CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

Solar Industries

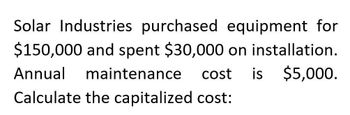

Transcribed Image Text:Solar Industries purchased equipment for

$150,000 and spent $30,000 on installation.

Annual maintenance

cost is $5,000.

Calculate the capitalized cost:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Lynda Inc. purchased a piece of equipment for $15,000. Additional costs include transportation, $300; installation, $700; test run, $1,000; and insurance from the date that the equipment begins productive output, $1,200. What is the capitalized amount of the equipment? $17,000 $18,200 $16,000 $15,000arrow_forwardThe table given below lists the relevant cost items for a specific system purchase. The operating expenses for the new system are $10,000 per year, and the useful life of the system is expected to be five years. The salvage value for depreciation purposes is equal to 25% of the hardware cost. Cost Item Cost Hardware $160,000 Training $15,000 Installation $15,000 a) What is the Book Value (BV) of the device at the end of year three if the Straight Line (SL) depreciation method is used? b) Suppose that after depreciating the device for two years with the SL method, the firm decides to switch to the double declining balance depreciation method for the remainder of the device's life (the remaining three years). What is the device's BV at the end of four years?arrow_forwardMortenson has purchased new equipment that initially costs$1,000,000. Setup costs are$100,000and delivery costs are$50,000. Calculate the year 3 MACRS depreciation of this equipment, which falls into the three-year asset class.arrow_forward

- Calculate the capitalized cost of an equipment maintained at a rate of 6% every year for $10,000, replaced every 3years for $25,000 at the same rate, and bought for $110,500.arrow_forwardA newly constructed water treatment facility costs $2 million. It is estimated that the facility will need revamping to maintain the original design specification every 30 years at a cost of $1 million. Annual repairs and maintenance costs are estimated to be $100,000. At an interest rate of 8%, determine the capitalized cost of the facility, assuming that it will be used for an indefinite period.arrow_forwardthe furure dismantling , removal and restoration costs are 750 000. an appropriate discount rate (after tax) of 9% is determined. The estimated useful life of the building is 20years. calculate the present value.arrow_forward

- Dumb Company constructed its own factory building. The company had a P1,000,000 two-year 12% loan specifically obtained to finance the asset construction. The construction began on January 1, 2021 and the building was completed on December 30, 2022. Expenditures on the building were made as follows: January 1, 2021 P800,000April 30, 2021 300,000November 1, 2021 600,000March 1, 2022 600,000September 30, 2022 400,000Dumb has the following outstanding loans from general borrowings: 10% note issued prior to construction of new building; term, 10 years 1,500,000 12% note issued prior to construction of new building; term, 15 years 2,500,000 13) How much is total initial cost of the building? 14) How much is the finance cost that should be recognized in profit or loss for the year 2022?arrow_forwardThe value of your investment is divided into $30,000 for the land and $120,000 for the office space. Assume the salvage value of your investment is $40,000 at the end of seventh year. Using CCA=1%, compute the undepreciated capital cost of the office space for year four. a) Between $114,000 and $117,000 b) Between $120,000 and $123,000 c) Between $95,000 and $98,000 O d) Between $110,000 and $113,000 e) None of the answers are correct f) Between $92,000 and $95,000arrow_forwardUtica Corporation paid 360,000 to purchase land and a building. An appraisal showed that the land is worth 100,000 and the building is worth 300,000. What cost should Utica assign to the land and to the building, respectively?arrow_forward

- During the current year, Arkells Inc. made the following expenditures relating to plant machinery. Renovated seven machines for $250,000 to improve efficiency in production of their remaining useful life of eight years Low-cost repairs throughout the year totaled $79,000 Replaced a broken gear on a machine for $6,000 A. What amount should be expensed during the period? B. What amount should be capitalized during the period?arrow_forwardUtica Machinery Company purchases an asset for 1,200,000. After the machine has been used for 25,000 hours, the company expects to sell the asset for 150,000. What is the depreciation rate per hour based on activity?arrow_forwardBeaverton Lumber purchased a milling machine for $35,000. In addition to the purchase price, Beaverton made the following expenditures: freight, $1,500; installation, $3,000; testing, $2,000; personal property tax on the machine for the first year, $500. What is the initial cost of the machine?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College