Economics Today and Tomorrow, Student Edition

1st Edition

ISBN: 9780078747663

Author: McGraw-Hill

Publisher: Glencoe/McGraw-Hill School Pub Co

expand_more

expand_more

format_list_bulleted

Question

Solve the following with complete solutions

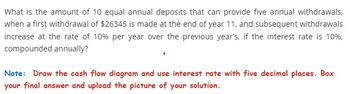

Transcribed Image Text:What is the amount of 10 equal annual deposits that can provide five annual withdrawals,

when a first withdrawal of $26345 is made at the end of year 11, and subsequent withdrawals

increase at the rate of 10% per year over the previous year's, if the interest rate is 10%,

compounded annually?

Note: Draw the cash flow diagram and use interest rate with five decimal places. Box

your final answer and upload the picture of your solution.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the total amount of interest from a 5,000 loan after three years with a simple interest rate of 6?arrow_forwardHow is buying a house to live in a type of financial investment?arrow_forwardWhat are some ways that someone looking for a loan might reassure a bank that is faced with imperfect information about whether the borrower will repay the loan?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Economics Today and Tomorrow, Student EditionEconomicsISBN:9780078747663Author:McGraw-HillPublisher:Glencoe/McGraw-Hill School Pub Co

Economics Today and Tomorrow, Student EditionEconomicsISBN:9780078747663Author:McGraw-HillPublisher:Glencoe/McGraw-Hill School Pub Co Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics Today and Tomorrow, Student Edition

Economics

ISBN:9780078747663

Author:McGraw-Hill

Publisher:Glencoe/McGraw-Hill School Pub Co

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...

Economics

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning