of operation. Fixed Cost + (Variable Cost per Unit x Number of Units) = Mixed Cost $________________ + $_____ x 7,000 hours) = $___________ For this scenario, calculate the mixed costs at different levels across the relevant range, then graph them. Hours of Operation Mixed Cost 0 hours $________________ 4,000 $________________ 9,000 $________________ 12,000 $________________ 15,000 $________________ B. Based on the data from the table completed above, select the graph that correctly represents the mixed cost data. (selections in screenshot)arrow_forwardAdditional Information: a. Sales revenue per unit will be decreased by BD 1.200 fils for sales more than 9,000 units. Direct material cost is a variables cost and other production overheads are fixed cost. C. Direct labour consists of machine operatives' wages and the total wages behave as a step cost: Output Up to 7,500 units Over 7,501 and up to 11,000 units Over 11,001 and up to 15,000 units Machine running costs are a semi-variable cost. There is a fixed charge of BD 5,000 plus BD 1.200 fils per unit. Total Direct Labour cost BD 4,850 BD 8,563 BD 10,484 Required the budgeted direct labor cost under the output of 11300 unit is:arrow_forward

- If the total maintenance cost of the lowest month is RM1,500 and the variable cost per unit is RM1.25 with 300 units produced, what is the total maintenance cost for 600 units. (find the fixed portion of the mixed cost using the high-low method)arrow_forwardAdditional Information: Şales revenue per unit will be decreased by BD 1.200 fils for sales more than 9,000 units. a. b. Direct material cost is a variables cost and other production overheads are fixed cost. C. Direct labour consists of machine operatives' wages and the total wages behave as a step cost: Output Up to 7,500 units Over 7,501 and up to 11,000 units Over 11,001 and up to 15,000 units Machine running costs are a semi-variable cost. There is a fixed charge of BD 5,000 plus BD 1.200 fils per unit. Total Direct Labour cost BD 4,850 BD 8,563 BD 10,484 d. Required: the budgeted other production overhead under the output of 11300 units is:arrow_forwardNeed answer the accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College