Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Provide this question solution general accounting

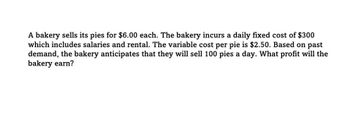

Transcribed Image Text:A bakery sells its pies for $6.00 each. The bakery incurs a daily fixed cost of $300

which includes salaries and rental. The variable cost per pie is $2.50. Based on past

demand, the bakery anticipates that they will sell 100 pies a day. What profit will the

bakery earn?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Currently, Sweet Treats Bakery sells 1,200 cupcakes per month. The owners would like to increase net income above what is currently earned. Fixed costs are $1,500 per month and their contribution margin is $3 per cupcake. What would be a reasonable net income goal? O $1,800 O $2,600 O $2,100 O $5,600arrow_forwardYou are opening a coffee shop. You estimate the weekly costs of $375 for rent, $2100 for employee costs, and $125 for miscellaneous costs. The ingredients and material cost for each cup of coffee is 0.35 (cents) per cup. 1) Create a cost function for the coffee shop. 2) If the investors estimate that they will be able to sell 1100 cups of coffee per week. How much should they charge per cup to make a profit? Justify your answer and/or explain.arrow_forwardbed Cruse Cleaning offers residential and small office cleaning services. An average cleaning service has the following price and costs. Sales price Variable costs Fixed costs $127.00 per service 89.00 per service 119,548 per year Cruse Cleaning is subject to an income tax rate of 22 percent. Required: a. How many cleaning services must Cruse Cleaning sell in a year to break even? ook b. How many cleaning services must Cruse Cleaning sell in a year to earn an annual operating profit of $32,604 after taxes? a Required sales in a year to break even int rences b. Required sales in a year to earn an annual operating profit of $32,604 after taxes: cleaning services cleaning servicesarrow_forward

- Please explain the step so I can understand. Gobblecakes is a bakery that specializes in cupcakes. The annual fixed cost to make cupcakes is $18,000. The variable cost including ingredients and labor to make a cupcake is $0.90. The bakery sells cupcakes for $3.20 apiece. (a). If the bakery sells 12,000 cupcakes annually, determine the total cost, total revenue, and profit. (b). How many cupcakes will the bakery need to sell in order to break even?arrow_forwardRolf's Golf store sells golf balls for $32 per dozen. The store's overhead expenses are 30% of cost and the owners require a profit of 19% of cost. a. How much does Rolf's Golf store buy the golf balls for? b. What is the price needed to cover all the costs and expenses? c. What is the highest rate of markdown at which the store will still break even? d. What markdown rate would price the golf balls at cost? Anna sells a certain pair of earrings at her store for $46.40 per pair. Her overhead expenses are $6.00 per pair and she makes 55.00% operating profit on selling price.Round to the nearest cent. a. What is her amount of markup per pair of earrings? b. How much does it cost her to purchase each pair of earrings?arrow_forwardCarondelet Coffee has begun making and selling pastries. The fixed costs of making the pastry are $4,000, and the company estimates that the variable costs are $.75 per pastry. How many pastries does Carondelet have to sell to earn net income of $5,000 if it sells each pastry for $3 apiece?arrow_forward

- sarrow_forwardBill Prichett’s store makes and sells small pottery items which are sold at $10 per item. Fixed cost for the store is $1000 and the variable cost per item is $5. (a) Find the break-even quantity. (b) How many items should the store make to realize a profit of $25000? revenue of $25000? (c) What is the break-even quantity if Bill wants to earn a salary of $15000?arrow_forwardPlease help me fastarrow_forward

- A company sells a toy for $12.80 each. The material, labour, and marketing costs add up to $1.00 per toy. The company also bears fixed costs of $10,100 per month related to this particular product. If the company produces and sells 850 toys each month, what is its monthly net income? Monthly net income = $ there is a loss.) (Enter your answer as negative ifarrow_forwardYou have a business selling and delivering pizzas to businesses for lunch. You pay $4,000 per month in rent, $320 for utilities, and $2,000 a month for salaries. You also have delivery cars that cost $1,000 per month. Your variable costs are $8 per pizza for ingredients and $4 per pizza for delivery costs. You sell the pizzas for $20 each. Round up if necessary What is the number of pizzas you need to sell to break even for the month If you want to make a profit of 2,000 per month, how many pizzas do you need to sell? Round up if necessary Go back to the original numbers If the price of cheese goes up and your variable costs go by $3 what is your new break even in pizzas if you increase your price to $21 Round up if necessary Golden Company has a fleet of delivery trucks and has the following Overhead costs per month with the miles driven Miles Driven Total Costs March 50.000 194.000 Aprill 40.000 170.200 this is the low May 60.000 217.600 June 70.000 241.000 Use the High-Low method to…arrow_forwardA local pizza shop owner decides to hire an economic consultant to help him set his prices. Currently, one slice of pizza costs $2 and the store sells about 800 slices per week. The pizza shop's current revenue from sales is equal to $____. The economic consultant estimates that the price elasticity of demand is equal to -0.25, and suggests that the shop owner should increase the price of a slice of pizza by $0.50; that is, the consultant recommends increasing the price of pizza by ____%. The consultant claims that doing so would (a. Increase b. Decrease or C.have no effect on)_____ the number of slices sold by ____% or ____ slices. As a result, the economist predicts that the new revenue would be ____ Thus as a result of the increase in the price there is ____ in revenue. This is due to the fact that the pizza shop owner was operating on the ____ portion of the demand curve. (fill in the blanks)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College