EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

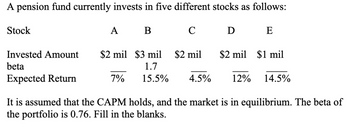

Transcribed Image Text:A pension fund currently invests in five different stocks as follows:

Stock

A B

C

D

E

Invested Amount

$2 mil $3 mil

$2 mil

$2 mil $1 mil

beta

1.7

Expected Return

7% 15.5%

4.5%

12% 14.5%

It is assumed that the CAPM holds, and the market is in equilibrium. The beta of

the portfolio is 0.76. Fill in the blanks.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- CAPM As an equity analyst, you have developed the following return forecasts and risk estimates for two different stock mutual funds (Fund T and Fund U): Fund T Fund U Forecasted Return CAPM Beta 1.20 0.80 9.0% 10.0 a. If the risk-free rate is 3.9 percent and the expected market risk premium (E(RM)-RFR) is 6.1 percent, calculate the required return for each mutual fund according to the CAPM. b. Using the estimated required of returns from part (a) along with your return forecasts, demonstrate whether Fund T and Fund U are currently priced to fall directly on the security market line (SML), above the SML, or below the SML. c. According to your analysis, are Funds T and U overvalued, undervalued, or properly valued?arrow_forwardAssume that the financial markets are in equilibrium. Information on three particular shares is provided in the table below. Find the risk free rate and the expected return on the market portfolio. Asset A B C A. 6%, 18% B. 6%, 14% C. 5%, 18% D. 7%, 16% E. 5%, 14% Expected Return 7.6% 12.4% 15.6% Beta 0.2 0.8 1.2arrow_forwardAs an equity analyst, you have developed the following return forecasts and risk estimates for two different stock mutual funds (Fund T and Fund U): Fund T Fund U Forecasted Return 9.0% 10.0 CAPM Beta 1.20 0.80 a) If the risk-free rate is 3.9 % and the expected market risk premium is 6.1%, calculate the expected return for each mutual fund according to the CAPM. b) Using the estimated expected returns from Part a along with your own return forecasts, explain whether Fund T and Fund U are currently priced to fall directly on the security market line (SML), above the SML, or below the SML. Are Funds T and U overvalued, undervalued, or properly valued?arrow_forward

- Suppose that many stocks are traded in the market and that it is possible to borrow at the risk-free rate, rƒ. The characteristics of two of the stocks are as follows: Stock Expected Return Standard Deviation A 11 % 35 % B 20 % 65 % Correlation = –1 a. Calculate the expected rate of return on this risk-free portfolio? (Hint: Can a particular stock portfolio be substituted for the risk-free asset?) (Round your answer to 2 decimal places.) b. Could the equilibrium rƒ be greater than 14.15%?multiple choice Yes Noarrow_forwardA $33,622 portfolio is invested in a risk-free security and two stocks. The beta of Stock A is 2.1 while the beta of Stock B is 0.84. One-half of the portfolio is invested in the risk-free security. How much (in $) is invested in Stock A if the beta of the portfolio is 0.56? Answer to two decimalsarrow_forwardAs an equity analyst, you have developed the following return forecasts and risk estimates for two different stock mutual funds (Fund T and Fund U}: Forecasted Return CAPM Beta Fund T 9.00% 1.20 Fund U 10.00% 0.80 a. If the risk-free rate is 3.9 percent and the expected market risk premium (£(RM) -RFR} is 6.1 percent, calculate the expected return for each mutual fund according to the CAPM. b. Using the estimated expected returns from part (a) along with your own return forecasts, demonstrate whether Fund T and Fund U are currently priced to fall directly on the security market line (SML), above the SML, or below the SML. c. According to your analysis, are Funds T and U overvalued, undervalued, or properly valued?arrow_forward

- Which one of the following stocks is correctly priced if the risk-free rate of return is 3.0 percent and the market risk premium is 7.5 percent? Expected Return 8.46% Stock A B с D E 0000С Stock A O Stock D Stock C O Stock E Beta 77 1.46 1.27 1.44 .95 Stock B 12.47 11.19 13.80 8.65arrow_forwardAn investor plans to invest funds in the following stocks: Stock Beta Amount Invested A 1.39 $1,939.00 B 1.21 $2,818.00 C 0.75 $1,378.00 The risk-free rate is currently 3.00%, while the market risk premium is 6.00%. What is the beta of this portfolio?arrow_forwardSuppose that there are many stocks in the security market and that the characteristics of stocks A and B are given as follows: Stock Expected Return Standard DeviationA 10% 5%B 15% 10%Correlation = -1 Suppose that it is possible to borrow at the risk-free rate, rf. What must be the value of the risk-free rate? a. The weight of Stock A in the portfolio: Blank 1. Fill in the blank, read surrounding text. b. The weight of Stock B in the portfolio: Blank 2. Fill in the blank, read surrounding text.c. The Expected rate of return of the portfolio: Blank 3. Fill in the blank, read surrounding text.d. The risk-free rate is: Blank 4. Fill in the blank, read surrounding text.arrow_forward

- Using the CAPM, estimate the appropriate required rate of return for the three stocks listed here, given that the risk-free rate is 6 percent and the expected return for the market is 14 percent. STOCK ВЕТА A 0.62 B 1.09 1.48 a. Using the CAPM, the required rate of return for stock A is %. (Round to two decimal places.) b. Using the CAPM, the required rate of return for stock B is %. (Round to two decimal places.) c. Using the CAPM, the required rate of return for stock C is %. (Round to two decimal placesarrow_forwardAssume that the risk-free rate is 2.5% and the market risk premium is 8%. What is the required return for the overall stock market? Round your answer to one decimal place. ? % What is the required rate of return on a stock with a beta of 0.5? Round your answer to one decimal place. ? % The above is a two part question, therefore the second answer is determined based off the first answer provided. Please, please, please do provide both answers.arrow_forwardAssume the expected return on the market is 7 percent and the risk-free rate is 4 percent. a. What is the expected return for a stock with a beta equal to 1.10? (Enter your answers in decimals. Do not enter percent values.) b. What is the market risk premium? (Enter your answers in decimals. Do not enter percent values.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT