FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

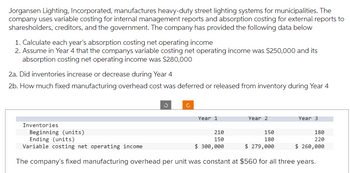

Transcribed Image Text:Jorgansen Lighting, Incorporated, manufactures heavy-duty street lighting systems for municipalities. The

company uses variable costing for internal management reports and absorption costing for external reports to

sharesholders, creditors, and the government. The company has provided the following data below

1. Calculate each year's absorption costing net operating income

2. Assume in Year 4 that the companys variable costing net operating income was $250,000 and its

absorption costing net operating income was $280,000

2a. Did inventories increase or decrease during Year 4

2b. How much fixed manufacturing overhead cost was deferred or released from inventory during Year 4

Inventories

Year 1

Year 2

Year 3

150

Beginning (units)

Ending (units)

210

150

180

Variable costing net operating income

$ 300,000

$ 279,000

The company's fixed manufacturing overhead per unit was constant at $560 for all three years.

180

220

$ 260,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information applies to the questions displayed below.] Jorgansen Lighting, Incorporated, manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports. The company provided the following data: Year 1 Year 2 Year 3 Inventories Beginning (units) 210 150 190 Ending (units) 150 190 230 Variable costing net operating income $ 290,000 $ 269,000 $ 260,000 The company's fixed manufacturing overhead per unit was constant at $550 for all three years. 2. Assume in Year 4 the company's variable costing net operating income was $250,000 and its absorption costing net operating income was $300,000. Did inventories increase or decrease during Year 4? How much fixed manufacturing overhead cost was deferred or released from inventory during Year 4 ?arrow_forwardMarks Corporation has two operating departments, Drilling and Grinding, and an office. The three categories of office exApenses are alocated to the tavo opertng cene different allocatlon bases. The following Information is avallable for the current period: Office Expenses Salaries Total Allocation Basis Number of employees 44,000 Depreciation Advertising 21,000 Cost of goods Bold 44,000 Percentage of total sales Department Drilling Grinding Number of employees Sales Cost of goods sold 900 $ 350,000 $ 91,200 2,100 525,000 148,800 Total 3,000 $ 875,000 $ 240,000 The amount of depreciation that should be allocated to Drilling for the current period is: Multiple Choice $7,980. $13,020. $21,000. 8 of 25arrow_forwardMiddleton Associates is a consulting firm that specializes in information systems for construction and landscaping companies. The firm has two offices-one in Toronto and one in Vancouver. The firm classifies the direct costs of consulting jobs as variable costs. A segmented contribution format income statement for the company's most recent year is given below: Office Sales Variable expenses Contribution margin Traceable fixed expenses Office segment margin Common fixed expenses not traceable to offices Operating income Increase in operating income $ Total Company $900,000 100.0% 414,000 46.00 486,000 54.00 187,200 20.80 298,800 33.20 Required: 1. By how much would the company's operating income increase if Vancouver increased its sales by $87,000 per year? Assume no change in cost behaviour patterns. 43,500 117,000 13.00 $181,800 20.20% Toronto Vancouver $120,000 100% $780,000 100% 390,000 50 24,000 20 96,000 80 390,000 50 140,400 18 46,800 39 $ 49,200 41% $249,600 32% 2-a. Refer to…arrow_forward

- Solve this attachment.arrow_forwardSteuben Company produces dog houses. During the current year, Steuben Company incurred the following costs: Rent on manufacturing facility $ 250,000 Office manager's salary 150,000 Wages of factory machine operators 110,000 Depreciation on manufacturing equipment 50,000 Insurance and taxes on selling and administrative offices 30,000 Direct materials purchased and used 170,000 Based on the above information, the amount of period costs shown on Steuben's income statement is: Multiple Choice $150,000. $180,000. $430,000. S 30,000.arrow_forwardAJ Manufacturing Company Incurred $55,500 of fixed product cost and $44,400 of variable product cost during its first year of operation. Also during its first year, AJ incurred $17.650 of fixed and $14.100 of variable selling and administrative costs. The company sold all of the units it produced for $182.000. Required a. Prepare an income statement using the format required by generally accepted accounting Principles (GAAP) b. Prepare an income statement using the contribution margin approach. Complete this question by entering your answers in the tabs below. Required A Required B Prepare an income statement using the format required by generally accepted accounting Principles (GAAP). AJ MANUFACTURING COMPANY Income Statementarrow_forward

- Vikrambhaiarrow_forwardPlease help me with part a and b thankuarrow_forwardJorgansen Lighting. Incorporated, manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for Internal management reports and absorption costing for external reports. The company provided the following data: Inventories: Beginning (units) Ending (units) Variable costing net operating income Year 1 Year 2 Year 3 200 178 180 170 180 220 $ 1,080,400 $ 1,032,400 $ 996,400 The company's fixed manufacturing overhead per unit was constant at $560 for all three years. Exercise 7-3 (Static) Part 1 Required: 1. Calculate each year's absorption costing net operating Income. Note: Enter any losses or deductions as a negative value. Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Variable costing net operating income Add (deduct) fixed manufacturing overhead deferred in (released from) inventory under absorption costing Absorption costing net operating income Year 1 Year 2 Year 3arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education