Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

F1

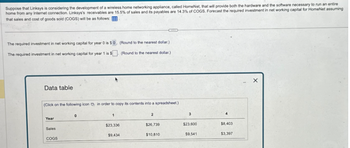

Transcribed Image Text:Suppose that Linksys is considering the development of a wireless home networking appliance, called HomeNet, that will provide both the hardware and the software necessary to run an entire

home from any Internet connection. Linksys's receivables are 15.5% of sales and its payables are 14.3% of COGS. Forecast the required investment in net working capital for HomeNet assuming

that sales and cost of goods sold (COGS) will be as follows:

The required investment in net working capital for year 0 is $ 0, (Round to the nearest dollar.)

The required investment in net working capital for year 1 is $

(Round to the nearest dollar.)

Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

Year

Sales

COGS

0

1

2

3

$23,336

$26,739

$23,600

$8,403

$9,434

$10,810

$9,541

$3,397

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hello sir how r u, please helparrow_forwardA venture capital investment group received a proposal from Wireless Solutions to produce a new smartphone. The variable cost per unit is estimated at $250, the sales price would be set at twice the VC/unit, fixed costs are estimated at $750,000, and the investors will put up the funds if the project is likely to have an operating income of $500,000 or more. What would sales volume (units) be required to meet this profit goal?arrow_forwardNonearrow_forward

- A group of venture investors is considering putting money into Lemma Books, which wants to produce a new reader for electronic books. The variable cost per unit is estimated at $248, the sales price would be set at twice the VC/unit, and fixed costs are estimated at $357730. The investors will put up the funds if the project is likely to have an operating income of $406340 or more. What sales volume would be required in order to meet the minimum profit goal? (Hint: Use the break-even formula, but include the required profit in the numerator.) Note: Answers should be whole numbers (no decimals) Answer:arrow_forwardi. Calculate the Net Present Value (NPV) for this project. ii. Calculate the Internal Rate of Return (IRR)of this project. iii. Make a recommendation to your department manager concerning whether toprovide finance for this project.arrow_forwardCalculate the NPV of the proposed investment, using the inputs suggested in this case. How sensitive is this NPV to future sales volume? *The answer is 15.7 million; please show me the work.arrow_forward

- Pinto.com has developed a powerful new server that would be used for corporations’ Internet activities. It would cost $25 million at Year 0 to buy the equipment necessary to manufacture the server. The project would require net working capital at the beginning of each year in an amount equal to 12% of the year’s projected sales; for example, NWC0 = 12%(Sales1 ). The servers would sell for $21,000 per unit, and Pinto believes that variable costs would amount to $15,000 per unit. After Year 1, the sales price and variable costs will increase at the inflation rate of 2.5%. The company’s nonvariable costs would be $1.5 million at Year 1 and would increase with inflation. The server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. Also, the project’s returns are expected to be highly correlated with returns on the firm’s other assets. The firm believes it could sell 2,000 units per year. The equipment would be depreciated over…arrow_forwardPinto.com has developed a powerful new server that would be used for corporations’ Internet activities. It would cost $25 million at Year 0 to buy the equipment necessary to manufacture the server. The project would require net working capital at the beginning of each year in an amount equal to 12% of the year’s projected sales; for example, NWC0 = 12%(Sales1 ). The servers would sell for $21,000 per unit, and Pinto believes that variable costs would amount to $15,000 per unit. After Year 1, the sales price and variable costs will increase at the inflation rate of 2.5%. The company’s nonvariable costs would be $1.5 million at Year 1 and would increase with inflation. The server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. Also, the project’s returns are expected to be highly correlated with returns on the firm’s other assets. The firm believes it could sell 2,000 units per year. The equipment would be depreciated over…arrow_forwardPinto.com has developed a powerful new server that would be used for corporations’ Internet activities. It would cost $25 million at Year 0 to buy the equipment necessary to manufacture the server. The project would require net working capital at the beginning of each year in an amount equal to 12% of the year’s projected sales; for example, NWC0 = 12%(Sales1 ). The servers would sell for $21,000 per unit, and Pinto believes that variable costs would amount to $15,000 per unit. After Year 1, the sales price and variable costs will increase at the inflation rate of 2.5%. The company’s nonvariable costs would be $1.5 million at Year 1 and would increase with inflation. The server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. Also, the project’s returns are expected to be highly correlated with returns on the firm’s other assets. The firm believes it could sell 2,000 units per year. The equipment would be depreciated over…arrow_forward

- K Innovation Company is thinking about marketing a new software product. Upfront costs to market and develop the product are $4.98 million. The product is expected to generate profits of $1.09 million per year for 10 years. The company will have to provide product support expected to cost $98,000 per year in perpetuity. Assume all profits and expenses occur at the end of the year. a. What is the NPV of this investment if the cost of capital is 5.6%? Should the firm undertake the project? Repeat the analysis for discount rates of 1.6% and 14.5%, respectively. b. What is the IRR of this investment opportunity? c. What does the IRR rule indicate about this investment? a. What is the NPV of this investment if the cost of capital is 5.6%? Should the firm undertake the project? Repeat the analysis for discount rates of 1.6% and 14.5%, respectively. If the cost of capital is 5.6%, the NPV will be $ (Round to the nearest dollar.) Should the firm undertake the project? (Select the best choice…arrow_forwardYou are considering an investment in a clothes distributer. The company needs $106,000 today and expects to repay you $124,000 in a year from now. What is the IRR of this investment opportunity? Given the riskiness of the investment opportunity, your cost of capital is 15%. What does the IRR rule say about whether you should invest? What is the IRR of this investment opportunity? The IRR of this investment opportunity is %. (Round to two decimal places.)arrow_forwardPlease show work. Pinto.com has developed a powerful new server that would be used for corporations’ Internet activities. It would cost $25 million at Year 0 to buy the equipment necessary to manufacture the server. The project would require net working capital at the beginning of each year in an amount equal to 12% of the year’s projected sales; for example, NWC0 = 12%(Sales1 ). The servers would sell for $21,000 per unit, and Pinto believes that variable costs would amount to $15,000 per unit. After Year 1, the sales price and variable costs will increase at the inflation rate of 2.5%. The company’s nonvariable costs would be $1.5 million at Year 1 and would increase with inflation. The server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. Also, the project’s returns are expected to be highly correlated with returns on the firm’s other assets. The firm believes it could sell 2,000 units per year. The equipment would be…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College