Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Financial accounting questions

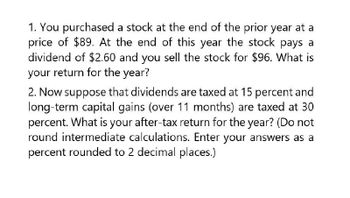

Transcribed Image Text:1. You purchased a stock at the end of the prior year at a

price of $89. At the end of this year the stock pays a

dividend of $2.60 and you sell the stock for $96. What is

your return for the year?

2. Now suppose that dividends are taxed at 15 percent and

long-term capital gains (over 11 months) are taxed at 30

percent. What is your after-tax return for the year? (Do not

round intermediate calculations. Enter your answers as a

percent rounded to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Need helparrow_forwardYou purchased a stock at the end of last year at a price of $98. At the end of this year, the stock pays a dividend of $2.10 and you sell the stock for $107. What is your return for the year? Now suppose that dividends are taxed at 15 percent and long-term capital gains (over 11 months) are taxed at 30 percent. What is your aftertax return for the year? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Pretax return 11.33 % Aftertax return %arrow_forwardYou buy a stock for $47 per share and sell it for $50 after holding it for slightly over a year and collecting a $4 per share dividend. If dividend incone is taxed at a 20% rate and capital gains are taxed at 25%, what is your after tax holding period return? (Write your answer in percentage and round it to 2 decimal places)arrow_forward

- $30 per share, holds the shares for 5 years, and sells them for $65. (Hint: Find the holding period return and divide by the number of years in the holding period.) The annualized rate of return is ☐ %. (Round to two decimal places.) What is his after-tax rate of return if he is in the 25 percent marginal tax bracket? The tax due is $ (Round to the nearescent.) The after-tax rate of return is ☐ %. (Round to two decimal places.)arrow_forward22) You buy a stock for $30 per share and sell it for $33 after holding it for slightly over a year and collecting a $0.75 per share dividend. Your ordinary income tax rate is 28 percent and your capital gains tax rate is 20 percent. Your after-tax rate of return is to e asse (8 A) 12.50 percent. B) 9.80 percent. C) 8.75 percent. D) 8.00 percent. E) None of the above 22) riesarrow_forwardNeed Help pleasearrow_forward

- Best Corporation is expected to pay $.60 next year and $1.10 the following year and $1.25 each year thereafter. If the required return is .14, what is the priice of the stock? $7.40 $2.95 $8.24 $2.22arrow_forwardWhat is your total return for last year on these financial accounting question?arrow_forwardAn investor purchases a share for £6.89 at the beginning of the year. Six months later, the investor receives a dividend of £0.08 (net of tax) and immediately sells the share for £7.26. Capital gains tax of 30% is paid on the difference between the sale and the purchase price. Calculate the net annual effective rate of return the investor obtains on the investment. 数字 Enter a percentage correct to 2 decimal places %arrow_forward

- You sold a stock for $90 that you purchased fourteen years earlier for $45. What was the holding period return and annualized compounded returns? Use Appendix A to answer the questions. Round your answers to the nearest whole number. Holding period return: % Annualized compounded return: %arrow_forwardPlease Provide answerarrow_forwardYou purchased a share of stock in The Hephaestus Company last year at $40, which paid you a $2 dividend during the year. What is your holding period return if: a. You sell the stock for $44. b. You sell the stock for $50. c. You sell the stock for $35arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning