Concept explainers

Jorgansen Lighting, Inc., manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports to shareholders, creditors, and the government. The company has provided the following data:

The company’s fixed manufacturing

Required:

1. Calculate each year’s absorption costing net operating income. Present your answer in the form of a reconciliation report.

2. Assume in Year 4 that the company’s variable costing net operating income was $984,400 and its absorption costing net operating income was $1,012,400.

a. Did inventories increase or decrease during Year 4?

b. How much fixed

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

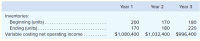

- Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 61,000 to 101,000 units is given below: Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 91,000 units during the year at a selling price of $9.94 per unit. Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. (Round the per unit variable cost and fixed cost to 2 decimal places.) Total cost: Variable cost Fixed cost Total cost Cost per unit: Variable cost Fixed cost Total cost per unit $ $ $ 61,000 Units Produced and Sold 81,000 244,000 400,000 644,000 $ 0.00 $ 0 $ 0.00 $ 101,000 0 0.00arrow_forwardHarris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 60,000 to 100,000 units is given below: Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 90,000 units during the year at a selling price of $7.70 per unit. Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. (Round the per unit variable cost and fixed cost to 2 decimal places.) Total cost: Variable cost Fixed cost Total cost Cost per unit: Variable cost Fixed cost Total cost per unit $ $ $ 60,000 Units Produced and Sold 80,000 162,000 320,000 482,000 $ 0.00 $ 0 $ 0.00 $arrow_forwardJorgansen Lighting, Incorporated, manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports. The company provided the following data: Year 1 Year 2 Year 3 Inventories Beginning (units) 210 160 190 Ending (units) 160 190 230 Variable costing net operating income $ 300,000 $ 269,000 $ 260,000 The company’s fixed manufacturing overhead per unit was constant at $560 for all three years. Required: 1. Calculate each year’s absorption costing net operating income. Note: Enter any losses or deductions as a negative value.arrow_forward

- Rent on a manufacturing plant donated by the city, where the agreement calls for a fixed-fee payment unless 200,000 labor-hours are worked, in which case no rent is paid.arrow_forwardHarris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 68,000 to 108,000 units is given below: Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 98,000 units during the year at a selling price of $8.42 per unit. Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. Note: Round the per unit variable cost and fixed cost to 2 decimal places. Total cost: Variable cost Fixed cost Total cost Cost per unit: Variable cost Fixed cost Total cost per unit $ $ $ 68,000 Units Produced and Sold 88,000 210,800 380,000 590,800 $ 3.10 5.59 8.69 $ 272,800 380,000 652,800 $ 3.10 4.32 7.42…arrow_forwardFeed 'N Grow Co. manufactures fertilizer for farmers in the prairies. It specialises in fertilizer that helps crops grow during dry seasons. The income statement presented below shows the operating results for the fiscal year just ended. Feed 'N Grow had sales of 1,800 tonnes of product during that year. The maximum output under the existing manufacturing facilities at Feed 'N Grow is 4,800 tonnes. Feed 'N Grow Co. Revenues Variable Costs: Income Statement For the year ended June 30, Year 6 Direct materials Direct labour Sales commissions Maintenance expenses Administration expenses Total variable costs Fixed costs: Amortization - Factory equipment Marketing expenses Administrators' salaries Other Total fixed costs Operating income before income taxes Income taxes Net Income 225,000 75,000 55,000 44,000 33,000 125,000 90,000 60,000 25,350 $1,080,000 432,000 300,350 347,650 69,530 $ 278,120 Required: a) If the sales volume is estimated to increase by 600 tonnes for next year, and if the…arrow_forward

- Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 63,000 to 103,000 units is given below: Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 93,000 units during the year at a selling price of $9.14 per unit. Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. (Round the per unit variable cost and fixed cost to 2 decimal places.) Total costs: Variable costs Fixed costs Total costs Cost per unit: Variable cost Fixed cost Total cost per unit 63,000 Units Produced and Sold $ $ $ 83,000 Units Produced and Sold 163,800 460,000 623,800 $ 0.00 $ 103,000 Units Produced and…arrow_forwardMcNulty, Inc., produces desks and chairs. A new CFO has just been hired and announces a new policy that if a product cannot earn a margin of at least 35 percent, it will be dropped. The margin is computed as product gross profit divided by reported product cost. Manufacturing overhead for year 1 totaled $1,071,000. Overhead is allocated to products based on direct labor cost. Data for year 1 show the following. Chairs Desks Sales revenue $1,580,800 $2,786,000 Direct materials 595,000 910,000 Direct labor 230,000 400,000 Required: a-1. Based on the CFO's new policy, calculate the profit margin for both chairs and desks. a-2. Which of the two products should be dropped? b. Regardless of your answer in requirement (a), the CFO decides at the beginning of year 2 to drop the chair product. The company cost analyst estimates that overhead without the chair line will be $760,000. The revenue and costs for desks are expected to be the same as last year. What is the…arrow_forwardJorgansen Lighting, Incorporated, manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports. The company provided the following data: Year 1 Year 2 Year 3 Inventories Beginning (units) 210 160 190 Ending (units) 160 190 230 Variable costing net operating income $ 300,000 $ 269,000 $ 260,000 The company’s fixed manufacturing overhead per unit was constant at $560 for all three years. 2. Assume in Year 4 the company’s variable costing net operating income was $250,000 and its absorption costing net operating income was $310,000. Did inventories increase or decrease during Year 4? How much fixed manufacturing overhead cost was deferred or released from inventory during Year 4?arrow_forward

- Johnson Company estimates that its production workers will work 88,400 direct labor hours to produce 9,170 units during the upcoming period and that overhead costs will amount to $1,091,230. During the year, its manufacturing employees actually worked 100,000 direct labor hours to produce 10,000 units and incurred $1,100,000 of overhead costs. Because the goods made by Johnson are homogeneous (that is, they are identical), the company has decided it makes sense to use number of units as the allocation base for overhead. Based on this information the predetermined overhead rate is: Multiple Choice $11.00 per direct labor hour. $129.00 per unit. $119.00 per unit.arrow_forwardHarris Company manufactures and sells a single product. A partially completed schedule of the company’s total costs and costs per unit over the relevant range of 68,000 to 108,000 units is given below: Required: 1. Complete the schedule of the company’s total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 98,000 units during the year at a selling price of $9.34 per unit. Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Complete the schedule of the company’s total costs and costs per unit as given in the relevant tab below. (Round the per unit variable cost and fixed cost to 2 decimal places.) 68,000 Units Produced and Sold 88,000 Units Produced and Sold 108,000 Units Produced and Sold Total cost: Variable cost $204,000 Fixed cost 470,000 Total cost $674,000…arrow_forwardThe following costs result from the production and sale of 1,000 drum sets manufactured by Tight Drums Company for the year ended December 31. The drum sets sell for $500 each. Variable costs Plastic for casing Wages of assembly workers Drum stands Sales commissions Fixed costs Taxes on factory Factory maintenance Factory machinery depreciation Lease of equipment for sales staff Accounting staff salaries Administrative salaries Required 1 Required 2 Required: 1. Prepare a contribution margin income statement for the year. 2. Compute contribution margin per unit and contribution margin ratio. 3. For each dollar of sales, how much is left to cover fixed costs and contribute to income? Sales Variable costs: Complete this question by entering your answers in the tabs below. Contribution margin Fixed costs $ 17,000 82,000 Required 3 Income 26,000 15,000 Prepare a contribution margin income statement for the year. TIGHT DRUMS COMPANY Contribution Margin Income Statement For Year Ended…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education