Microeconomic Theory

12th Edition

ISBN: 9781337517942

Author: NICHOLSON

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

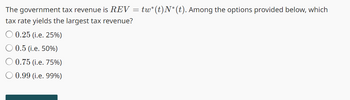

Transcribed Image Text:The government tax revenue is REV = tw*(t)N*(t). Among the options provided below, which

tax rate yields the largest tax revenue?

0.25 (i.e. 25%)

0.5 (i.e. 50%)

0.75 (i.e. 75%)

0.99 (i.e. 99%)

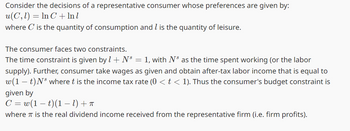

Transcribed Image Text:Consider the decisions of a representative consumer whose preferences are given by:

u(C,1) = In C+ Inl

where C is the quantity of consumption and 1 is the quantity of leisure.

The consumer faces two constraints.

The time constraint is given by 1 + N³ = 1, with N³ as the time spent working (or the labor

supply). Further, consumer take wages as given and obtain after-tax labor income that is equal to

w(1t)Ns where t is the income tax rate (0 < t < 1). Thus the consumer's budget constraint is

given by

C = w(1 − t)(1 − 1) + π

where is the real dividend income received from the representative firm (i.e. firm profits).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Metropolitan Hospital has estimated its average monthly bed needs as N=1,000+9X where X=timeperiod(months);January2002=0 N=monthlybedneeds Assume that no new hospital additions are expected in the area in the foreseeable future. The following monthly seasonal adjustment factors have been estimated, using data from the past five years: Forecast Metropolitans bed demand for January, April, July, November, and December 2007. If the following actual and forecast values for June bed demands have been recorded, what seasonal adjustment factor would you recommend be used in making future June forecasts?arrow_forwardBell Greenhouses has estimated its monthly demand for potting soil to be the following: N=400+4X where N=monthlydemandforbagsofpottingsoil X=timeperiodsinmonths(March2006=0) Assume this trend factor is expected to remain stable in the foreseeable future. The following table contains the monthly seasonal adjustment factors, which have been estimated using actual sales data from the past five years: Forecast Bell Greenhouses demand for potting soil in March, June, August, and December 2007. If the following table shows the forecasted and actual potting soil sales by Bell Greenhouses for April in five different years, determine the seasonal adjustment factor to be used in making an April 2008 forecast.arrow_forwardGo to this website (http://www.measuringworth.com/ppowerus/) for the Purchasing Power Calculator at measuringWorth.com. How much money would it take today to purchase what one dollar would have bought in the year of your birth?arrow_forward

- What is deflation?arrow_forwardEdna is living in a retirement home where home where most of her needs are taken care of, but she has some discretionary spending. Based on the basket of goods in Table 22.5, by what percentage does Ednas cost of living increase between time 1 and time 2arrow_forwardWhy do you mink the U.S. experience with inflation over the last 50 years has been so much milder than in many other countries?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning