Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Can you please give correct answer for this accounting question?

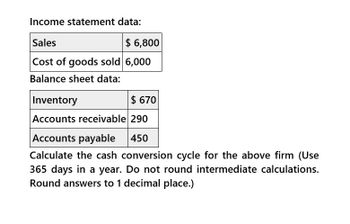

Transcribed Image Text:Income statement data:

Sales

$6,800

Cost of goods sold 6,000

Balance sheet data:

Inventory

$ 670

Accounts receivable 290

Accounts payable

450

Calculate the cash conversion cycle for the above firm (Use

365 days in a year. Do not round intermediate calculations.

Round answers to 1 decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Last year, Nikkola Company had net sales of 2.299.500,000 and cost of goods sold of 1,755,000,000. Nikkola had the following balances: Refer to the information for Nikkola Company above. Required: Note: Round answers to one decimal place. 1. Calculate the average accounts receivable. 2. Calculate the accounts receivable turnover ratio. 3. Calculate the accounts receivable turnover in days.arrow_forwardThe following selected information is taken from the financial statements of Arnn Company for its most recent year of operations: During the year, Arnn had net sales of 2.45 million. The cost of goods sold was 1.3 million. Required: Note: Round all answers to two decimal places. 1. Compute the current ratio. 2. Compute the quick or acid-test ratio. 3. Compute the accounts receivable turnover ratio. 4. Compute the accounts receivable turnover in days. 5. Compute the inventory turnover ratio. 6. Compute the inventory turnover in days.arrow_forwardGeneral Accountingarrow_forward

- Accounting calculate a. b. c.arrow_forwardTeams MSFT Corporation has the following information: Inventory conversion period 79.02 days Receivables collection period 35.8 days Payables deferral period 9.6 days Can you determine the length of time (days) for them to cycle cash in the company? (represent your numeric result in two decimal places)arrow_forwardAttached Questionarrow_forward

- Calculate the accounts receivable period?arrow_forwardComplete the balance sheet and sales information using the following financial data: Total assets turnover: 1.1x Days sales outstanding: 73.0 days* Inventory turnover ratio: 4x Fixed assets turnover: 3.0x Current ratio: 2.0x Gross profit margin on sales: (Sales Cost of goods sold)/Sales = 20% Calculation is based on a 365-day year. Do not round intermediate calculations. Round your answers to the nearest dollar. Cash Accounts receivable Inventories Fixed assets Total assets Sales Balance Sheet. $360,000 Current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity Cost of goods sold $ $ 90,000 90,000arrow_forwardBALANCE SHEET ANALYSIS Complete the balance sheet and sales information using the following financial data: Total assets turnover: 1.2x Days sales outstanding: 36 days Inventory turnover ratio: 7x Fixed assets turnover: 2.5x Current ratio: 1.5x Gross profit margin on sales: (Sales- Cost of goods sold)/Sales = 20% Calculation is based on a 365-day year. Do not round intermediate calculations. Round your answer to the nearest cent. Balance Sheet Cash Accounts receivable. Inventories Fixed assets Total assets Sales $300,000 Current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity Cost of goods sold 45,000 90,000arrow_forward

- Complete the balance sheet and sales information using the following financial data: Total assets turnover: 1x Days sales outstanding: 73.0 days² Inventory turnover ratio: 3.75x Fixed assets turnover: 3.0x Current ratio: 2.5x Gross profit margin on sales: (Sales - Cost of goods sold)/Sales = 35% *Calculation is based on a 365-day year. Do not round intermediate calculations. Round your answers to the nearest dollar. Balance Sheet Cash Accounts receivable Inventories Fixed assets Total assets Sales $ $ $360,000 Current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity Cost of goods sold $ $ $ 90,000 90,000arrow_forwardHii expert please provide correct answer this general Accounting questionarrow_forwardFinancial Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT