FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

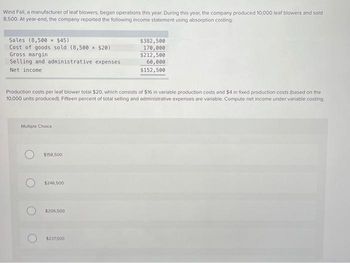

Transcribed Image Text:Wind Fall, a manufacturer of leaf blowers, began operations this year. During this year, the company produced 10,000 leaf blowers and sold

8,500. At year-end, the company reported the following income statement using absorption costing:

Sales (8,500 × $45)

Cost of goods sold (8,500 × $20)

Gross margin

Selling and administrative expenses

Net income

Production costs per leaf blower total $20, which consists of $16 in variable production costs and $4 in fixed production costs (based on the

10,000 units produced). Fifteen percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Multiple Choice

$158,500

$246,500

$206,500

$382,500

170,000

$212,500

60,000

$152,500

$237.500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Unions dues, vacation account, 401k, insurance, subtracted from gross pay Options are: personal exemptions, tax deductions, adjusted gross income, social security tax, taxable wages, fit, net pay, personal deductions, Medicare tax, dependent, graduated income tax, and withholding allowances. Which one is it?arrow_forwardA condensed income statement by product line for Crown Beverage Inc. indicated the following for King Cola for the past year: Sales $236,100 Cost of goods sold 112,000 Gross profit $124,100 Operating expenses 142,000 Loss from operations $(17,900) It is estimated that 13% of the cost of goods sold represents fixed factory overhead costs and that 21% of the operating expenses are fixed. Since King Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. Question Content Area a. Prepare a differential analysis, dated March 3, to determine whether King Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter zero "0". Use a minus sign to indicate a loss. Differential AnalysisContinue King Cola (Alt. 1) or Discontinue King Cola (Alt. 2)January 21 Continue KingCola (Alternative 1) Discontinue KingCola (Alternative 2) Differential Effecton Income(Alternative 2)…arrow_forwardA condensed income statement by product line for British Beverage Inc. indicated the following for King Cola for the past year: Sales $235,100 Cost of goods sold 112,000 Gross profit $123,100 Operating expenses 145,000 Loss from operations $(21,900) It is estimated that 16% of the cost of goods sold represents fixed factory overhead costs and that 19% of the operating expenses are fixed. Since King Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. a. Prepare a differential analysis, dated March 3, to determine whether to Continue King Cola (Alternative 1) or Discontinue King Cola (Alternative 2). If an amount is zero, enter zero "0". For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential AnalysisContinue King Cola (Alt. 1) or Discontinue King Cola (Alt. 2)March 3 Continue KingCola (Alternative 1) Discontinue KingCola (Alternative 2) Differential…arrow_forward

- Bent Tree incurred the following unit costs during the year: variable manufacturing cost, $27; fixed manufacturing cost, $10; variable marketing and administrative cost, $8; and fixed marketing and administrative cost, $6. During the year, Bent Tree produced 30,000 units and sold 25,000 units of product. The selling price was $67 per unit. What was Bent Tree's total gross margin? Multiple Choice None of these. $1,000,000 $400,000 $750,000 $800,000arrow_forwardLattimer Company had the following results of operations for the past year: Contribution margin income statement Sales (18,000 units) Variable costs Direct materials Direct labor Overhead Contribution margin Fixed costs Fixed overhead Fixed selling and administrative expenses Income Multiple Choice O $6,000 profit. Per Unit $ 12.00 $4,000 loss. 1.50 4.00 1.00 5.50 1.00 1.40 $ 3.10 A foreign company offers to buy 6,000 units at $7.50 per unit. In addition to variable costs, selling these units would add a $0.25 selling expense for export fees. Lattimer's annual production capacity is 28,000 units. If Lattimer accepts this additional business, the special order will yield a: Annual Total $ 216,000 27,000 72,000 18,000 99,000 18,000 25, 200 $ 55,800arrow_forwardA condensed income statement by product line for British Beverage Inc. indicated the following for Royal Cola for the past year: Sales $236,800 Cost of goods sold 109,000 Gross profit $127,800 Operating expenses 145,000 Loss from operations $(17,200) It is estimated that 14% of the cost of goods sold represents fixed factory overhead costs and that 19% of the operating expenses are fixed. Since Royal Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. a. Prepare a differential analysis, dated March 3, to determine whether Royal Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter zero "0". Use a minus sign to indicate a loss. Differential Analysis Continue Royal Cola (Alt. 1) or Discontinue Royal Cola (Alt. 2) January 21 Continue RoyalCola (Alternative 1) Discontinue RoyalCola (Alternative 2) Differential Effecton Income(Alternative 2)…arrow_forward

- Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 5,800 rackets and sold 4,700. Each racket was sold at a price of $88. Fixed overhead costs are $74,240 for the year, and fixed selling and administrative costs are $65,000 for the year. The company also reports the following per unit variable costs for the year. Direct materials Direct labor Variable overhead Variable selling and administrative expenses Required: Prepare an income statement under variable costing. $ 11.94 7.94 4.92 1.80arrow_forwardVariable and Absorption CostingChandler Company sells its product for $108 per unit. Variable manufacturing costs per unit are $49, and fixed manufacturing costs at the normal operating level of 12,000 units are $240,000. Variable selling expenses are $17 per unit sold. Fixed administrative expenses total $104,000. Chandler had no beginning inventory for the year. During the year, the company produced 12,000 units and sold 9,000. Would net income for Chandler Company be higher if calculated using variable costing or using absorption costing?Calculate reported income using each method.Do not use negative signs with any answers.arrow_forwardReview the contribution margin income statements for Cover-to-Cover Company and Biblio Files Company on their respective Income Statements. Complete the following table from the data provided on the income statements. Each company sold 82,800 units during the year. Cover-to-Cover Company Biblio Files Company Contribution margin ratio (percent) Unit contribution margin Break-even sales (units) Break-even sales (dollars) $ %arrow_forward

- Ida Company produces a handcrafted musical instrument called a gamelan that is similar to a xylophone. The gamelans are sold for $840. Selected data for the company's operations last year follow: Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs: Fixed manufacturing overhead Fixed selling and administrative The absorption costing income statement prepa Sales Cost of goods sold Gross margin Selling and administrative expense Net operating income 0 300 275 25 $ 100 $310 $ 30 $ 35 $ 66,000 $ 31,000 by the company's accountant for last year appears below: $ 231,000 181,500 49,500 40,625 $ 8,875 Required: 1. Under absorption costing, how much fixed manufacturing overhead cost is included in the company's inventory at the end of last year? 2. Prepare an income statement for last year using variable costing.arrow_forwardDowell Company produces a single product. Its income statements under absorption costing for its first two years of operation follow. Income Statements (Absorption Costing) Sales ($52 per unit) Cost of goods sold ($36 per unit) Year 2 Year 1 $ 1,508,000 1,044,000 $ 2,756,000 1,908,000 Gross profit Selling and administrative expenses Income Additional Information a. Sales and production data for these first two years follow. Units Units produced Units sold Year 1 41,000 29,000 Year 2 41,000 53,000 464,000 366,000 848,000 462,000 $ 98,000 $ 386,000 b. Variable costs per unit and fixed costs per year are unchanged during these years. The company's $36 per unit product cost using absorption costing consists of the following. Direct materials Direct labor Variable overhead Fixed overhead ($451,000/41,000 units) Total product cost per unit $ 11 11 3 11 $ 36 c. Selling and administrative expenses consist of the following. Selling and Administrative Expenses Variable selling and administrative…arrow_forwardThe following information for the past year for the Blaine Corporation has been provided: Fixed costs: Manufacturing $130,000 Marketing 18,000 Administrative 21,000 Variable costs: Manufacturing $113,000 Marketing 35,000 Administrative 38,000 During the year, the company produced and sold 60,000units of product at a selling price of $19.19 per unit. There was no beginning inventory of product at the beginning of the year. What is the contribution margin for the year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education