Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Accounting question

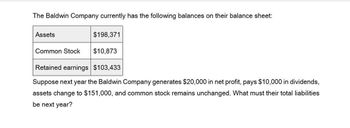

Transcribed Image Text:The Baldwin Company currently has the following balances on their balance sheet:

Assets

$198,371

Common Stock

$10,873

Retained earnings $103,433

Suppose next year the Baldwin Company generates $20,000 in net profit, pays $10,000 in dividends,

assets change to $151,000, and common stock remains unchanged. What must their total liabilities

be next year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- DIVIDENDS Brooks Sporting Inc. is prepared to report the following 2019 income statement (shown in thousands of dollars). Prior to reporting this income statement, the company wants to determine its annual dividend. The company has 320,000 shares of common stock outstanding, and its stock trades at 37 per share. a. The company had a 25% dividend payout ratio in 2018. If Brooks wants to maintain this payout ratio in 2019, what will be its per-share dividend in 2019? b. If the company maintains this 25% payout ratio, what will be the current dividend yield on the companys stock? c. The company reported net income of 1.35 million in 2018. Assume that the number of shares outstanding has remained constant. What was the companys per-share dividend in 2018? d. As an alternative to maintaining the same dividend payout ratio. Brooks is considering maintaining the same per-share dividend in 2019 that it paid in 2018. If it chooses this policy, what will be the companys dividend payout ratio in 2019? e. Assume that the company is interested in dramatically expanding its operations and that this expansion will require significant amounts of capital. The company would like to avoid transactions costs involved in issuing new equity. Given this scenario, would it make more sense for the company to maintain a constant dividend payout ratio or to maintain the same per-share dividend? Explain.arrow_forwardCompany Y currently has the following balances on its balance sheet: Assets Common Stock $198,162 $46,723 Retained earnings $29,420 Suppose next year Company Y generates $20,000 in net profit, pays $10,000 in dividends, assets change to $151,000, and common stock remains unchanged. What must their total liabilities be next year? a. $122,019. b. $111,580. c. $64,857. d. $44,857.arrow_forwardPlease give me answer general accountingarrow_forward

- Current balances in liability and equity accounts: Total liabilities: $28,059,085, Common Stock: $13,308,000, Retained Earnings: $59,143,173. Next year the company generates $36,000,000 in net profit and pays $15,000,000 in dividends. Total Liabilities and Common Stock remain unchanged. What will total assets be next year?arrow_forwardCan you please answer the accounting question?arrow_forwardWhat is Evergreen's total stockholder's equity on these general accounting question?arrow_forward

- Compute the amount of liabilities for Company E at the beginning of the year. End of Year $ Assets Equity, beginning of year Add: Stock issuances Add: Net income 115,920 Less: Cash dividends Equity, end of year Beginning of Year Assets $ = = = 101,010 = $ $ $ Liabilities + 91,576 + 6,500 8,642 15,142 11,000 24,344 Liabilities 101,010 + + GA $ Equity 24,344 Equityarrow_forwardSwifty Incorporated had average total assets in 2025 of $6343000. It reported sales for of $8209000 that year. Average liabilities for the year were $5187000. Net income for the year was $964136. What is Swifty' return on assets for 2025? O 15.20% 18.59% O 11.74% 6.60%arrow_forwardCoronado Incorporated had average total assets in 2025 of $6345000. It reported sales for of $8217000 that year. Average liabilities for the year were $5199000. Net income for the year was $958095. What is Coronado' return on assets for 2025? O 15.10 % O 18.43% O 6.52% O 11.66%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning