FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Financial Accounting

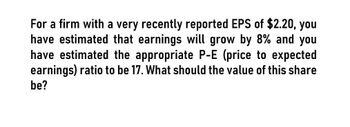

Transcribed Image Text:For a firm with a very recently reported EPS of $2.20, you

have estimated that earnings will grow by 8% and you

have estimated the appropriate P-E (price to expected

earnings) ratio to be 17. What should the value of this share

be?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- General Accountingarrow_forwardIf D1 = $1.15, g (which is constant) = 5.24%, and P0 = $56.45, what is the stock's expected capital gains yield for the coming year? Please work out the problem, do not use excel.arrow_forwardYou forecast to have a ROE of 14%, and dividend payout ratio of 12%. Currently the company has a price of $30 and $7 earnings per share. What is the PEG ratio based on market price?arrow_forward

- If D1 = $1.50, g (which is constant) = 2.1%, and PO = $56, what is the stock's expected capital gains yield for the coming year?arrow_forwardEstimate its cost of common equity, Maxell and Associcates recently hired you. Obtain the following data, D0=$0.90, P0= $27.50, gl=7% constant. Based on the dividend grwoth model, What is the cost of common for reinvested earnings? (10.50%,9.29%,10.08%,9.68%,10.92%)arrow_forwarda company has a stock of 1.40, risk free 4.25%, market risk of 5.50%. what is the future return growth rate?arrow_forward

- You obtain the following information about RIO: Estimated earnings growth rate: 11.00% Current Share Price: $25.00 EPS today: 1.71 You also have the following information about industry RIO is in: Estimated earnings growth rate: 11.00% Median P/E ratio: 19.90 Using the PEG approach and assume RIO has the same risk as the industry, is RIO’s equity value overvalued or undervalued compare to the industry?arrow_forwardYou forecast the company A’s future earning is going to be $5.34 per share. The current market price is $55. What the market forward PE ratio? The estimated growth rate is 10%, what is the PEG ratio based on your estimate of growth rate? The industry average has a P/E ratio of 14 and growth rate of 12%, what does it mean for A’s stock price?arrow_forwardFor Company ABC, if stock price P0 = $30; dividend paid at the end of period 1 D1 = $3.00; growth rate g = 5%; What’s the required rate of return for equity holder rs = ? If the flotation cost F = 10%; What’s the required rate of return for equity holder rs = ?arrow_forward

- (13) If D1 = $3.00, g = 7%, and P0 = $44, what is the stock’s expected dividend yield, capital gains yield, and total expected return for the coming year?arrow_forwardIf D1 = $1.25, g (which is constant) = 5.5%, and P0 = $44, what is the stock's expected total return for the comingyear?arrow_forwardIf Do= $2.25, g (which is constant) = 3.5%, and Po= $44, what is the stock's expected dividend yield for the coming year? Select the correct answer. Oa. 4.15% b. 4.53% O c. 5.29% d. 4.91% O e. 5.67%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education