FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

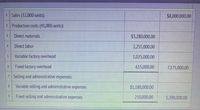

Gallatin county motors inc. assembled and sells snowmobile engines. The company began operations on July 1 and operated at 100% of capacity during the first month. The following data summarize the results for july:

Transcribed Image Text:1 Sales (32,000 units)

$8,000,000.00

2 Production costs (41,000 units):

Direct materials

$3,280,000.00

3

4

Direct labor

2,255,000.00

Variable factory overhead

1,025,000.00

6.

Fixed factory overhead

615,000.00

7,175,000.00

7 Selling and administrative expenses:

Variable selling and administrative expenses

$1,180,000.00

Fixed selling and administrative expenses

210,000.00

1,390,000.00

Transcribed Image Text:Required:

a. Prepare an income statement according to the absorption costing concept.*

b. Prepare an income statement according to the variable costing concept.*

C. What is the reason for the difference in the amount of Operating income reported in (a) and (b)?

* Be sure to complete the statement heading. Refer to the list of Labels and Amount Descriptions provided for the exact wording of the answer

choices for text entries. A colon () will automatically appear if it is required. Enter amounts as positive numbers unless the amount is a

calculation that results in a negative amount. For example: Net loss should be negative. Expenses should be positive.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Joe’s Beverage Co produces bottled water and has provided the following information for the month of April: Units Sold during April: 82,200 Finished Goods Inventory, April 1: 75,000 Salary of CFO: 175,000 Finished Goods Inventory, April 30: 70,000 Commissions: 200,000 Advertising: 750,000 Research and development: 120,000 Cost of Goods Manufactured: 1,640,000 Depreciation on corporate office: 60,000 Unit price per sold item 45 Prepare a multi-step income statement for the month of Aprilarrow_forwardIn its first month of business, Soles for Souls, Inc., started and completed 5,000 shoes and sold 4,000 shoes during the month. Its cost for the month included: Advertising Costs $100 Direct materials per shoe $3.00 Direct labor per shoe $1.00 Allocated Manufacturing Overhead $1,000 Sales Manager's Salary $4,000 Calculate Soles for Soul's cost of goods manufactured for the montharrow_forwardMcNeil, inc manufactures and sells guitars. During June, McNeil started and completed the production of 300 guitars. McNeil engaged in the following transaction in june: A) Paid $68,000 for materials that were used to make guitars in June. B) Paid $94,000 wages to production workers C) Recorded $34,000 of depreciation on factory equipment D) Sold 260 guitars on account in June for $900 each. Mcneil recorded the cost of goods sold at the time of sale. Required: record the above transactions using the horizontal financial statements model. Be sure to identify the specific accounts affected by the transaction.arrow_forward

- Campbell Manufacturing Company produced 1,400 units of inventory in January Year 2. It expects to produce an additional 9,000 units during the remaining 11 months of the year. In other words, total production for Year 2 is estimated to be 10,400 units. Direct materials and direct labor costs are $74 and $71 per unit, respectively. Campbell expects to incur the following manufacturing overhead costs during the Year 2 accounting period. Production supplies Supervisor salary Depreciation on equipment Utilities Rental fee on manufacturing facilities Required a. Combine the individual overhead costs into a cost pool and calculate a predetermined overhead rate assuming the cost driver is number of units. b. Determine the cost of the 1,400 units of product made in January. Complete this question by entering your answers in the tabs below. Required A Required B $6,500 186,000 126,000 17,000 223,500 Determine the cost of the 1,400 units of product made in January. Allocated Cost Indirect…arrow_forwardWithout calculations, determine the contribution margin at the break-even point. Break-even point $arrow_forwardYou are reviewing all customer complaints received in any one of your stores in a 12 month period. You want to know if there is a certain time of the working week in which you receive more complaints. please RANK the weekdays from the HIGHEST complaints reported to the LOWEST complaints reported for the last 8 months of the year.arrow_forward

- The Department of Roads for a large Canadian city has several depots throughout the city where they store rock- salt. The rock-salt is used during the winter. The fiscal year starts on April 1 and ends on the following March 31. At April 1 2021, they had an inventory of 2,000 tons of rock-salt worth $800,000. The following are transactions occurred during the fiscal year:< Summer and Fall 2021: Purchased 68,000 tons at an average price of $300/ton< Months of December 2021 and January 2022: used 62,000 tons February 1 2022: purchased 40,000 tons at $505/ton Month of February 2022: used 20,000 tons March 12 2022: helped a neighbouring city that had run out of salt by giving them 20,000 tons in exchange for equipment worth $12.2 million Required: 1. Calculate the value of the rock salt in the remaining inventory at March 31 2022 based on: FIFO • Weighted average - Periodic 2. Which method of inventory valuation do you recommend they use? Explain your response.<arrow_forwardThe following information is available about electricity costs for the first six months of the year. Management think that electricity costs are likely to be related to how long machines are running. Month Machinehours ElectricityCost January 2,800 $2,925 February 5,600 $5,526 March 6,200 $5,980 April 3,500 $3,620 May 2,300 $2,470 June 4,500 $4,450 You may wish to refer to the formula sheet to answer this question. If you haven't already downloaded it, you can download it here. Required: Using the high-low method, (a) calculate the fixed costs b. state the cost formula for estimating the electricity cost based on the machine hoursarrow_forwardGarfield Company manufactures a popular brand of dog repellant known as DogGone It, which it sells in gallon-size bottles with a spray attachment. The majority of Garfield's business comes from orders placed by homeowners who are trying to keep neighborhood dogs out of their yards. Garfield's operating information for the first six months of the year follows: Operating Cost Month January February March April Number of Bottles Sold 1,080 $ 10,570 1,330 15,670 1,850 16,050 2,480 19,680 3,490 27,350 3,610 34,750 May June Required: 3. Using the high-low method, calculate Garfield's total fixed operating costs and variable operating cost per bottle. 4. Perform a least-squares regression analysis on Garfield's data. 5. Determine how well this regression analysis explains the data. 6. Using the regression output, create a linear cost equation (ya+ bx) for estimating Garfield's operating costs. Complete this question by entering your answers in the tabs below. Required 3 Required 4 Required 5…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education