FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

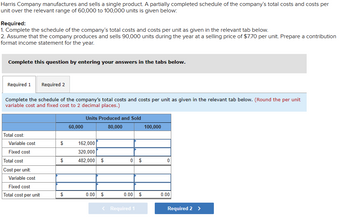

Transcribed Image Text:Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per

unit over the relevant range of 60,000 to 100,000 units is given below:

Required:

1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below.

2. Assume that the company produces and sells 90,000 units during the year at a selling price of $7.70 per unit. Prepare a contribution

format income statement for the year.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. (Round the per unit

variable cost and fixed cost to 2 decimal places.)

Total cost:

Variable cost

Fixed cost

Total cost

Cost per unit:

Variable cost

Fixed cost

Total cost per unit

$

$

$

60,000

Units Produced and Sold

80,000

162,000

320,000

482,000 $

0.00 $

0 $

0.00 $

< Required 1

100,000

0

0.00

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ! Required information [The following information applies to the questions displayed below.] O'Brien Company manufactures and sells one product. The following information pertains to each of the company's first three years of operations: Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses a. Compute the unit product cost for Year 1, Year 2, and Year 3. b. Prepare an income statement for Year 1, Year 2, and Year 3. During its first year of operations, O'Brien produced 98,000 units and sold 74,000 units. During its second year of operations, it produced 80,000 units and sold 99,000 units. In its third year, O'Brien produced 90,000 units and sold 85,000 units. The selling price of the company's product is $78 per unit. Req 4A 4. Assume the company uses absorption costing and a LIFO inventory flow assumption (LIFO…arrow_forwardHarris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 55,000 to 95,000 units is given below: Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 85,000 units during the year at a selling price of $8.67 per unit. Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. (Round the per unit variable cost and fixed cost to 2 decimal places.) Total cost: Variable cost Fixed cost Total cost Cost per unit: Variable cost Fixed cost Total cost per unit $ $ 55,000 Units Produced and Sold 75,000 187,000 320,000 507,000 95,000arrow_forwardam.103.arrow_forward

- Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales $ 85,000 Variable expenses 59,500 Contribution margin 25,500 Fixed expenses 20,400 Net operating income $ 5,100 14. Assume that the amounts of the company’s total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $20,400 and the total fixed expenses are $59,500. Under this scenario and assuming that total sales remain the same, what is the degree of operating leverage? (Round your answer to 2 decimal places.)arrow_forwardHarris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 53,000 to 93,000 units is given below: Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 83,000 units during the year at a selling price of $9.29 per unit. Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 1 Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. (Round the per unit variable cost and fixed cost to 2 decimal places.) Total cost Variable cost Fixed cost Total cost Cost por unit: Required 2 Variable cost Fixed cost Total cost per unit 53,000 Units Produced and Sold $ S $ Required 1 Required 2 73,000 Units Produced and Sold 185,500 350,000…arrow_forwardOslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales $ 15,000 Variable expenses 9,000 Contribution margin 6,000 Fixed expenses 3,120 Net operating income $ 2,880 14. Assume that the amounts of the company’s total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $3,120 and the total fixed expenses are $9,000. Under this scenario and assuming that total sales remain the same, what is the degree of operating leverage? (Round your answer to 2 decimal places.)arrow_forward

- Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales $ 50,000 Variable expenses 27,500 Contribution margin 22,500 Fixed expenses 14,850 Net operating income $ 7,650 Required: 1. What is the contribution margin per unit? (Round your answer to 2 decimal places.)arrow_forwardDirections Below is information for Blue Company. Using this information, answer the following questions on the "Calculation" tab in the file. Show your work (how you got your answer) and format appropriately. Blue company has prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 to 1,500 units): Sales $ 20,000 Variable expenses 12,000 Contribution margin 8,000 NOTE: Use the amounts in the original fact pattern to the left as your basis for the questions below. Fixed expenses 6,000 Net operating income $ 2,000 Questions:…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education