Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

answer

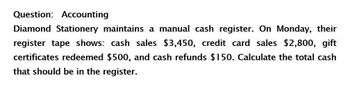

Transcribed Image Text:Question: Accounting

Diamond Stationery maintains a manual cash register. On Monday, their

register tape shows: cash sales $3,450, credit card sales $2,800, gift

certificates redeemed $500, and cash refunds $150. Calculate the total cash

that should be in the register.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Catherines Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger?arrow_forwardHappy Tails Inc. has a September 1, 20Y4, accounts payable balance of 620, which consists of 320 due Labradore Inc. and 300 due Meow Mart Inc. Transactions related to purchases and cash payments completed by Happy Tails Inc. during the month of September 20Y4 are as follows: a. Prepare a purchases journal and a cash payments journal to record these transactions. The forms of the journals are similar to those used in the text. Place a check mark () in the Post. Ref. column to indicate when the accounts payable subsidiary ledger should be posted. Happy Tails Inc. uses the following accounts: b. Prepare a listing of accounts payable creditor balances on September 30, 20Y4. Verify that the total of the accounts payable creditor balances equals the balance of the accounts payable controlling account on September 30, 20Y4. c. Why does Happy Tails Inc. use a subsidiary ledger for accounts payable?arrow_forwardDescribe the who, what, where, and how of the following scenario: A customer gives his purchase to a sales clerk, who enters the sale in a cash register and puts the money in the register drawer. At the end of the day, the sales clerk gives the cash and the register tape to the cashier.arrow_forward

- Enter the following transactions in a cash payments journal like the one illustrated in the chapter: Aug. 2 Issued Check No. 193 in payment of August rent (Rent Expense), 2,200. 6 Issued Check No. 194 to Mason Hardware in payment of merchandise purchased on account, 1,700, less 2% discount. The check was written for 1,666. 10 Issued Check No. 195 to Augies Wholesale for cash purchase of merchandise, 2,730.arrow_forwardTotal cash? That should be in the register.arrow_forward?? Give me solutionarrow_forward

- While examining cash receipts information, the accounting department determined the following information: opening cash balance $177, cash on hand $1,328.37, and cash sales per register tape $1,166.57. Prepare the required journal entry based upon the cash count sheet. (Round answers to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Cash 1151.37 Cash Over and Short 15.2 Accounts Receivable 1166.57arrow_forwardWhile examining cash receipts information, the accounting department determined the following information: opening cash balance $178, cash on hand $1,016.25, and cash sales per register tape $853.27. Prepare the required journal entry based upon the cash count sheet. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, eg. 52.75.) Account Titles and Explanation Debit Creditarrow_forwardAt the end of the day, the cash register tape lists $1,147.42 as total income from services. Cash on hand consists of $21.13 in coins, $547.52 in currency, $70.00 in traveler's checks, and $603.62 in customers' checks. The amount of the Change Fund is $100. Required: Record the entry to record the day's cash revenue. If an amount box does not require an entry, leave it blank.arrow_forward

- At the end of the day, the cash register tape lists $1,021.18 as total income from services. Cash on hand consists of $17.66 in coins, $749.91 in currency, $70.00 in traveler's checks, and $276.27 in customers' checks. The amount of the Change Fund is $100. Required: Record the entry to record the day's cash revenue. If an amount box does not require an entry, leave it blank.arrow_forwardRecord the following transactions into the general journal. Be sure to include explanations. When finished upload your journal to this problem. Establish a petty cash fund of $150 on September 1 with check #1001. On September 10, the petty cash fund was replenished with check #1015 when there was $16 remaining and there were petty cash receipts for: office supplies, $30; transportation-in on inventory purchased, (company uses perpetual method) $52; and postage, $42. On September 15, the petty cash fund was increased to $175 in total with check #1020.arrow_forwardCash Over and Short At the end of each day, Spangle counts the cash in its cash registers. Spangle then compares the physical amount of cash to the amount of cash that the register tape indicates should be in the cash drawer. On a recent day, Spangle Company obtained the following data from its cash registers: Cash Sales per Register Tape Cash in Register After Removing Opening Change Register 1 $14,759.62 $14,757.98 Register 2 15,101.59 15,104.06 Register 3 14,802.18 14,798.87 Spangle deposits its cash receipts in its bank account daily. Required: Prepare a journal entry to record these cash sales. For those boxes in which no entry is required, leave the box blank. Round your answers to two decimal places, if necessary.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:9781133935940

Author:Ulric J. Gelinas

Publisher:CENGAGE L