FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

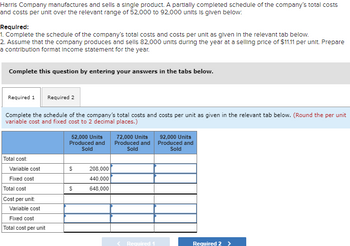

Transcribed Image Text:Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs

and costs per unit over the relevant range of 52,000 to 92,000 units is given below:

Required:

1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below.

2. Assume that the company produces and sells 82,000 units during the year at a selling price of $11.11 per unit. Prepare

a contribution format Income statement for the year.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. (Round the per unit

variable cost and fixed cost to 2 decimal places.)

Total cost:

Variable cost

Fixed cost

Total cost

Cost per unit:

Variable cost

Fixed cost

Total cost per unit

52,000 Units

Produced and

Sold

$

$

208,000

440,000

648,000

72,000 Units

Produced and

Sold

< Required 1

92,000 Units

Produced and

Sold

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 65,000 to 105,000 units is given below: Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 95,000 units during the year at a selling price of $9.36 per unit. Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. (Round the per unit variable cost and fixed cost to 2 decimal places.) Total cost Variable cost Fixed cost Total cost Cost per unit: Variable cost Fixed cost Total cost per unit $ $ $ 65,000 Units Produced and Sold 85,000 214,500 430,000 644,500 $ 0.00 $ 43,000 43,000 $ 0.00 $ 105,000 43,000 43,000 0.00arrow_forwardCullumber Company has the following information available for September 2020. Unit selling price of video game consoles $490 Unit variable costs $294 Total fixed costs $92,120 Units sold 600 Compute the unit contribution margin. Unit contribution margin enter the unit contribution margin Prepare a CVP income statement that shows both total and per unit amounts. CULLUMBER COMPANYCVP Income StatementFor the Month Ended September 30, 2020 Total Per Unit select an income statement item Administrative ExpensesContribution MarginCost of Goods SoldFixed CostsGross ProfitNet Income/(Loss)SalesSelling ExpensesVariable Costs $enter a dollar amount $enter a dollar amount select an income statement item Administrative ExpensesContribution MarginCost of Goods…arrow_forwardAssume that a company provided the following cost formulas for three of its expenses (where q refers to the number of hours worked): Rent (fixed) $ 3,000 Supplies (variable) $ 4.00q Utilities (mixed) $150 + $0.75q The company’s planned level of activity was 2,000 hours and its actual level of activity was 1,900 hours. If these are the company’s only three expenses and the company uses revenue formula of $8.40q for budgeting purposes, what net operating income would appear in the company’s flexible budget?arrow_forward

- A company reports the following contribution margin income statement. Contribution Margin Income Statement For Year Ended December 31 Sales (19,200 units at $22.50 each) Variable costs (19,200 units at $18.00 each) Contribution margin. Fixed costs Income The manager believes the company can increase sales volume to 22,000 total units by increasing advertising costs by $16,200. Required A Required B Complete this question by entering your answers in the tabs below. Contribution Margin Income Statement For Year Ended December 31 $ 432,000 345,600 Prepare a contribution margin income statement assuming the company incurs the additional advertising costs and sales volume increases to 22,000 units. Sales Variable costs Contribution margin 86,400 64,800 $ 21,600 Fixed costs Incomearrow_forwardRequired information [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales (11,600 units at $225 each) Variable costs (11,600 units at $180 each) Contribution margin Fixed costs Income $ 2,610,000 2,088,000 522,000 315,000 $ 207,000 1. Assume Hudson has a target income of $150,000. What amount of sales (in dollars) is needed to produce this target income? 2. If Hudson achieves its target income, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.)arrow_forwardThe GAAP income statement for Carla Vista Company for the year ended December 31, 2022,s shows sale $930,000, cost of good sold $555,000, and operating expenses $235,000. Assuming all costs and expenses are 70% variable and 30% fixed, prepare a CVP income statement through contribution margin.arrow_forward

- Can somebody check my work on the variable costing income statement in the screenshot attached? Summarized data for 2019 (the first year of operations) for Gorman Products, In. are as follows Sales (70,000 units) $2,800,000 Production costs (80,000 units): Direct materials 880,000 Direct labor 720,000 Manufacturing overhead: Variable 544,000 Fixed 320,000 Operating expenses: Variable 175,000 Fixed 240,000 Depreciation on equipment 60,000 Real estate taxes 18,000 Personal property taxes (inventory and equipment 28,000 Personnel department expenses 30,000 Problem b) Prepare an income statement based on variable costingarrow_forwardI need help with question is answerarrow_forwardReview the contribution margin income statements for Cover-to-Cover Company and Biblio Files Company on their respective Income Statements. Complete the following table from the data provided on the income statements. Each company sold 82,800 units during the year. Cover-to-Cover Company Biblio Files Company Contribution margin ratio (percent) Unit contribution margin Break-even sales (units) Break-even sales (dollars) $ %arrow_forward

- A manufacturer's contribution margin income statement for the year follows. Prepare a contribution margin income statement if the number of units sold (a) increases by 300 units and (b) decreases by 300 units. Sales ($12 per unit x 10,300 units) $123,600 Variable costs 72,100 Contribution margin 51,500 Fixed costs Income 41,000 $ 10,500 Sales Variable costs Contribution Margin Income Statement For Year Ended December 31 Contribution margin Fixed costs Income 10,600 units sold 10,000 units sold $ 127,200 $ 120,000 $ 41,000 41,000 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted.arrow_forwardDirections Below is information for Blue Company. Using this information, answer the following questions on the "Calculation" tab in the file. Show your work (how you got your answer) and format appropriately. Blue company has prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 to 1,500 units): Sales $ 20,000 Variable expenses 12,000 Contribution margin 8,000 NOTE: Use the amounts in the original fact pattern to the left as your basis for the questions below. Fixed expenses 6,000 Net operating income $ 2,000 Questions:…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education