Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Photo from MR. A

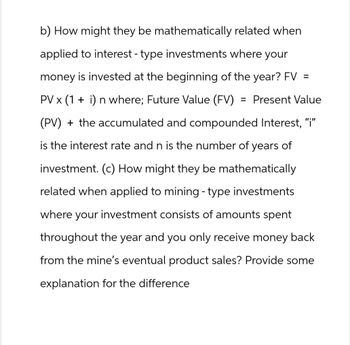

Transcribed Image Text:b) How might they be mathematically related when

applied to interest - type investments where your

money is invested at the beginning of the year? FV =

= Present Value

PV × (1 + i) n where; Future Value (FV)

(PV) + the accumulated and compounded Interest, "i"

is the interest rate and n is the number of years of

investment. (c) How might they be mathematically

related when applied to mining - type investments

where your investment consists of amounts spent

throughout the year and you only receive money back

from the mine's eventual product sales? Provide some

explanation for the difference

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A. Assume that the variables I, N, and PV represent the interest rate, investment or deposit period, and present value of the amount deposited or invested, respectively. Which equation best represents the calculation of a future value (FV) using: Compound interest? FV = (1 + I)NN / PV FV = PV / (1 + I)NN FV = PV x (1 + I)NN B. Simple interest? FV = PV + (PV x I x N) FV = PV - (PV x I x N) FV = PV / (PV x I x N) C. Identify whether the following statements about the simple and compound interest methods are true or false. Statement True False After the end of the second year and all other factors remaining equal, a future value based on compound interest will never exceed the future value based on simple interest. All other variables held constant, investments paying simple interest have to pay significantly higher interest rates to earn the same amount of interest as an account earning compound…arrow_forward,Match the following terms with the appropriate definition.Effective yield or interest rateMonetary liabilityCompound interestPresent ValueFuture value of a single amountA.Fixed obligation to pay an amount in cash.B.The rate at which money will actually grow.C.Interest accumulates on interest.D.Current worth of future cash flows.E.The money to which an amount invested will grow over time.arrow_forwardThe value of a sum after investing over one or more periods is calleda) Discount Valueb) Nonec) Compound and future valued) Present valuearrow_forward

- 5. The _____ or _____ interest rate reflects the real rate of return on an investment. a. annual or nominal b. periodic or effective c. periodic or compounding d. annual percentage yield or effectivearrow_forwardAssume that the variables I, N, and PV represent the interest rate, investment or deposit period, and present value of the amount deposited or invested, respectively. Which equation best represents the calculation of a future value (FV) using: Compound interest? O FV = PV / (1+1)N O FV = PV + (PV XIX N) O FV = PV x (1 + I)N Simple interest? OFV = PV + (PV XIX N) O FV = PV XIX N O FV = PV/(PV XIX N)arrow_forwardMatch the correct term to the description in each question.arrow_forward

- The formula for calculating the discount rate to use in net present value (NPV) calculations is as follows PV = 1+ (1+r)" Where 'r represents: OA. The number of years you are investing B. The initial investment OC. The number of years - stated as a decimal D. The cost of capital stated as a decimalarrow_forwardWhen comparing investments with different horizons, the ____________ provides the more accurate comparison. A. effective annual rate B. average annual return C. historical annual average D. arithmetic averagearrow_forwardWhich of the following discounts future cash flows to their present value at the expected rate of return, and compares that to the Initial Investment? A. internal rate of return (IRR) method B. net present value (N PV) C. discounted cash flow model D. future value methodarrow_forward

- What does the Excel argument Nper refer to? Number of periods of time for a loan or investment. The constant periodic payment required to pay off a loan or investment. Periodic interest rate. Present value of an investment.arrow_forwardThe formula for calculating the discount rate to use in net present value (NPV) calculations is as follows: PV = 1 + (1+r)" Where 'n' represents: OA. The number of years you are investing OB. The cost of capital - stated as a percentage OC. The initial investment OD. The cost of capital - stated as a decimalarrow_forwardThe actual interest paid or earned is commonly referred to as the: a. Risk premium. b. Annual effective interest rate. c. Nominal interest rate. d. Real rate of return.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning