FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Need answer the accounting question

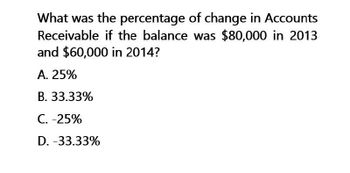

Transcribed Image Text:What was the percentage of change in Accounts

Receivable if the balance was $80,000 in 2013

and $60,000 in 2014?

A. 25%

B. 33.33%

C. -25%

D. -33.33%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please help me with show all calculation thankuarrow_forwardM7Q1 Redoarrow_forwardThe following data are available for XYZ Corporation for years 2014 and 2013. XYZ Corporation Statement of Financial Position As of December 31 Change Peso % 2013 2014 Assets Cash and equivalents Receivables Inventories Prepayments and others Total Current Assets 14,000 28,800 54,000 4,800 101,600 16,000 55,600 85,600 _7,400 164,600 2,000 26,800 ? 93.06% ? 2,600 54.17% 62.01% Property, Plant & Equipment - net of depreciation Total Assets 43,200 73,400 238,000 143.05% 30,200 131.800 Liabilities and Equity Notes payable to banks Accounts payable Accrued liabilities Income taxes payable Total current liabilities Share capital Retained earnings Total equity Total liabilities and equity 10,000 31,600 4,200 _ 5,800 51,600 44,600 35.600 80,200 131,800 54,000 55,400 6,800 7,000 123,200 44,600 70,200 44,000 23,800 2,600 .? ? 440.00% 61.90% 0.00% 34,600 34,600 43,14% 114,800 238.000 XYZ Corporation Income Statement Years ended December 31 (P thousands) Change Peso 2013 2014 266,400 191,400…arrow_forward

- Assume Metro Company had a net income of $2,100 for the year ending December 2018. Its beginning and ending total assets were $30,000 and $18,000, respectively. Calculate Metro's return on assets (ROA). (Round your percentage answer to two decimal places.) A. 7% B. 11.67% C. 4.38% D. 8.75%arrow_forwardThe comparative balance sheets of SandhillClothiers are as follows: Cash Accounts receivable Inventory Total assets Cash December 31, 2014 $58,800 31,360 45,080 Inventory Total assets Perform horizontal analysis for SandhillClothiers. (If amount and percentage are a decrease show the numbers as negative, e.g. -55,000, -20% or (55,000), (20%). Round percentages to 1 decimal place, eg. 12.1%) 2014 Accounts receivable 31,360 $58,800 588,000 45,080 2013 $41,160 19,600 37,240 December 31, 2013 $41,160 19,600 588,000 568,400 37,240 568,400 Amount Increase (Decrease) Percentage % % % %arrow_forwardPlease givearrow_forward

- The following information is taken Aiello Corporation's fiscal 2016 annual report. Selected Balance Sheet Data 2016 2015 Inventories........................ $221,418 $226,893 Accounts Receivable........... $121,333 $122,087 Assume that Aiello Corporation had $1,003,881 sales on credit during fiscal year 2016. What amount did the company collect from credit customers during the year? a. $1,003,881 b. $1,004,635 c. $1,003,127 d. $1,247,301arrow_forwardWhat is the quick ratio for 2017? A. 2.11 times B. .74 times C. 1.97 times D. 1.34 times E. .77 timesarrow_forwardFor 2018, GLCE's ROA is Select one: a. 12.96% b. 5.99% c. 5.55% O d. 9.62% e. 13.25%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education