ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

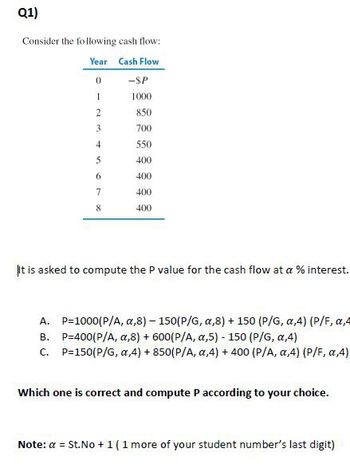

Transcribed Image Text:Q1)

Consider the following cash flow:

Year

Cash Flow

0

-SP

1

1000

2

850

3

700

4

550

5

400

6

400

7

400

8

400

It is asked to compute the P value for the cash flow at a % interest.

A. P=1000(P/A, a,8) - 150(P/G, a,8) + 150 (P/G, a,4) (P/F, a,4

B.

P=400(P/A, a,8) + 600(P/A, a,5) - 150 (P/G, a,4)

C. P=150(P/G, a,4) + 850(P/A, a,4) + 400 (P/A, a,4) (P/F, a,4)

Which one is correct and compute P according to your choice.

Note: a = St.No +1 (1 more of your student number's last digit)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- How much money would you need to deposit today at 9% annual interest compounded monthly to have $12000 in the account after 6 years? A) $7,007 B) $20,550 $20,125 D) $7,155arrow_forwardHow much must be invested now at 6% simple interest to accumulate $1,000 at the end of 5 years? Choose an answer by clicking on one of the letters below, or click on "Review topic" if needed. A P = $1,000 / [ 1 + (0.06)(5) ] = $1,000 / 1.30 = $769 B F = $1,000 [ 1 + (0.06)(5) ] = $1,000 (1.30) = $1,300 C P = $1,000 / 5 = $200 D P = $1,000 (P/F,6%,5) = $1,000 (0.7473) = $747arrow_forwardUsing the data given below, select the equation that will correctly calculate the future value of the cash flow at the end of Year 6. Use an interest rate of i =4% Year Income Expense 0 $10,000 1 $1000 2 $900 3 $800 4 $700 5 $600 6 $500 Group of answer choices {10,000 – 1,000(P/A, 4%, 6) -100(P/G, 4%, 5)} (P/F, 4%, 6) {10,000 – 1,000(F/A, 4%, 6) +100(F/G, 4%, 6)} (F/P, 4%, 6) {10,000 – 1,000(P/G, 4%, 6) +100(P/A, 4%, 6)} (F/P, 4%, 6) 10,000 – {1,000(P/A, 4%, 6) +100(P/G, 4%, 6)} (P/F, 4%, 6) {10,000 – 1,000(P/A, 4%, 6) +100(P/G, 4%, 6)} (F/P, 4%, 6)arrow_forward

- A firm has borrowed $5,000,000 for 5 years at 10% per year compound interest. The firm will make no payments until the loan is due, when it will pay off the interest and principal in one lump sum. What is the total payment? Assume that your answer is in units of $. Only input the numeric value of your calculation.arrow_forwardCompound Interest. Determine the future value of $700 which is invested at10% interest which is compounded early after 8 years.arrow_forwardCompute the number of years (t) if future value (FV) = $13514, present value (FV) = $1186, and interest rate (r) = 11.8%,.arrow_forward

- A woman deposits $9000 at the end of each year for 10 years in an account paying 3% interest compounded annually. (a) Find the final amount she will have on deposit. (b) Her brother-in-law works in a bank that pays 2% compounded annually. If she deposits money in this bank instead of the other one, how much will she have in her account? (c) How much would she lose over 10 years by using her brother-in-law's bank?arrow_forwardYou purchased a winning ticket for a $5 million lottery which pays $500,000 immediately and the rest in 9 annual installments. A finance company called and offered you $3 million for it. Would you accept the offer if the rate is 10%arrow_forward1.Find the present value of $20800 in 4 months at 12% simple interest. a)$200 b)$200,000 c)$2000 d)$20000 2.The simple interest on a $6500 loan at 15% for 9 months is. a)$731.25 b)$7312.50 c)$73.13 d)$2925 3. If we deposit $5000 in an account that pays 9% per year. Find the amount of simple interest earned during 8 months. a)$3000 b)$300 c)$360 d)$3600 4.The simple interest charged on a loan amount of $8500 for 2 years was $1275. What rate of interest was charged a)22.5% b)3.75% c)15% d)7.5% 5.What rate of simple interest will make a principal double itself in 6 years. a)16.67% b)8.33% c)33.33% d)4.16% 6.Find the present value of $20800 in 4 months at 12% simple interest. a)$200 b)$200,000 c)$2000 d)$20000arrow_forward

- Subject: financearrow_forward2arrow_forwardYou are 65 years old and about to retire. You have $100,000 saved in a retirement account and would like to withdraw it in equal annual amounts so that nothing is left after 5 years. How much can you withdraw each year if the account earns 8% interest each year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education