Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

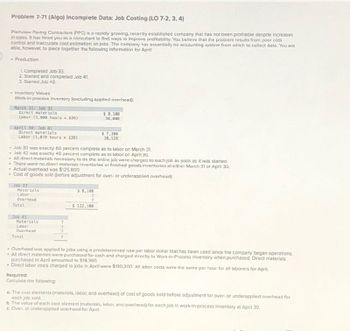

Transcribed Image Text:Problem 7-71 (Algo) Incomplete Data: Job Costing (LO 7-2, 3, 4)

Plainview Paving Contractors (PPC) is a rapidly growing, recently established company that has not been profitable despite increases

in sales. It has hired you as a consultant to find ways to improve profitability. You belleve that the problem results from poor cost

control and inaccurate cost estimation on jobs. The company has essentially no accounting system from which to collect data. You are

able, however, to piece together the following information for April:

Production

1. Completed Job 33.

2. Started and completed Job 41

3. Started Job 42.

Inventory Values

Work-in-process inventory (excluding applied overhead):

March 31: Job 33

Direct materials

$8,100

Labor (1,000 hours $36)

36,000

April 30: Job 42

Direct materials

Labor (1,078 hours $36)

$ 7,300

38,520

- Job 33 was exactly 60 percent complete as to labor on March 31.

Job 42 was exactly 40 percent complete as to labor on April 30.

All direct materials necessary to do the entire job were charged to each job as soon as it was started.

There were no direct materials inventories or finished goods Inventories at either March 31 or April 30,

Actual overhead was $125,800.

Cost of goods sold (before adjustment for over- or underapplied overhead):

Job 33

Materials

Labor

Overhead

5 8,100

7

Total

Job 41

$122,100

Materials

Labor

Overhead

Total

Overhead was applied to jobs using a predetermined rate per labor dollar that has been used since the company began operations.

All direct materials were purchased for cash and charged directly to Work-in-Process Inventory when purchased. Direct materials

purchased in April amounted to $18,360.

Direct labor costs charged to jobs in April were $130,200. All labor costs were the same per hour for all laborers for April.

Required:

Calculate the following:

a. The cost elements (materials, labor, and overhead) of cost of goods sold before adjustment for over- or underapplied overhead for

each job sold.

b. The value of each cost element (materials, labor, and overhead) for each job in work-in-process inventory at April 30.

c. Over- or underapplied overhead for April

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Murphy corporation has the following data pertaining solve this accounting questionsarrow_forwardI'm having trouble determining the profitability of the firm's information systems services and e-commerce consulting activities in problem 3. Could you help me solve this problem? I'm confused by the activity-based costing system and need to find the total billings, income, and profitability percentage.arrow_forwardDropping a customer, activity-based costing, ethics. Justin Anders is the management accountant for Carey Restaurant Supply (CRS). Sara Brinkley, the CRS sales manager, and Justin are meeting to discuss the profitability of one of the customers, Donnelly’s Pizza. Justin hands Sara the following analysis of Donnelly’s activity during the last quarter, taken from CRS’s activity-based costing system: Sara looks at the report and remarks, “I’m glad to see all my hard work is paying off with Donnelly’s. Sales have gone up 10% over the previous quarter!” Justin replies, “Increased sales are great, but I’m worried about Donnelly’s margin, Sara. We were showing a profit with Donnelly’s at the lower sales level, but now we’re showing a loss. Gross margin percentage this quarter was 40%, down five percentage points from the prior quarter. I’m afraid that corporate will push hard to drop them as a customer if things don’t turn around.” “That’s crazy,” Sara responds. “A lot of that overhead for…arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward9. Accounting Issues in a Lean Environment Pinnacle Technologies has recently implemented a lean manufacturing approach. A production manager has approached the controller with the following comments: I am very upset with our accounting system now that we have implemented our new lean manufacturing methods. It seems as if all I’m doing is paperwork. Our product is moving so fast through the manufacturing process that the paperwork can hardly keep up. For example, it just doesn’t make sense to me to fill out daily labor reports. The employees are assigned to complete cells, performing many different tasks. I can’t keep up with direct labor reports on each individual task. I thought we were trying to eliminate waste. Yet the information requirements of the accounting system are slowing us down and adding to overall lead time. Moreover, I’m still getting my monthly variance reports. I don’t think that these are necessary. I have nonfinancial performance measures that are more timely…arrow_forward

- Please don't provide image based answer.. thankuarrow_forwardInfo in images (a) What is the customer margin under activity-based costing when the number of orders increases to 11? (Enter a loss as a negative amount.) Customer margin under activity-based costing [ ] (b) What is the product margin under the traditional costing system when the number of orders increases to 11? (Enter a loss as a negative amount.) Product margin under the traditional costing system [ ] (c) Which of the following statements are true? (You may select more than one answer.) check all that apply If a customer orders more frequently, but orders the same total number of units over the course of a year, the customer margin under activity based costing will decrease.unanswered If a customer orders more frequently, but orders the same total number of units over the course of a year, the product margin under a traditional costing system will decrease.unanswered If a customer orders more frequently, but orders the same…arrow_forwardI have attached the file. Please help me with the solution.arrow_forward

- As manufacturing moves toward automation, direct laborA. continues to be a major factor in the cost of products since automation is not capable of totally supplanting production workers.B. continues to be an appropriate base for computing overhead rates in all situations.C. is becoming less of a factor in the cost of products since machines now perform various functions that once were performed by direct labor workers.D. continues to be a major factor in the cost of products since supervisory salaries are increasing.arrow_forwardI need help with this accounting problemarrow_forwardNote:- • Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. • Answer completely. • You will get up vote for sure.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College