EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please need answer the general accounting question

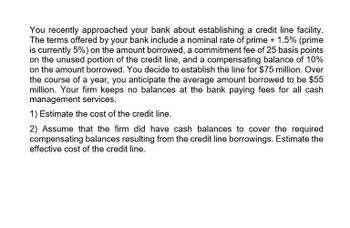

Transcribed Image Text:You recently approached your bank about establishing a credit line facility.

The terms offered by your bank include a nominal rate of prime + 1.5% (prime

is currently 5%) on the amount borrowed, a commitment fee of 25 basis points

on the unused portion of the credit line, and a compensating balance of 10%

on the amount borrowed. You decide to establish the line for $75 million. Over

the course of a year, you anticipate the average amount borrowed to be $55

million. Your firm keeps no balances at the bank paying fees for all cash

management services.

1) Estimate the cost of the credit line.

2) Assume that the firm did have cash balances to cover the required

compensating balances resulting from the credit line borrowings. Estimate the

effective cost of the credit line.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please provide the steps to solving this problem using a financial calculator: You just opened a brokerage account, depositing $3,500. You expect the account to earn an interest rate of 9.652%. You also plan on depositing $4,500 at the end of years 5 through 10. What will be the value of the account at the end of 20 years, assuming you earn your expected rate of return?arrow_forwardSuppose you secure a home improvement loan in the amount of $5,000 from a local bank. The loan officer gives you the following loan terms:• Contract amount = $5,000• Contract period = 24 months• Annual percentage rate = 12%• Monthly installment = $235 .37Shown is the cash flow diagram for this loan. Construct the loan payment schedule by showing the remaining balance, interest payment, and principal payment at the end of each period over the life of the loan.arrow_forwardYou plan to use a 15 year mortgage obtained from a local bank to purchase a house worth $124,000.00. The mortgage rate offered to you is 7.75%. You will make a down payment of 20% of the purchase price. a. Calculate your monthly payments on this mortgage. List in a spreadsheet the cash flow the bank expects to receive from you. Submit the spreadsheet with your answers. b. Calculate the amount of interest and principal for the 60th payment. Show your work. c. Calculate the amount of interest and principal to be paid on the 180th payment. Show your work. d. What is the amount of interest paid over the life of this mortgage?arrow_forward

- You have approached your bank for a 30 year mortage loan in the sum of $2,160,000. The bank has agreed to lend you the money at the annual rate of 6.32% a Caluate the montly repayment on this loan b Compute the interest payment for the first month of the loan based on the answer in a.arrow_forwardCan you please help me with the following questions? 1. Determine the total amount of an investment of $1,400 at 3.5% simple interest for 48 months. 2. Determine the total interest on a loan of $5,000 if the interest rate is 6.24%, compounded monthly for 12 years. 3. Use a TVM solver to determine the interest rate on a loan of $5,400 if interest is compounded monthly for 72 months and the final amount of the loan is $6,965.35. List the values you used for present value, future value, number of years, and number of compounding periods per year. 4. Use a TVM solver to determine the monthly payment of a lease of $21,568 if the interest rate is 4.8% compounded monthly for 48 months. 5. Over a five-year period, the maintenance on a car included two oil changes per year ($48 each), new brakes ($452), new tires ($678), and a new set of spark plugs ($145). What is the average yearly maintenance fee on the car for the five-year period? 6. Compare the…arrow_forwardYou have just taken out a five-year loan from a bank to buy an engagement ring. The ring costs $6,200. You plan to put down $1,400 and borrow $4,800. You will need to make annual payments of $1,100 at the end of each year. Show the timeline of the loan from your perspective. How would the timeline differ if you created it from the bank's perspective? Show the timeline of the loan from your perspective. (Select the best choice below.) O A. Year 1 2 3 4 Cash Flow $4,800 - $1,100 -$1,100 - $1,100 - $1,100 - $1,100 O B. Year 1 2 3 4 Cash Flow - $1,400 $1,100 $1,100 $1,100 $1,100 $1,100 O C. Year 1 2 3 4 Cash Flow - $4,800 $1,100 $1,100 $1,100 $1,100 $1,100 O D. Year 1 2 3 4 Cash Flow $6,200 - $1,100 -$1,100 - $1,100 - $1,100 - $1,100arrow_forward

- Suppose that you're planning a vacation and borrow $2,000 from a bank for one year at a stated annual interest rate of 14 percent, with interest prepaid (a discount interest loan). Also, assume that the bank requires you to maintain a compensating balance equal to 10 percent of the initial loan value. What effective annual interest rate are you being charged?arrow_forwardSuppose you take out a 36-month installment loan to finance a delivery van for $26,100. The payments are $989 per month, and the total finance charge is $9,504. After 25 months, you decide to pay off the loan. After calculating the finance charge rebate, find your loan payoff (in $). (Round your answer to the nearest cent.) Need Help? Read It Watch It Master Itarrow_forwardYou plan to borrow $10,000 from the bank. For a four-year loan, the bank requires annual end-of-year payments of $3,223.73. What is the annual interest rate on this loan?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT