International Financial Management

14th Edition

ISBN: 9780357130698

Author: Madura

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

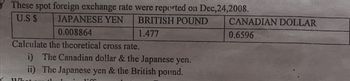

Transcribed Image Text:These spot foreign exchange rate were reported on Dec,24,2008.

U.S $

JAPANESE YEN

0.008864

Calculate the theoretical cross rate.

BRITISH POUND

1.477

i) The Canadian dollar & the Japanese yen.

ii) The Japanese yen & the British pound.

CANADIAN DOLLAR

0.6596

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Match each term in Column A with its related definition in Column B. Column A 1. ____________ Spot rate 2. ____________ Currency appreciation 3. ____________ Translation risk 4. ____________ Transaction risk 5. ____________ Exchange rate Column B a. The rate at which one currency can be traded for another currency. b. The possibility that future cash transactions will be affected by changing exchange rates. c. A month ago, 1 U.S. was worth 8.5 Mexican pesos. Today, 1 is worth 9.0 Mexican pesos. The U.S. dollar has undergone what? d. The degree to which a firms financial statements are exposed to exchange rate fluctuation. e. The exchange rate of one currency for another for immediate delivery (today).arrow_forwardUsing the currency cross rate table, convert C$300.00 to Japanese yen. Canadian dollar U.S. dollar Euro Japanese yen British pound Australian dollar Canadian U.S. Euro Japanese British Australian dollar dollar yen pound dollar 1.5792 0.0129 2.2735 1.1601 0.0078 1.6624 0.0083 1.4355 197.1834 1.4103 0.7091 0.6332 0.8620 77.5194 128.2051 120.4819 0.4399 0.6015 0.6966 1.1012 1.4945 1.7319 C$300.00 will purchase Japanese yen. (Round to the nearest yen as needed.) 0.0051 0.0126 2.4907 0.9081 0.6691 0.5774 79.4098 0.4015arrow_forwardUsing Exchange Rates Use the information below to answer the following questions. U.S. $ EQUIVALENT CURRENCY PER U.S. $ Polish Zloty .2985 3.3496 Euro 1.2318 .8118 Mexican Peso .0752 13.2980 Swiss Franc 1.0256 .9750 Chilean Peso .002071 482.80 New Zealand Dollar .8092 1.2358 Singapore Dollar .8015 1.2476 a. If you have $100, how many Polish zlotys can you get? (Do not include the Polish zlotys sign, zl. Round your answer to 2 decimal places, e.g., 32.16.) b. How much is one euro worth in U.S. dollars? (Round your answer to 4 decimal places, e.g., 32.1616.) c. If you have 5.00 million euros, how many dollars do you have? (Enter your answer in dollars, not millions of dollars, rounded to the nearest whole dollar, e.g., 1,234,567.) d. Which…arrow_forward

- TIPS FOR READING AN EXCHANGE RATE CHART: Read down the chart. For example, in column 1 it says the US Dollar is equal to each of the currencies below it. Therefore $1 = .76 £ or $1 = .89 €. Exchange Rate Table for Month 1 US Dollar $1 = British Pound 1 £ = Chinese Yuan 1 Y = Japanese Yen 1 ¥ = Euro 1€ US Dollar --- 1.32 .16 .0088 1.13 British Pound .76 --- .12 .0067 .85 Chinese Yuan 6.37 8.46 --- .056 7.21 Japanese Yen 113.04 149.55 17.75 --- 127.55 Euro .89 1.17 .14 .0078 --- Exchange Rate Table for Month 2 US Dollar $1 = British Pound 1 £ = Chinese Yuan 1 Y = Japanese Yen 1 ¥ = Euro 1€ US Dollar --- 1.40 .20 .0080 1.17 British Pound .70 --- .11 .0065 .89 Chinese Yuan 6.20 8.72 --- .062 7.59 Japanese Yen 116.24 146.89 16.32 --- 117.2 Euro .92 1.11 .15 .0078 --- A currency depreciates (or gets…arrow_forwardTIPS FOR READING AN EXCHANGE RATE CHART: Read down the chart. For example, in column 1 it says the US Dollar is equal to each of the currencies below it. Therefore $1 = .76 £ or $1 = .89 €. Exchange Rate Table for Month 1 US Dollar $1 = British Pound 1 £ = Chinese Yuan 1 Y = Japanese Yen 1 ¥ = Euro 1€ US Dollar --- 1.32 .16 .0088 1.13 British Pound .76 --- .12 .0067 .85 Chinese Yuan 6.37 8.46 --- .056 7.21 Japanese Yen 113.04 149.55 17.75 --- 127.55 Euro .89 1.17 .14 .0078 --- Exchange Rate Table for Month 2 US Dollar $1 = British Pound 1 £ = Chinese Yuan 1 Y = Japanese Yen 1 ¥ = Euro 1€ US Dollar --- 1.40 .20 .0080 1.17 British Pound .70 --- .11 .0065 .89 Chinese Yuan 6.20 8.72 --- .062 7.59 Japanese Yen 116.24 146.89 16.32 --- 117.2 Euro .92 1.11 .15 .0078 --- An American family goes on vacation…arrow_forwardTIPS FOR READING AN EXCHANGE RATE CHART: Read down the chart. For example, in column 1 it says the US Dollar is equal to each of the currencies below it. Therefore $1 = .76 £ or $1 = .89 €. Exchange Rate Table for Month 1 US Dollar $1 = British Pound 1 £ = Chinese Yuan 1 Y = Japanese Yen 1 ¥ = Euro 1€ US Dollar --- 1.32 .16 .0088 1.13 British Pound .76 --- .12 .0067 .85 Chinese Yuan 6.37 8.46 --- .056 7.21 Japanese Yen 113.04 149.55 17.75 --- 127.55 Euro .89 1.17 .14 .0078 --- Exchange Rate Table for Month 2 US Dollar $1 = British Pound 1 £ = Chinese Yuan 1 Y = Japanese Yen 1 ¥ = Euro 1€ US Dollar --- 1.40 .20 .0080 1.17 British Pound .70 --- .11 .0065 .89 Chinese Yuan 6.20 8.72 --- .062 7.59 Japanese Yen 116.24 146.89 16.32 --- 117.2 Euro .92 1.11 .15 .0078 --- An American company contracts a…arrow_forward

- Assume that the following exchange rates exist for the U.S. dollar ($), Euros (€) and the British Pound (£). $/€ Citibank Lloyds Bank Mitsubishi Bank $/£ $1.9324 $1.9324 $732,212.21 $500,000 $300,000 $159,223 €/£ €1.9405 €1.9405 $0.2667 $0.2667 If you are an arbitrageur that starts with $1,000,000 you will end up with the arbitrage loss of?arrow_forwardTable 2 gives the exchange rate quotations for the U.S. dollar and the British pound. Table 2. Foreign Exchange Quotations Britain (Pound) 30-day Forward 60-day Forward 180-day Forward U.S. Dollar Equivalent Tuesday 1.3448 1.3392 1.3278 1.3128 Monday 1.3561 1.3507 1.3401 1.3260 Currency Per U.S. Dollar Tuesday Monday 0.7436 0.7374 0.7467 0.7404 0.7531 0.7462 0.7617 0.7541 (a) If you were to buy pounds for immediate delivery, what is the dollar cost of each pound on Tuesday? (b) If you were to sell dollars for immediate delivery, what is the pound cost of each dollar on Tuesday? (c) Regarding the Tuesday quotations: compared to the cost of buying 100 pounds on the spot market, if 100 pounds were bought for future delivery in 180 days the dollar cost of the pounds would be how much higher or lower (if lower, enter as a negative number)?arrow_forwardAn exchange rate is the price of one country's currency expressed in another country's currency. The exchange rates of the euro () and the Japanese yen (X) relative to the U.S. dollar ($) are listed as follows: Spot Rate 0.6589 / $:1 Euro Yen 99.4400 / $1 quotation, the foreign exchange rate represents the number of American dollars that can be When exchange rates are stated as purchased with one unit of foreign currency. Given the exchange rate data above, how many yen (x) can one euro ( 1) purchase? ○ ¥ 166.01 x181.10 ○ ¥ 150.92 O173.56 quotation. The foreign currency price of one unit of the home currency is calledarrow_forward

- The following spot rates are observed in the foreign exchange market: Currency Units Required to Buy One US Dollar Britain (Pound) 0.62 Japan (Yen) 140.0 Europe (Euro ) 0.90 On the basis of this information, compute to the nearest second decimal the number of (a) British pounds that can be acquired for Us $ 100 (b) Euros that can be acquired for U.S $ 40 (c) U.S dollar that 200 Euros can buy (d) U.S dollars that 1,000 Japanese yen will buyarrow_forwardThe following table shows PPP exchange rates (the price of 1 U.S. dollar in units of the foreign currency) for several countries, determined based on the Big Mac Index. PPP exchange rate (1USS=) United States (US$) Argentina (Peso) Australia (A$) Brazil (Real) Britain (£) Canada (C$) Chile (Peso) China (Yuan) В.75 1.17 2.33 0.61 1.12 469 3.54 a. According to this data, what are the predicted exchange rates between the following countries? i. Argentina and Australia ii. Brazil and Canada iii. Chile and China iv. China and Canada b. Suppose that a Canadian dollar buys more silver in Australia than it buys in Mexico. What does purchasing-power parity imply should happen?arrow_forward2. Foreign exchange rate quotations Aa Aa An exchange rate is the price of one country's currency expressed in another country's currency. Suppose an American investor is given the current exchange rates in the following table. The listed quotations are quotations stated in American terms. Exchange Rate British pound (£) $1.9760 / pound Euro (€ ) $1.4770 / euro Australian dollar (AU$) $0.9240 / Australian dollar Given these rates, an Australian dollar can purchase British pounds. Purple Whale Foodstuffs Inc. is a U.S.-based firm that produces stereos in Germany at a cost of € 124 (including production and transportation costs) and sells them in England for £ 102. Based on the exchange rate table given in the preceding question, what is Purple Whale Foodstuffs Inc.'s dollar profit for each unit sold? $20.24 $18.40 $19.32 $16.56arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT