ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

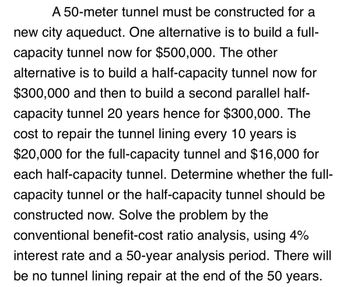

Based off the calculated conventional benefit-cost ratios (BCRs) for both options (the full-capacity tunnel and the 2 half-capacity tunnels please state whether the recommendation should be to build the full-capacity tunnel now or the first half-capacity tunnel. Make sure to show all mathematical work to get the 2 BCR values.

Transcribed Image Text:A 50-meter tunnel must be constructed for a

new city aqueduct. One alternative is to build a full-

capacity tunnel now for $500,000. The other

alternative is to build a half-capacity tunnel now for

$300,000 and then to build a second parallel half-

capacity tunnel 20 years hence for $300,000. The

cost to repair the tunnel lining every 10 years is

$20,000 for the full-capacity tunnel and $16,000 for

each half-capacity tunnel. Determine whether the full-

capacity tunnel or the half-capacity tunnel should be

constructed now. Solve the problem by the

conventional benefit-cost ratio analysis, using 4%

interest rate and a 50-year analysis period. There will

be no tunnel lining repair at the end of the 50 years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Ronald McDonald decides to install a fuel storage system for his farm that will save him anestimated 6.5 cents/gallon on his fuel cost. He uses an estimated 20,000 gallons/year on his farm.Initial cost of the system is $10,000 and the annual maintenance the first year is $25 and increasesby $25 each year thereafter. After a period of 10 years the estimated salvage is $3,000. If moneyis worth 12%, is it a wise investment?arrow_forwardLittrell's Nursery needs a new irrigation system. System one will cost $145,000, have annual maintenance costs of $10,000, and need an overhaul at the end of year six costing $30,000. System two will have first year maintenance costs of $5,000 with increases of $500 each year thereafter. System two would not require an overhaul. Both systems will have no salvage value after 12 years. If Littrell's cost of capital is 4%, using annual worth analysis determine the maximum Littrell's should be willing to pay for system two.arrow_forwardZoom inarrow_forward

- Data for four mutually exclusive alternatives are given in the table below. Assume a life of 7 years and a MARR of 9%,arrow_forwarddo fast i will 5 upvotes in differnt account.arrow_forwardConsider the cash flows of different projects and answer the questions from 1 to 4, (all amounts are in SR): n PROJECT 1 0 -30 000 PROJECT 2 -20 000 PROJECT 3 PROJECT 4 -15 000 -25 000 1 0 6.000 7 500 10 000 2 0 6 500 7 000 10 000 3 60 000 7 000 8 000 10 000 1. According to the equivalent annual worth criteria, which projects are accepted at MARR of 10%: A. Projects 1 and 4 B. Projects 1 and 3 C. Projects 2 and 3 D. All projects accepted E. All projects rejectedarrow_forward

- Can some one please help me to solve the following question. Please and thank youarrow_forwardCalisto Launch Services is an independent space corporation and has been contracted to develop and launch one oftwo different satellites. Initial equipment will cost $750,000 for the first satellite and $850,000 for the second.Development will take 5 years at an expected cost of $150,000 per year for the first satellite; $120,000 per year forthe second. The same launch vehicle can be used for either satellite and will cost $275,000 at the time of the launch5 years from now. At the conclusion of the launch, the contracting company will pay Calisto $2,500,000 for eithersatellite.Calisto is also considering whether they should consider launching both satellites. Because Calisto would haveto upgrade its facilities to handle two concurrent projects, the initial costs would rise by $150,000 in addition to thefirst costs of each satellite. Calisto would need to hire additional engineers and workers, raising the yearly costs to atotal of $400,000. An additional compartment would be added to…arrow_forwardA city has developed a plan to provide for future municipal water needs. The plan proposes an aqueduct that passes through 150 meters of tunnel in a nearby mountain. Two alternatives are being considered. The first proposes to build a full-capacity tunnel now for $556 000. The second proposes to build a half capacity tunnel now and a second identical half-capacity tunnel in 20 years. Each of half capacity tunnel costs $402 000. The maintenance cost of the tunnel lining for the full-capacity tunnel is $40 000 every 10 years, and for each half-capacity tunnel it is $32 000 every 10 years. The friction losses in the half-capacity tunnel will be greater than if the full-capacity tunnel were built. The estimated additional pumping costs for each half-capacity tunnel will be $2 000 per year. Using present worth method and a 7% interest rate, which alternative should be selected? Give typing answer with explanation and conclusionarrow_forward

- Don't treat uniform or gradient payments as single payment and answer whatever you can pleasearrow_forwardBrand A B 5:21 PM C D 2 years 3 years $13 4 years $17 5 years Which brand should the engineer select if the MARR is 9% a year? Cost m October 7, 2023 17:17 $7 2. An electrical engineer has to choose one brand of light bulbs among four available brands. The following information are available; lifetime $9 VPN G 4G+ LTE 22 8 0arrow_forwardA firm is considering three mutually exclusive alternatives as part of an upgrade to an existing transportation network. Installed cost $40,000 $6,400 $30,000 $20,000 Net annual revenue $5.650 $5,250 Salvage value Useful life 20 years 20 years 10 years Calculated IRR 15.0% 18.2% 22.9% At EOY 10, alternative NI would be replaced with another alternative having the same installed cost and net annual revenues. If MARR is 10% per year, which alternative (if any) should be chosen? Use the incremental IRR procedure. Arrange (rank order) the teasible alternatives to use the incremental IRR procedure (Hint DN indicates "do nothing" alternative). Choose the correct answer below O A. I, I, I, DN O B. DN, I, N, NI Oc. DN, ,N, O D. DN. .I Perform the incremental IRR Analysis. Fil-in the table below (Round to one decimal place) Incremental Alternative to be Investment Inc. IRR selectedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education